- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Leticia,

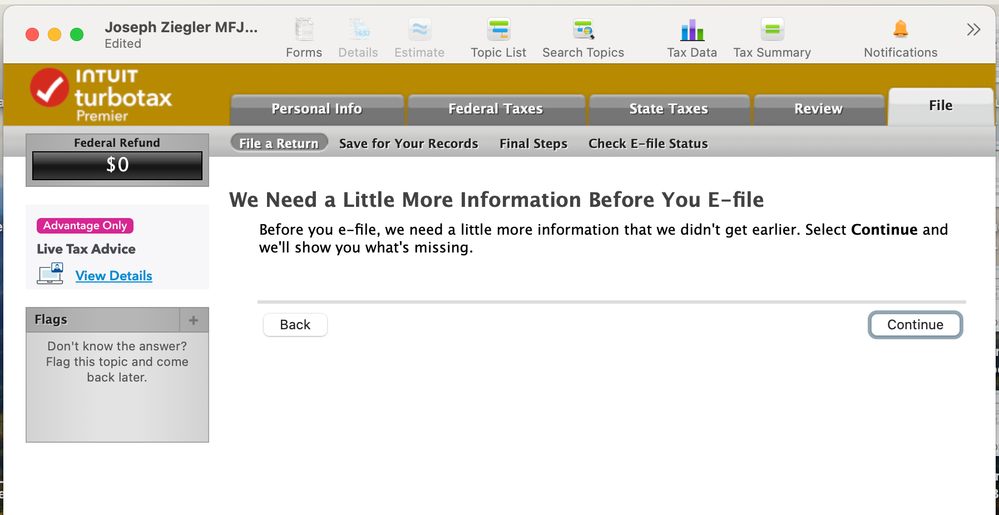

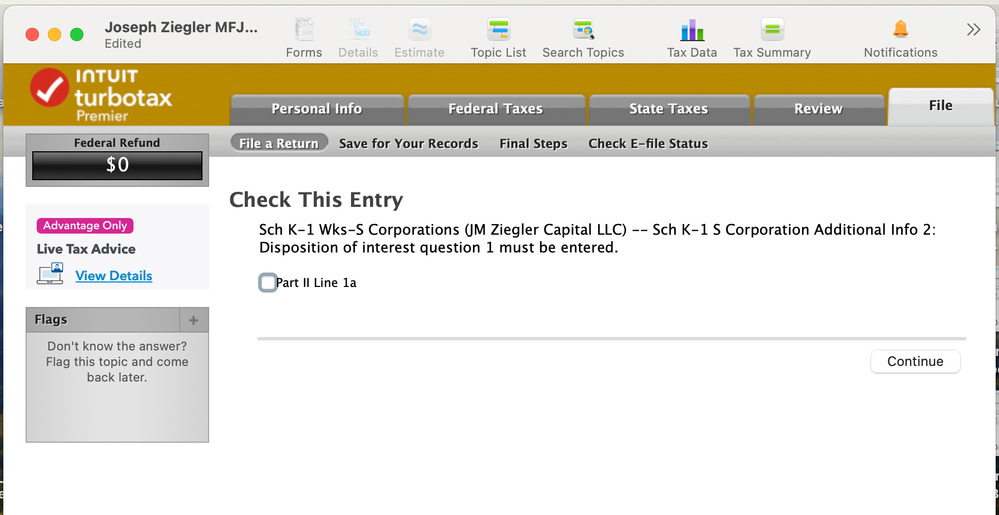

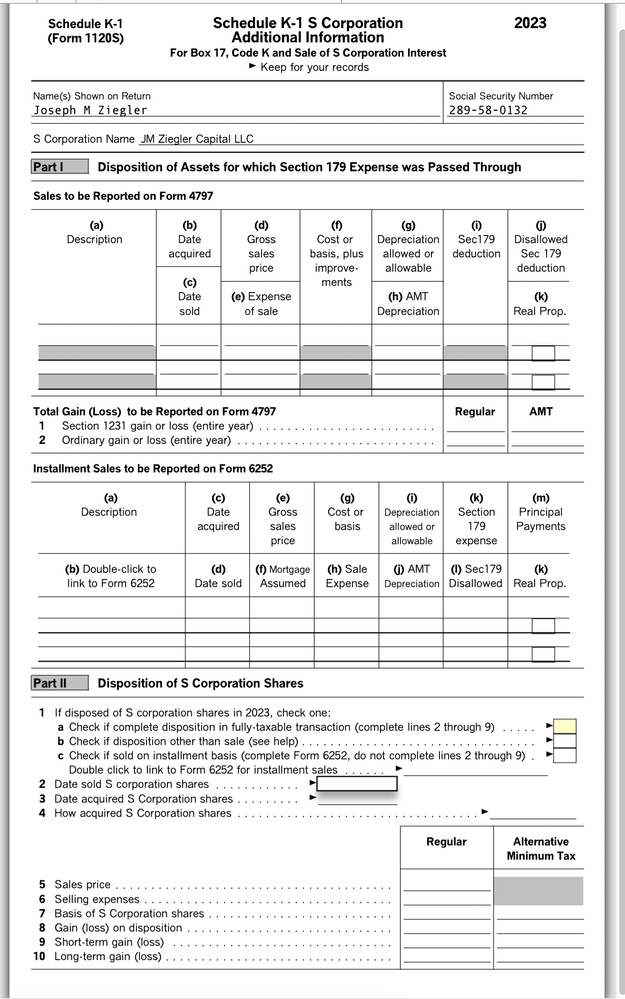

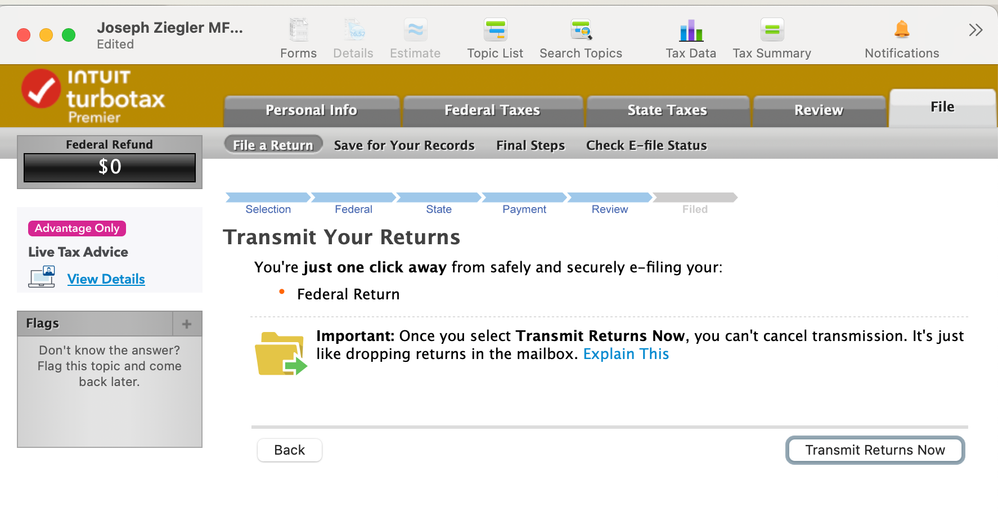

The problem in the program is that when entering the Schedule K-1 information, and checking Final K-1, the program requires that you click on K-1 Additional Information to enter at least one of choices of Disposition on Part II, Line 1a, 1b, or 1c be chosen. However, in the Easystep process of entering the K-1 it has choices of these 3 choices plus "None of the above" on how did you dispose of K-1 shares. As stated this entity is a single member LLC, filing as S-Corporation status for tax purposes, with a Corporate Dissolution Liquidation Form 966 and a completed Form 7203 completed. Even though the 7203 form was completed in TT properly - the program will not let you e-file unless share disposition choice 1a-1b-1c is chosen. How do you override this to allow e-file to complete? Attaching some screen shots.