- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Question about Advertising Expenses AS an Advertising Consultant.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Advertising Expenses AS an Advertising Consultant.

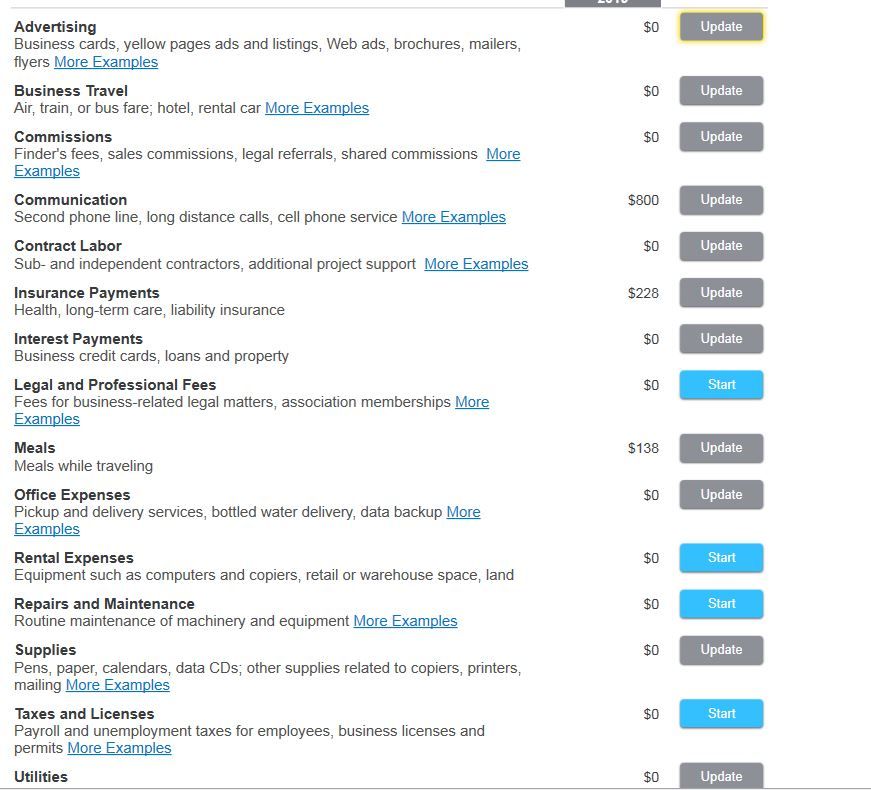

So, I feel like I hit kind of a roadblock. I do some digital marketing and make websites for people as an independent contractor, and I've gotten to the expenses section of my business. I was able to write off my office expsenses no problem (square footage, utilities, insurance, etc.) but now I've come to the part where I need to write off the actual ADVERTISING money spent for my clients.

Example: I made $52,000 from a single client, but I spent 75% doing my job and actually advertising and spending money on server space with that money. So my net is way, way off obviously.

My question is which one of these sections do I enter these expenses? It can't be advertising, right? Because that's for advertising related to promoting my business, correct?

Not pictured it also says "Other Miscellaneous Expenses." Where do I put these expenses?

Any help would be GREATLY appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Advertising Expenses AS an Advertising Consultant.

I've come to the part where I need to write off the actual ADVERTISING money spent for my clients.

That's where you claim/enter what *YOU* paid to advertise *YOUR* business.

What you paid for advertising for others I would report under Office Expenses. There you can label it for what it really is. For example, "Client Advertising Costs", or "Advertising cost for Clients" or something like that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Advertising Expenses AS an Advertising Consultant.

Some clarification would be helpful.

So from what I am reading, your client pays you $$ for your consulting expertise in marketing their product.

The $$ that are paid to you are for your consulting time AND the client expects you to market their product / business in the appropriate social media.

Do I have that correct?

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Advertising Expenses AS an Advertising Consultant.

So if they give me $50,000 and this includes their ad budget, my fee would 15% or $7500, and all other $42,500 would be allocated to their ads, website, etc. I have receipts for all of these expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Advertising Expenses AS an Advertising Consultant.

Based on the clarification of facts, just make sure you report the full amount of income and then report the expenses as noted previously; I would recommend misc expenses where you can title it "Advert XYZ Client" or something to that effect.

Also keep in mind the date of replies, as tax law changes.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lewlew

Level 2

Mima9

New Member

Bmck345

Level 2

Lbarber001

New Member

DisgustedUser

Level 1