- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: My LLC received a 1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My LLC received a 1099

I started a small LLC to provide funeral escort services. I use a Sched C to report the income and expenses. A business that I provide services sent me a 1099-MISC for the LLC using my TIN. How do i report/enter that 1099? Do I then not report the income on the Schedule C?

Thanks in advance!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My LLC received a 1099

The screenshot shared by user Carl is different than what you would see if you are using TurboTax Deluxe as you stated.

When using TurboTax Deluxe, you would click Start or Update beside the Business Income and Expenses (Sch C) line shown in your screenshot above. Then, click Edit beside your business name if you have already started entering the information for your business.

As you go through each page, you should come to a screen titled, 'Any 1099-MISC income?' This is where you can answer Yes and enter the information. Be sure to then adjust the total income amount that you already reported so that the 1099 income is not duplicated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My LLC received a 1099

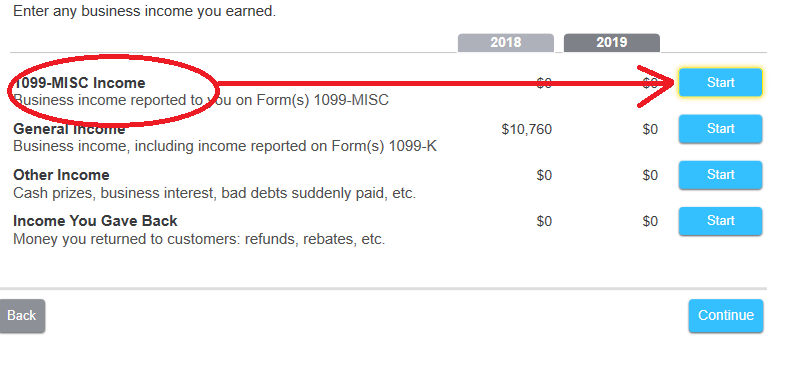

You missed a selection on one of the screens at the very beginning of the business income section. See screen shot below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My LLC received a 1099

Thanks for your reply! I could not find the page you provided in my TurboTax Deluxe. The attached photo is the business income section. None of the subsections have any 1099 entry sections, just a line for business income. I had already included the income that was on the 1099, but now I do not know how to get the 1099 entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My LLC received a 1099

The screenshot shared by user Carl is different than what you would see if you are using TurboTax Deluxe as you stated.

When using TurboTax Deluxe, you would click Start or Update beside the Business Income and Expenses (Sch C) line shown in your screenshot above. Then, click Edit beside your business name if you have already started entering the information for your business.

As you go through each page, you should come to a screen titled, 'Any 1099-MISC income?' This is where you can answer Yes and enter the information. Be sure to then adjust the total income amount that you already reported so that the 1099 income is not duplicated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My LLC received a 1099

Got it. Thanks!!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

malvinchip

New Member

championjerry

New Member

SoCalRetiree

Level 1

MakeMoreDave

Level 1

Marg03

New Member