- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How do I report if partnership shares were sold in 2019? Items on the "Sale information" are not all available in the Schedule K-1 Sale Schedule.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report if partnership shares were sold in 2019? Items on the "Sale information" are not all available in the Schedule K-1 Sale Schedule.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report if partnership shares were sold in 2019? Items on the "Sale information" are not all available in the Schedule K-1 Sale Schedule.

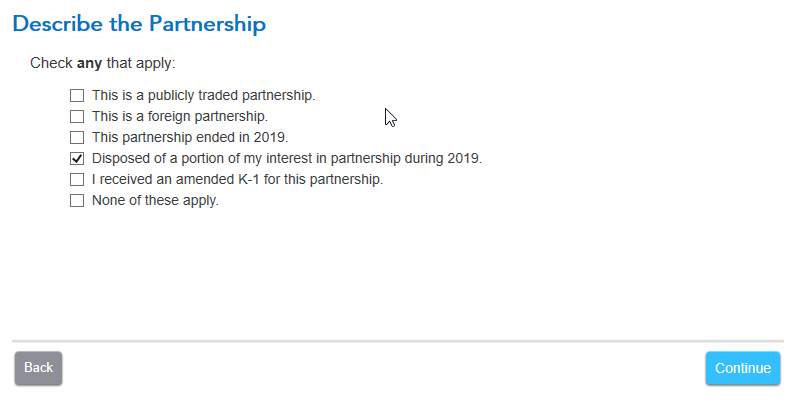

In the K-1 entry section, there is a screen "Describe the Partnership". On that screen is a line you need to check for "Disposed of a portion of my partnership interest in 2019". When you check that box, TurboTax will present you with the questions to report the disposition and correctly report the gain on your tax return.

Click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to begin edit the entry for your Schedule K-1.

Here is a screenshot of the TurboTax screen you are looking for:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report if partnership shares were sold in 2019? Items on the "Sale information" are not all available in the Schedule K-1 Sale Schedule.

One of the more important pieces of information that will be needed is your basis in your partnership interest. Hopefully you have maintained this information. Unless you have this, you will not be able to determine your overall gain or loss on this investment.

Also keep in mind the date of replies, as tax law changes.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chalmatt

New Member

abarmot

Level 1

sam992116

Level 4

gavronm

New Member

zenmster

Level 3