- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

Closed this LLC with S-Corp election ending 2023. In final review, TT will not let me skip Part II Disposition of S Corporation Shares section. I had no shares in the LLC, was only managing member. Form 7203 was completed. Basis beginning of Year $9309, Stock basis end of corporation tax year is $0 == TT will not let me e-file my final returns. due to this item? Please help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

A little more information. CPA who did K-1 S-Corp also completed Form 966 Corporate Dissolution or Liquidation under code of Section 331 -- with the Form 7203 showing Stock Basis beginning of year $9309, end of year $0 - again no shares listed on this entity.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

Can you please clarify, what error you are getting in the program?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

Leticia,

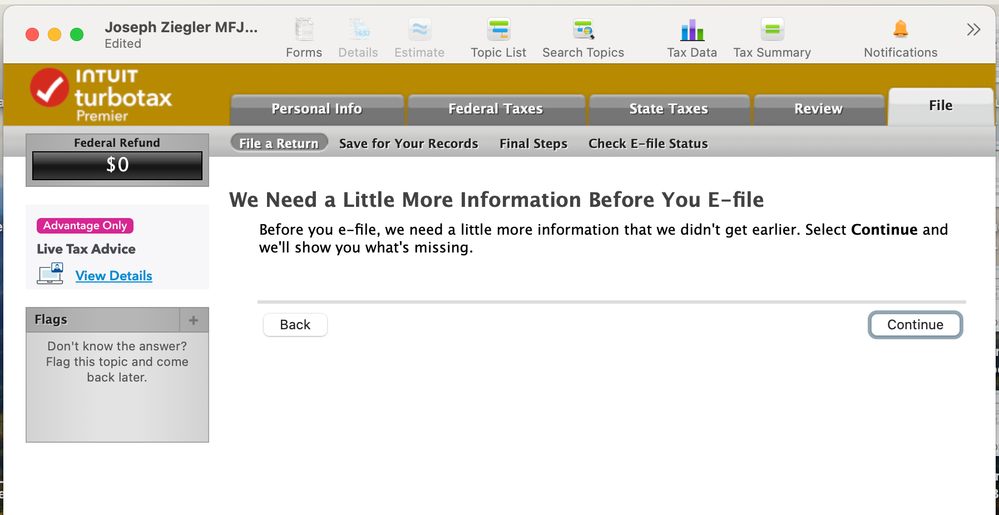

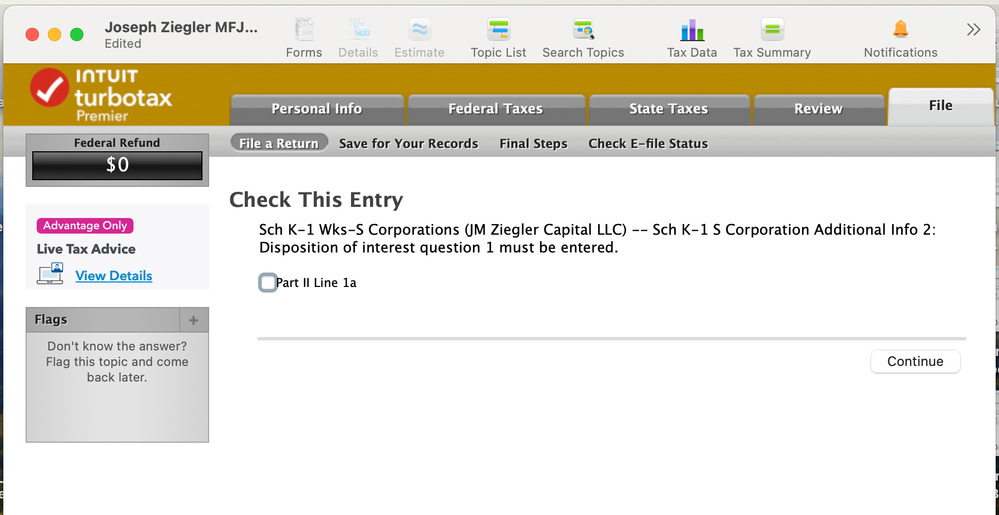

The problem in the program is that when entering the Schedule K-1 information, and checking Final K-1, the program requires that you click on K-1 Additional Information to enter at least one of choices of Disposition on Part II, Line 1a, 1b, or 1c be chosen. However, in the Easystep process of entering the K-1 it has choices of these 3 choices plus "None of the above" on how did you dispose of K-1 shares. As stated this entity is a single member LLC, filing as S-Corporation status for tax purposes, with a Corporate Dissolution Liquidation Form 966 and a completed Form 7203 completed. Even though the 7203 form was completed in TT properly - the program will not let you e-file unless share disposition choice 1a-1b-1c is chosen. How do you override this to allow e-file to complete? Attaching some screen shots.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

A few questions:

- Your facts don't make sense. Why are you receiving a K-1 if you indicate "I don't own any shares"?

- If you don't own any shares, what is the basis related to?

- How many years have you received a K-1?

- What other boxes on the K-1 have amounts in them?

- Did you receive a distribution in the final year?

- If this is a final K-1, you can't skip the disposition of S corporation shares section. That is the only way to handle this transaction correctly within TT.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

Hi Rick,

The entity is a Single Member LLC filing as an S-Corp for tax purposes. The LLC has no declared "shares", and as only member, I have 100% interest in the LLC ---- I have received a K-1 each year since I opened the LLC in 2021.

On K-1 I have values in Part III - Boxes 1,7,10, 17 -- In terms of final year distribution I just dissolved the S-Corp as CPA filed the Form 966 Corporate Dissolution or Liquidation. In entering the K-1, it has screen - Describe S corporation Disposal, with 4 choices - Sold Outright, Sold and Receiving Payments, Disposed of it but not by selling it, and "NONE of the ABOVE" -- which is what I checked. The first 3 choices are the only ones that can be selected -- TT should either have a 4th choice on K-1 Additional Information Part II Dispostion of S Corporation Shares - which would be None of the above or Dissolution. But it stops you from e-Filing there requiring one of those to be selected. In my case, none of those apply. This seems to be something TT technical needs to address. So I have only option of printing my return and mailing it to IRS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

Responses to your follow-up reply:

- While you may not technically own any shares, for tax purposes you in fact own 100%; so essentially all or any shares.

- You should select "disposed of but not by selling". Don't get hung up on nomenclature. Disposed and liquidated result in the same tax impact.

- Next what you need to do is update your tax basis for the applicable lines on the K-1, EXCEPT for any distributions. The beginning point for this is the beginning of the year basis figure of $9,309.

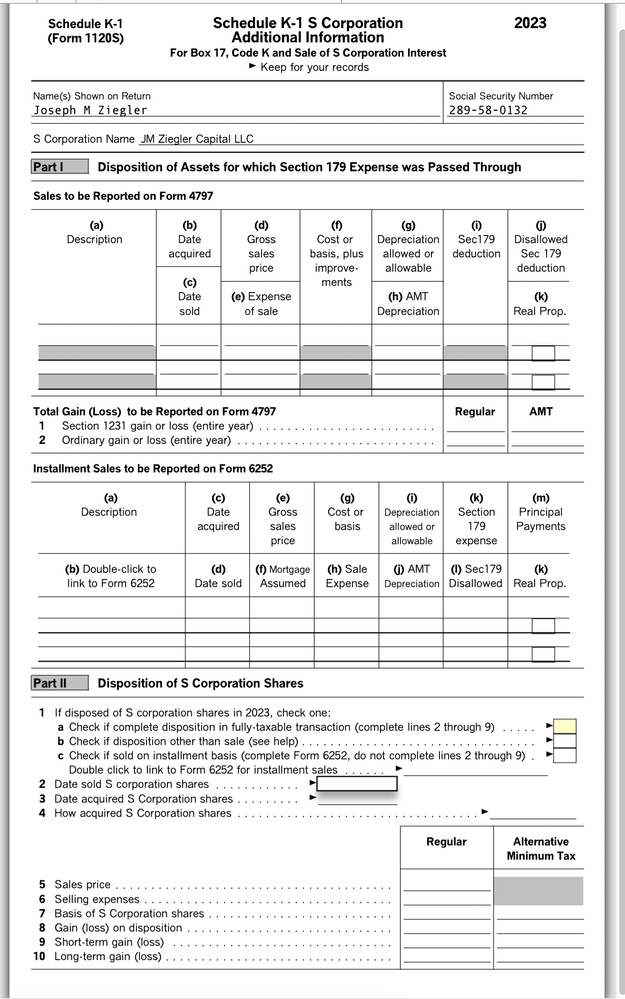

- The screen shot you shared (K-1 input screen) will then need to be completed and you have all this information for lines 2-7. Not sure if TT will automatically populate line 8; assuming it does.

- line 2 is the date of the liquidating distribution

- line 3 is the date you elected S corporation status; assuming this is the same date as you organized your LLC

- line 4 - just enter "purchased"

- line 5 is your liquidating distribution

- line 7 is your basis as determined above

- Unless you input the above, TT will not be able to determine you overall gain or loss on the transaction

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

Rick,

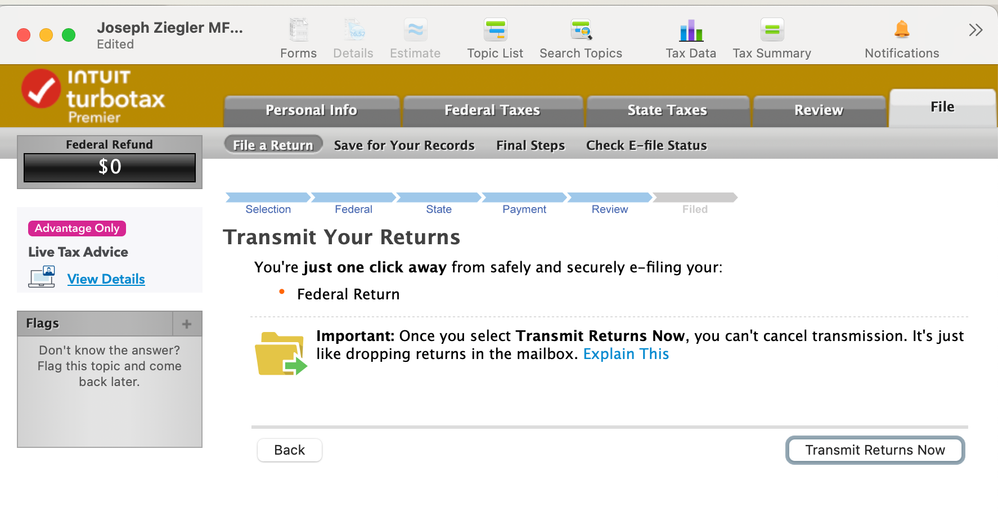

Thank you for your follow-up again. Just to let you know TT does not calculate Line 8 from the information entered in Form 7203 as in my case, the Beginning Year basis was $9309 (Line 1), Line 4 - $110, Line 5 was $9419, Line 6 Distributions was $0, Line 10 - Basis before Loss and Deduction Items $9419, Line 11 - Allowable Loss and Deduction Items - $4098, Line 13 - Other Items that decrease stock basis - $5321, Line 14 - $9419, leaving Line 15 - Stock Basis end of Corporate Tax Year - $0 So, Part II as loaded as you recommended resulted in No Errors on final check clearing it to be e-filed. Here is what it looked like after your suggestions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 2023 Final K-1 Checkbox - Disposition of S-Corp interest information

Obviously I can't verify some of the details you provided in the follow-up, but it appears to be handling it correctly and no errors. So that is a good thing.

What is included in "other items that decrease stock basis"?

Also keep in mind the date of replies, as tax law changes.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jmzchz5560

Returning Member

yayaroon

Level 2

MS456

Level 2

jman3

Level 3

maslinjarrod

Returning Member