- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How Loans Repaid to a Shareholder Effect Basis

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Loans Repaid to a Shareholder Effect Basis

I am very confused.

In 2023 as the 100% owner and shareholder in my S Corporation, I needed to give my company a short-term bridge loan for 2-months while waiting on some delayed receivables. The loan was made, and repaid, in the same year.

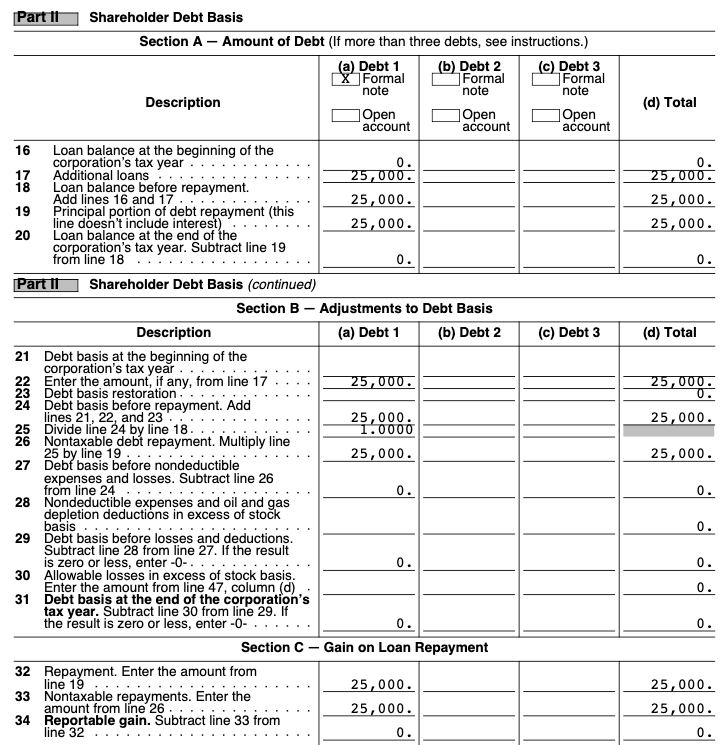

Going through the Step-by-Step in TurboTax Business Desktop, I responded that there were $25,000 in repayments of loans made by shareholders. During the accuracy check, I was brought to the S Corporation Shareholder Stock and Debt Basis Limitations Worksheet as a few other fields were red and needed to be filled out. See below:

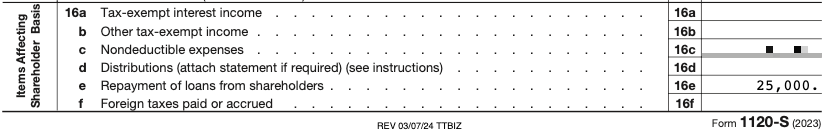

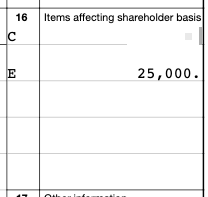

As you can see, I accurately filled out that there was no loan balance at the beginning of the year, or at the end of the year. However, even with this, the 1120-S:

Show $25,000 affecting basis.

To my brain, this doesn't make sense.

+$25,000

-$25,000

=======

$0.00

Sure, if there was a loan in one year, and a repayment in another year, this makes sense - but that isn't the case. So, is this accurate the way it is being shown? Or do amended returns need to be filed to fix this?

Please help me with my confusion. lol

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Loans Repaid to a Shareholder Effect Basis

what's the problem? the schedule shows the repayment is non-taxable. 16E only tells the IRS there was a loan repayment - not that it's taxable. the K-1 does not show and has never shown loans the shareholder(s) make to the corporation. that's probably why the IRS developed the form because some shareholders were misreporting basis and loan repayments when loans were used to provide basis for deducting losses. There is also the issue of whether the loans should carry interest.

IRC 7872

(3)$10,000 de minimis exception for compensation-related and corporate-shareholder loans

(A)In general

In the case of any loan described in subparagraph (B) or (C) of paragraph (1), this section shall not apply to any day on which the aggregate outstanding amount of loans between the borrower and lender does not exceed $10,000.

(C)Corporation-shareholder loans

Any below-market loan directly or indirectly between a corporation and any shareholder of such corporation.

put simply the loan was above $10K and the S-corp should have paid you interest on the loan.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Loans Repaid to a Shareholder Effect Basis

what's the problem? the schedule shows the repayment is non-taxable. 16E only tells the IRS there was a loan repayment - not that it's taxable. the K-1 does not show and has never shown loans the shareholder(s) make to the corporation. that's probably why the IRS developed the form because some shareholders were misreporting basis and loan repayments when loans were used to provide basis for deducting losses. There is also the issue of whether the loans should carry interest.

IRC 7872

(3)$10,000 de minimis exception for compensation-related and corporate-shareholder loans

(A)In general

In the case of any loan described in subparagraph (B) or (C) of paragraph (1), this section shall not apply to any day on which the aggregate outstanding amount of loans between the borrower and lender does not exceed $10,000.

(C)Corporation-shareholder loans

Any below-market loan directly or indirectly between a corporation and any shareholder of such corporation.

put simply the loan was above $10K and the S-corp should have paid you interest on the loan.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Loans Repaid to a Shareholder Effect Basis

I guess I don't know that there is a problem. lol

I was worried that since that $25k was in the box that says it was an item that affected basis, I was concerned that it was going to make my basis in the company a negative amount, and thus subject to capital gains.

This is the first time I've done a loan to the business so I just wasn't sure how that should appear on the K-1. In my head, I just imagined that if the loan crossed a year boundary that one year would have shown a +$25k, and the other year a -$25k, thus zeroing out. So, if both the loan and the repayment occurred in the same year, I wasn't sure why it was being shown at all. Again, this is just the logic that was going through my head based on absolutely nothing. lol 🙂

But I see now that even though that $25k is in that box, it's not affecting my basis the way I misunderstood that it was.

As an aside regarding interest, I actually did charge the business interest at 5.5% APR on a signed promissory note for recordkeeping. Making the loan to the business meant I was missing out on the 5.5% APY I would have received if I had left the money in my HYSA, so I figured it was only fair to make the business pay the interest I missed out on. I then issued myself a 1099-INT from the business for the interest that was paid to me (since that's what TurboTax told me to do lol).

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

JpsEnt

Level 1

gtom118

New Member

Samsun683

Level 2

hadley2002

New Member

RosieL

Level 1