- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

Closed this LLC with S-Corp election ending 2023. In final review, TT will not let me skip Part II Disposition of S Corporation Shares section. I had no shares in the LLC, was only managing member. Form 7203 was completed. Basis beginning of Year $9309, Stock basis end of corporation tax year is $0 == TT will not let me e-file my final returns. due to this item? Please help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

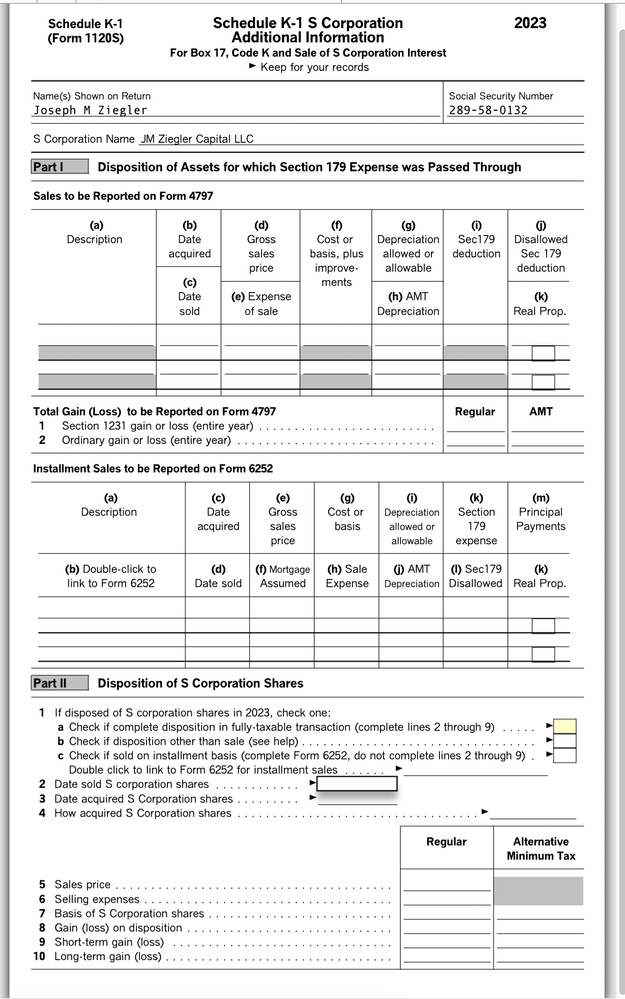

A little more information. CPA who did K-1 S-Corp also completed Form 966 Corporate Dissolution or Liquidation under code of Section 331 -- with the Form 7203 showing Stock Basis beginning of year $9309, end of year $0 - again no shares listed on this entity.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

Can you please clarify, what error you are getting in the program?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

Leticia,

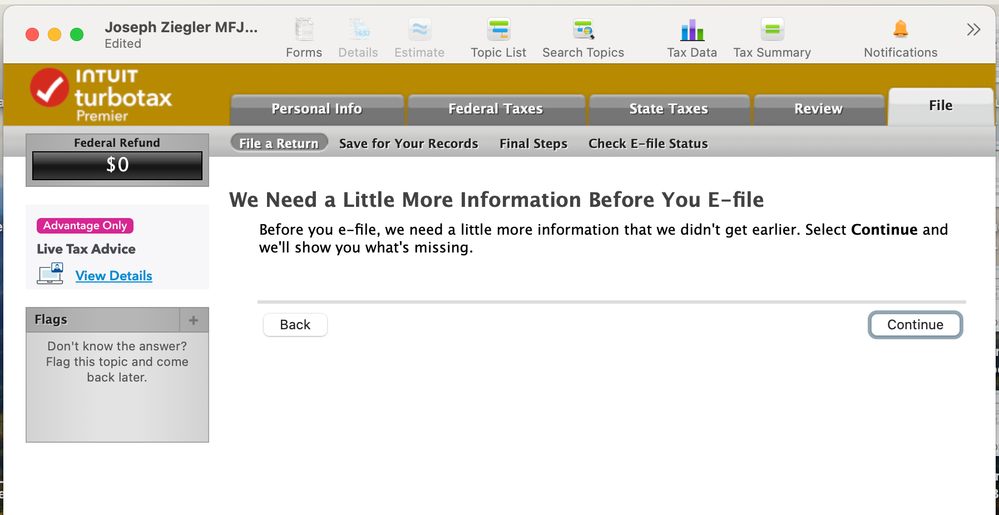

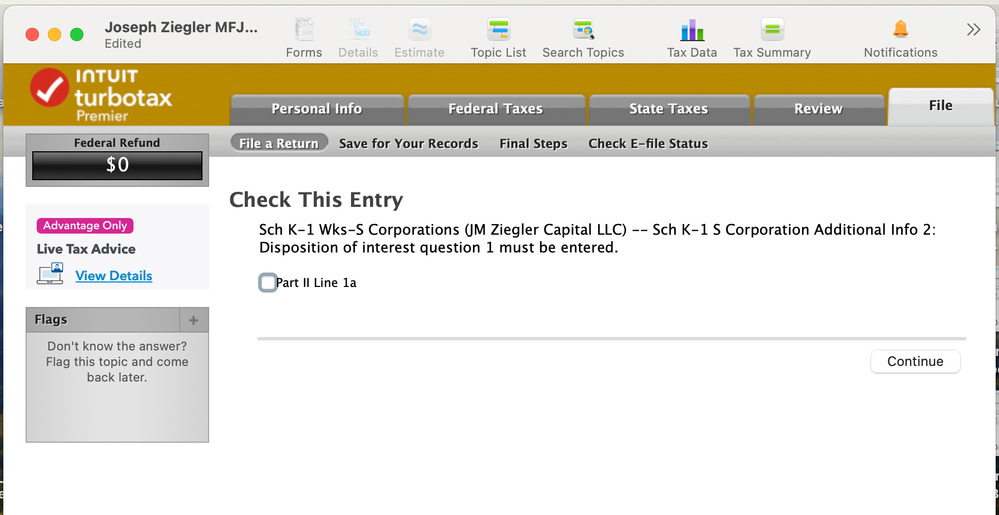

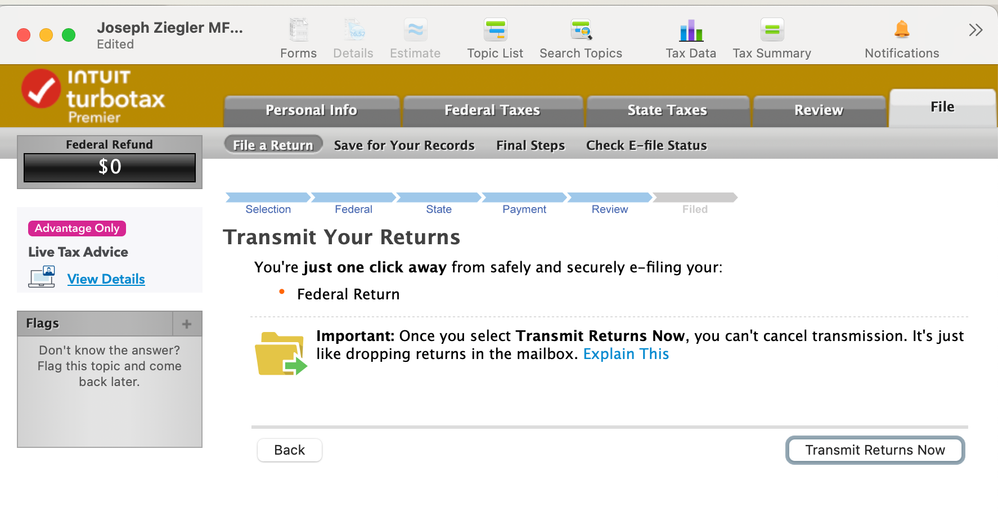

The problem in the program is that when entering the Schedule K-1 information, and checking Final K-1, the program requires that you click on K-1 Additional Information to enter at least one of choices of Disposition on Part II, Line 1a, 1b, or 1c be chosen. However, in the Easystep process of entering the K-1 it has choices of these 3 choices plus "None of the above" on how did you dispose of K-1 shares. As stated this entity is a single member LLC, filing as S-Corporation status for tax purposes, with a Corporate Dissolution Liquidation Form 966 and a completed Form 7203 completed. Even though the 7203 form was completed in TT properly - the program will not let you e-file unless share disposition choice 1a-1b-1c is chosen. How do you override this to allow e-file to complete? Attaching some screen shots.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

A few questions:

- Your facts don't make sense. Why are you receiving a K-1 if you indicate "I don't own any shares"?

- If you don't own any shares, what is the basis related to?

- How many years have you received a K-1?

- What other boxes on the K-1 have amounts in them?

- Did you receive a distribution in the final year?

- If this is a final K-1, you can't skip the disposition of S corporation shares section. That is the only way to handle this transaction correctly within TT.

Also keep in mind the date of replies, as tax law changes.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jmzchz5560

Returning Member

yayaroon

Level 2

MS456

Level 2

jman3

Level 3

maslinjarrod

Returning Member