- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

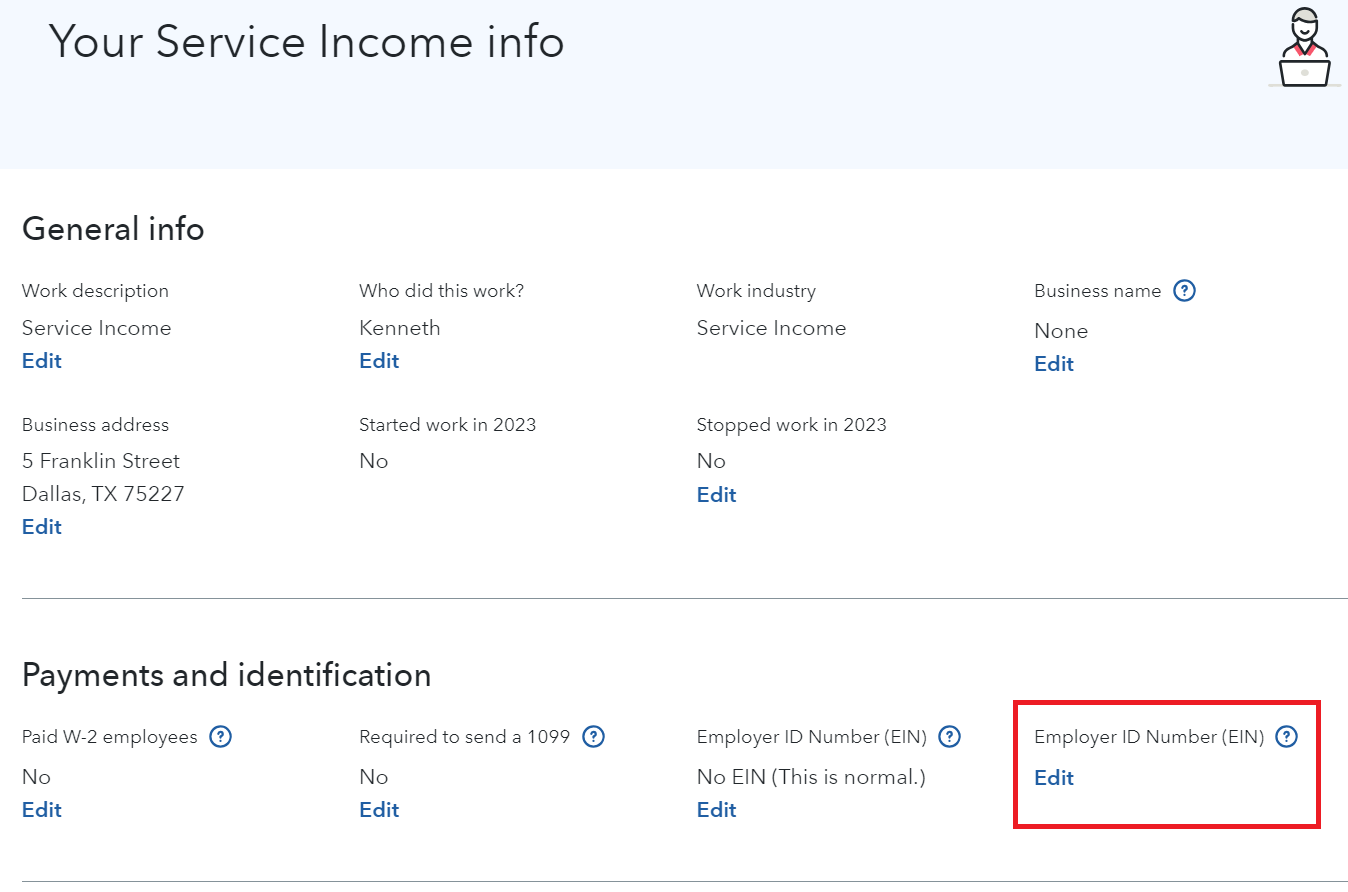

Yes, you can enter the EIN in your Schedule C business under 'Your Service Income Info', the 'Payments and identification'. Both 1099s belong to your business so the important action is to include all of the income on your Schedule C business. You can enter the 1099-NEC itself, or you can simply include the income 'Other self-employment income...'.

- Search (upper right magnifier) > Type Schedule C > Use the Jump to... link > Edit beside your business > Scroll to 'Business Summary' > Select 'Your Service Info'

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 29, 2024

9:57 AM

578 Views