- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Multiple Tax IDs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple Tax IDs

During the year I switched from using my SSN to an EIN for my sole prop. business. Amazon has issued two 1099s, one for each. How do I note this on my Schedule C filing for my business, or since my return has my SSN, do just use the EIN for my business info?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple Tax IDs

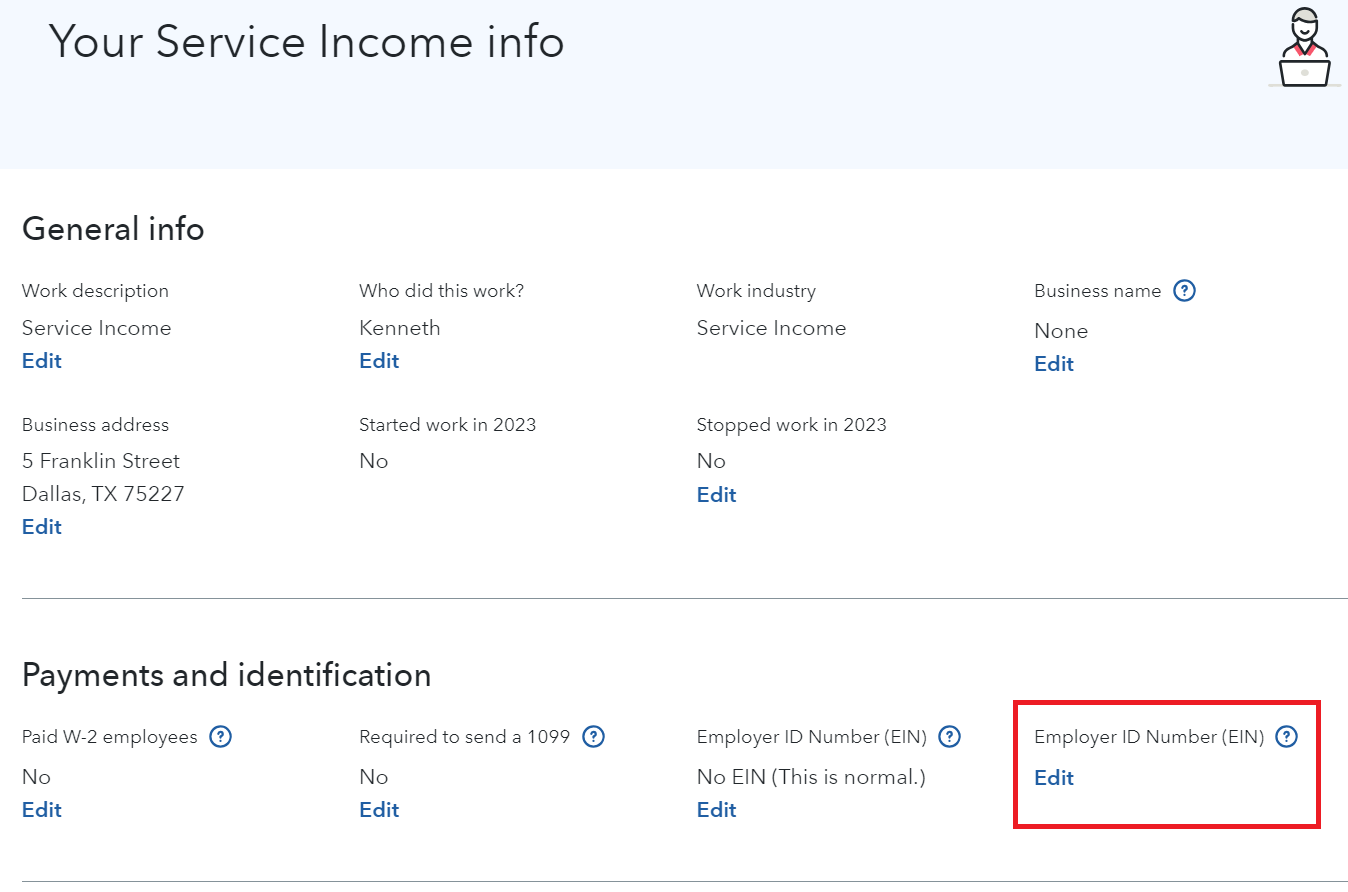

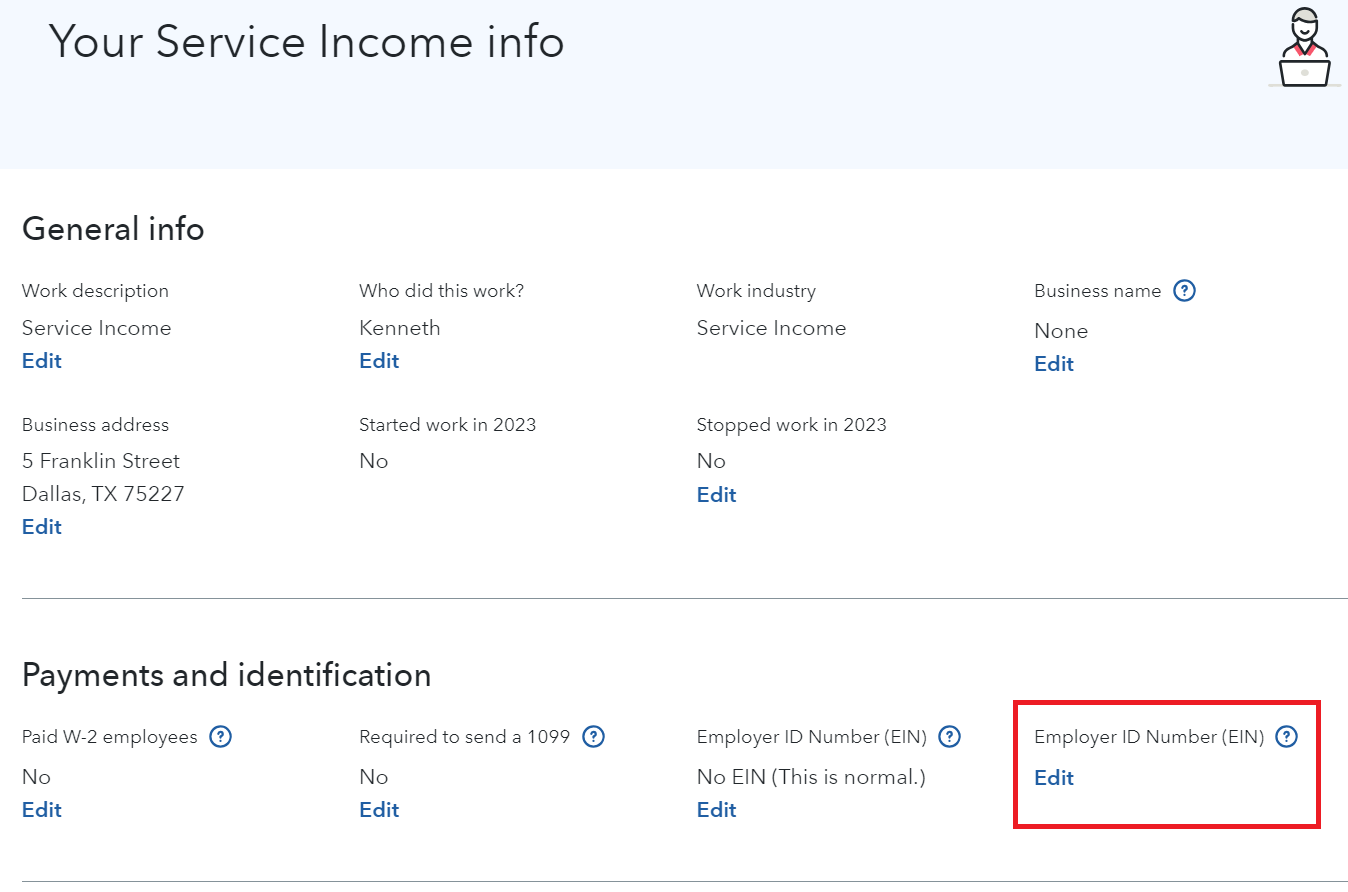

Yes, you can enter the EIN in your Schedule C business under 'Your Service Income Info', the 'Payments and identification'. Both 1099s belong to your business so the important action is to include all of the income on your Schedule C business. You can enter the 1099-NEC itself, or you can simply include the income 'Other self-employment income...'.

- Search (upper right magnifier) > Type Schedule C > Use the Jump to... link > Edit beside your business > Scroll to 'Business Summary' > Select 'Your Service Info'

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple Tax IDs

Yes, you can enter the EIN in your Schedule C business under 'Your Service Income Info', the 'Payments and identification'. Both 1099s belong to your business so the important action is to include all of the income on your Schedule C business. You can enter the 1099-NEC itself, or you can simply include the income 'Other self-employment income...'.

- Search (upper right magnifier) > Type Schedule C > Use the Jump to... link > Edit beside your business > Scroll to 'Business Summary' > Select 'Your Service Info'

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jadaadams44

Returning Member

AJSR111

New Member

Raph

Community Manager

sparksj337

Returning Member

eriksonalyssa

New Member