- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Loans Repaid to a Shareholder Effect Basis

I am very confused.

In 2023 as the 100% owner and shareholder in my S Corporation, I needed to give my company a short-term bridge loan for 2-months while waiting on some delayed receivables. The loan was made, and repaid, in the same year.

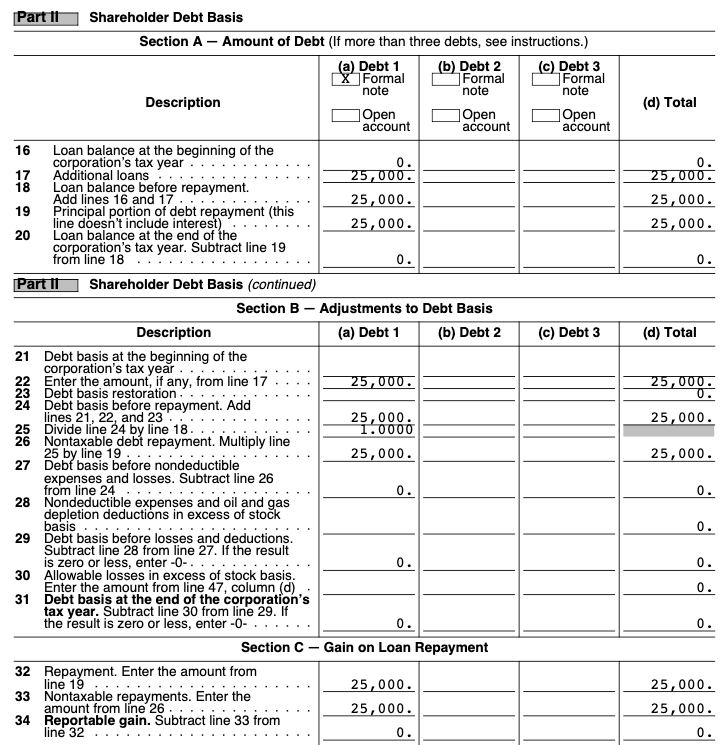

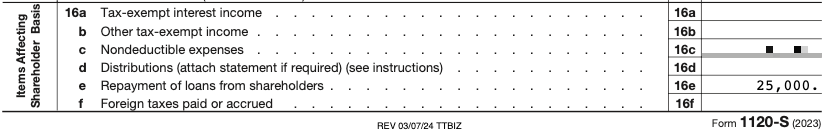

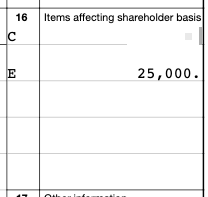

Going through the Step-by-Step in TurboTax Business Desktop, I responded that there were $25,000 in repayments of loans made by shareholders. During the accuracy check, I was brought to the S Corporation Shareholder Stock and Debt Basis Limitations Worksheet as a few other fields were red and needed to be filled out. See below:

As you can see, I accurately filled out that there was no loan balance at the beginning of the year, or at the end of the year. However, even with this, the 1120-S:

Show $25,000 affecting basis.

To my brain, this doesn't make sense.

+$25,000

-$25,000

=======

$0.00

Sure, if there was a loan in one year, and a repayment in another year, this makes sense - but that isn't the case. So, is this accurate the way it is being shown? Or do amended returns need to be filed to fix this?

Please help me with my confusion. lol

Thanks!