- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Crop Insurance payments on 1099-Misc

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

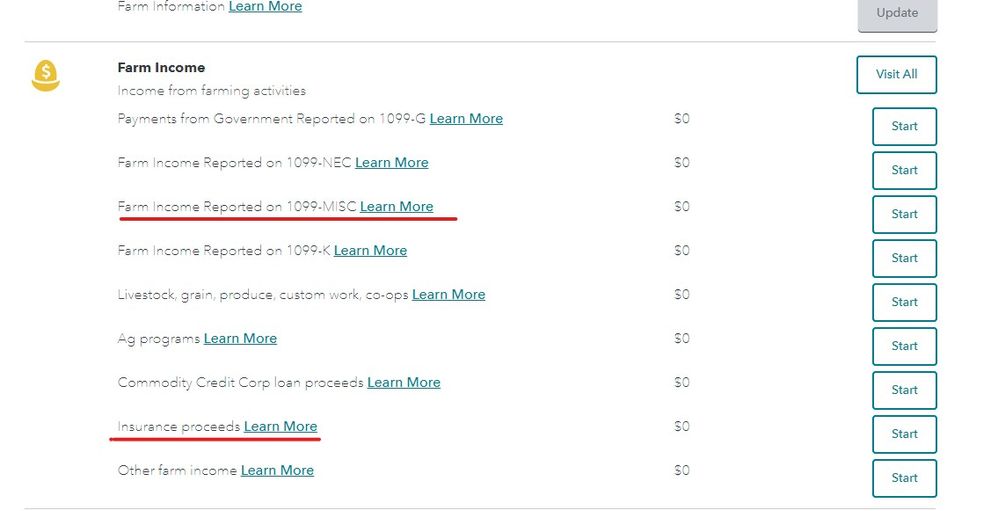

I have crop insurance payments reported in Box 9 of a 1099-Misc for a farm rental. Where do I enter this?

There is no place to report amounts in Box 9 in "Farm Income Reported on 1099-Misc" and there is no place to enter crop insurance payments reported on 1099-Misc under "Crop Insurance Payments".

In addition, I need to defer part of these proceeds to 2021.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

Thanks for your response but you didn't address the Turbo Tax issue with entering the 1099. I'm totally aware of how crop insurance proceeds are taxed and that they can be deferred. The issue is a TurboTax programming issue that they are finally working on. So if anyone else encounters this issue, it is a program bug, not an operator error.

In the meantime, I did find a work around. The 1099-Misc entry area that is not on the Farm Rental entry screen has a Box 9 that the payments can be entered in. Then the deferral can be entered under Crop Insurance proceeds on the Farm Rental input area for Crop Insurance not reported on 1099-MIsc. This method gets right amounts in the right places on Form 4835.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

Crop insurance proceeds are entered as Income on your Schedule F. TurboTax will walk you through the entries to enter the deferment.

You can postpone reporting some or all crop insurance proceeds as income until the year following the year the physical damage occurred if you meet all the following conditions.

-

You use the cash method of accounting.

-

You receive the crop insurance proceeds in the same tax year the crops are damaged.

-

You can show that under your normal business practice you would have included income from the damaged crops in any tax year following the year the damage occurred.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

Thanks for your response but you didn't address the Turbo Tax issue with entering the 1099. I'm totally aware of how crop insurance proceeds are taxed and that they can be deferred. The issue is a TurboTax programming issue that they are finally working on. So if anyone else encounters this issue, it is a program bug, not an operator error.

In the meantime, I did find a work around. The 1099-Misc entry area that is not on the Farm Rental entry screen has a Box 9 that the payments can be entered in. Then the deferral can be entered under Crop Insurance proceeds on the Farm Rental input area for Crop Insurance not reported on 1099-MIsc. This method gets right amounts in the right places on Form 4835.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

I have the same situation. My 1099-MISC has an amount in Box 9 Crop insurance proceeds. I also file as a Farm Rental and not Schedule F. Seems possible that the 1099-MISC form has changed since last year? On my 2019 form from the same insurer, Box 10 was labeled crop insurance proceeds.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

Yes, the 1099-MISC was changed for 2020. Crustv's answer above is the correct way to enter this: The 1099-Misc entry area that is not on the Farm Rental entry screen has a Box 9 that the payments can be entered in. Then the deferral can be entered under Crop Insurance proceeds on the Farm Rental input area for Crop Insurance not reported on 1099-MIsc. This method gets right amounts in the right places on Form 4835.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

In the farm rental section there are 2 options for that income to be reported ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

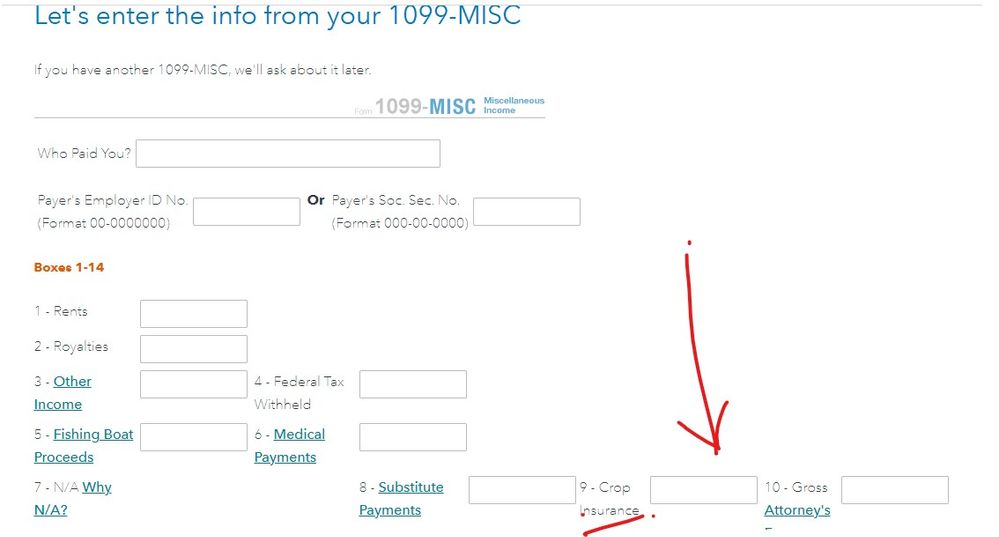

As stated earlier, the first option doesn't have an input area for amounts in Box 9 of the 1099. The second option doesn't have an input area for amounts reported on a 1099 so please clarify how either of these options will work for me if there is no input area for the 1099 amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

Entries in the FORMS mode can void the accuracy guarantee and/or keep you from efiling.

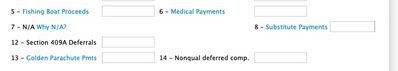

The entry screen has a box 9 in the farm rental section :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

As stated earlier, input boxes 9 and 10 are cut off in customer versions of TurboTax Premier. I'm aware that TT support versions show the boxes but customer versions do not. If there's anyway you can advocate to have it corrected, we'd all appreciate the correction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

I can also confirm to previous post that there is a programming/formatting error in TurboTax. There is NOT a rectangular box to fill in adjacent to the word "9 Cro" followed by a chopped off letter p.

I'm using TT Home and Business version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

Here's a screenshot of the 9-Cro... text and entry box cut off (Windows 10 latest updates)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

I'm using Home and Business for Mac. I just installed the latest updates and there is still no box 9 for 1099-MISC in the farm rental section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

If you are using the CD/Download version of TurboTax, you can enter the payment for crop insurance proceeds in Forms Mode.

- Go into Forms Mode by clicking on the Forms icon in the top right of the blue bar.

- In the Forms in My Return list on the left, click on the form 1099-MISC you wish to open .

- Scroll down to Box 9 and enter the information on crop insurance proceeds.

- To return to the interview, click the Step-By-Step icon in the top right of the blue bar.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crop Insurance payments on 1099-Misc

I see now that the Home and Business for Mac product has been updated to display Box 9 Crop Insurance.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

devinrendon27

New Member

yaquelin2

New Member

ceunmeesuh

Returning Member

siddjain1

Level 2

kevin19801980

Returning Member