- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Business income and Income from investments

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business income and Income from investments

I purchased the 2020 Home and Business product and I guess I may need a different product. I need to enter my retrement income, Income from investments and my wife's self-employment income (schedule C). Do I need a different TurboTax version in order to do this, because this version isn't allowing me to do my wife's income. If so, which version do I need and how much is it to upgrade to the new version. How should I do it.

Thanks,

Gary

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business income and Income from investments

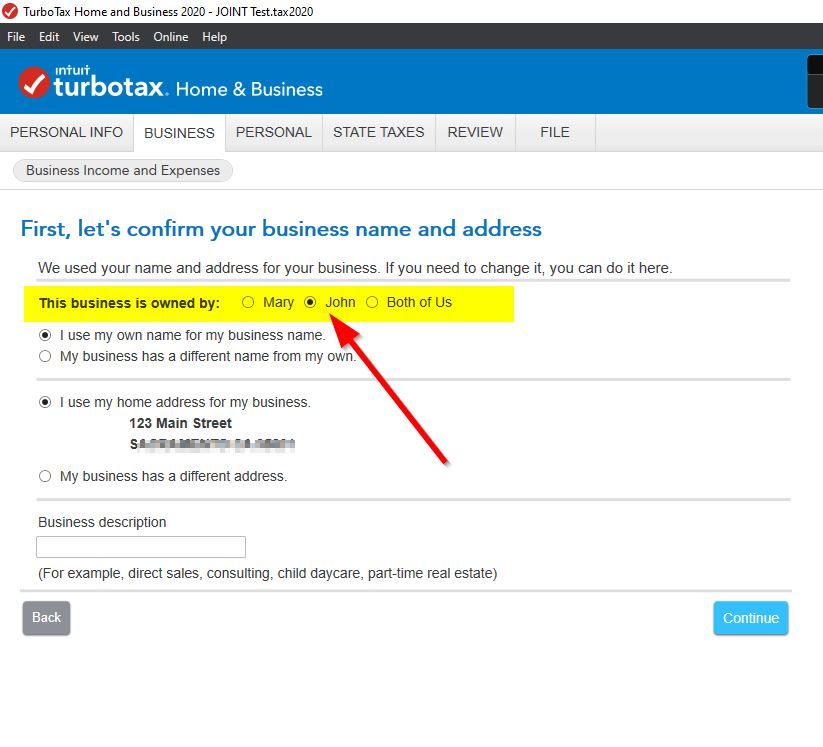

The Home & Business version is the highest personal version. It has everything the lower versions have. Did you select married and filing Joint under Personal Info? I have Home & Business for Windows so I can give you screen shots.

To add a business

Go to Business tab-Continue

Business Income and Expenses

Profit or Loss from Business, click Start or Update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business income and Income from investments

Can you find this screen when you Add a Business?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business income and Income from investments

If you can't find where to enter income, just keep going. When you first add a business you have to go though the business set up questions until you get to entering the income and expenses. You can also switch to Forms Mode (click Forms at the top) and open a schedule C to fill out.

Are you stuck on a screen? When you start a new tax return in the Home & Business version after you enter your personal info it takes you though the Business tab first so I don't know how you missed it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business income and Income from investments

If you will just use the program the way it's designed and intended to be used, everything will be covered. One good thing about having the CD version is that it's easy to start over. Just start using the program and actually work it all the way through. You will most likely make mistakes along the way. That's fine. It's how you learn. Any time you want to start over, simply exit the program. Then delete the .tax2020 file from the documents/turbotax directory. When you fire up the program again it's "as if" you just installed it for the very first time and everything starts over from the beginning.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business income and Income from investments

Yes. I selected joint filing and my wife's information shows on the profile.

Usually, when after I put in my self employment income I just select hers to input her self employment income, but nothing shows up for her.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business income and Income from investments

Usually, when after I put in my self employment income I just select hers to input her self employment income, but nothing shows up for her.

I'm just guessing here, but that's most likely because you are including all business income on one SCH C. If you have a SCH C business and your spouse has a SCH C business and you're filing joint, that means there should be two SCH C's with your joint tax return. One for each tax filer's business.

Work through the first SCH C business entering only the income and expenses from one of the businesses. Upon completing that one business in it's entirety the screen will have a button on it for "Add Another Business".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business income and Income from investments

Thanks for everyones help. I was able to figure it out with your help.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

knownoise

Returning Member

Budman7226

Level 1

j-zee

New Member

KarenL

Employee Tax Expert

shirleyzeng

Returning Member