- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Home Baking Business - Replaced All Plumbing in House, where and how to enter as depreciating asset?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Baking Business - Replaced All Plumbing in House, where and how to enter as depreciating asset?

We have a home baking business we run entirely out of our home. We have some storage areas used exclusively for the business' ingredients and sales equipment like bags, boxes, flour, nuts etc. We do all baking in the same kitchen we use for all personal food preparation.

This past summer, we replaced all pipes in the house (the entire neighborhood was built using a type of plastic piping that's prone to catastrophic and sudden leaks).

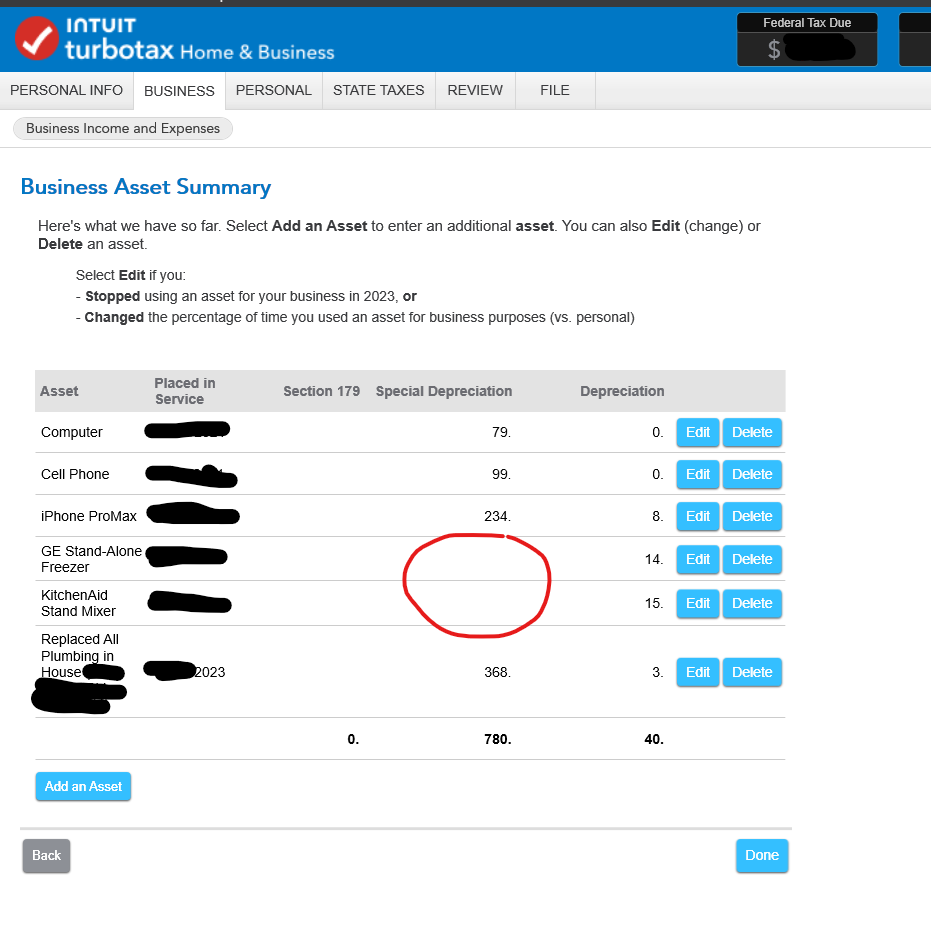

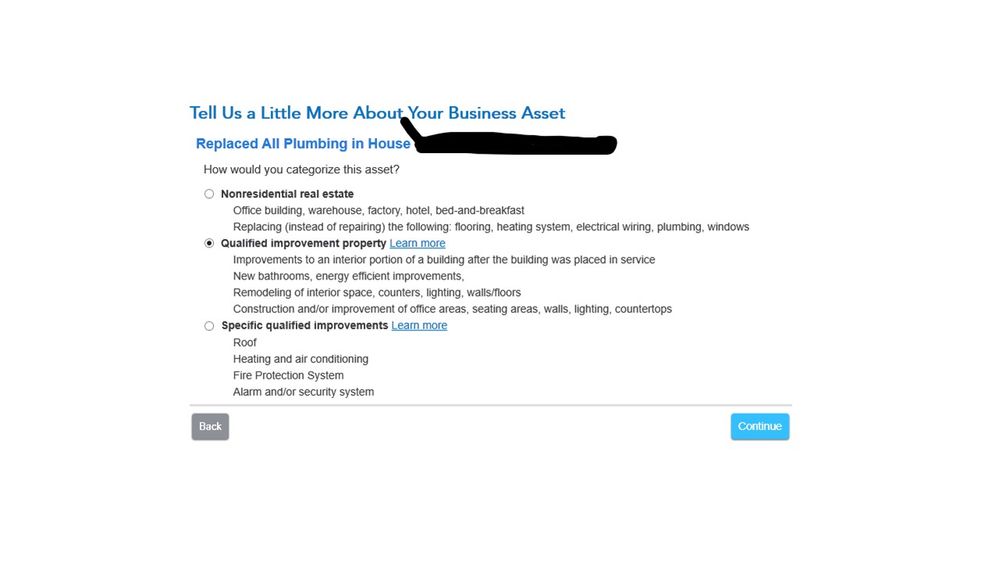

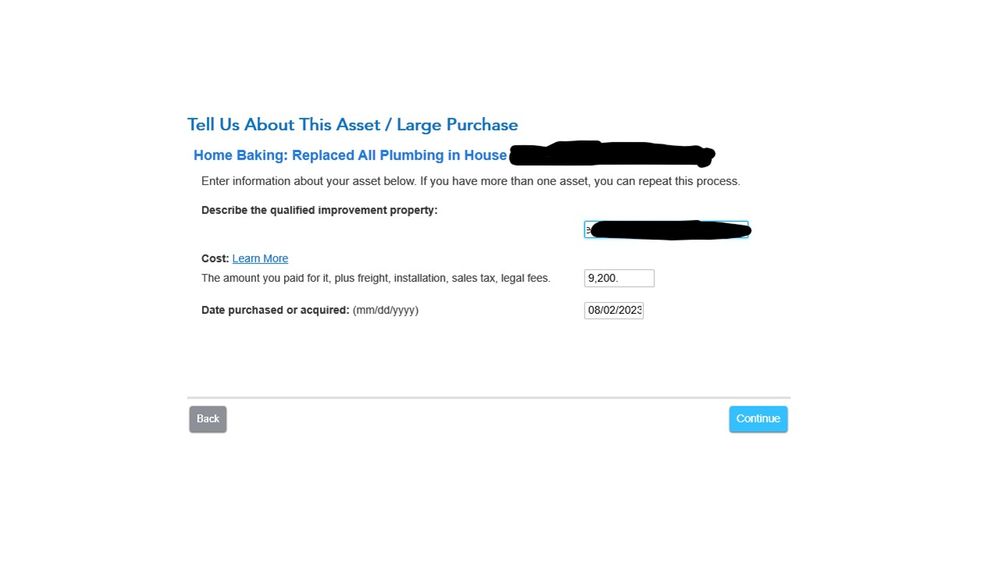

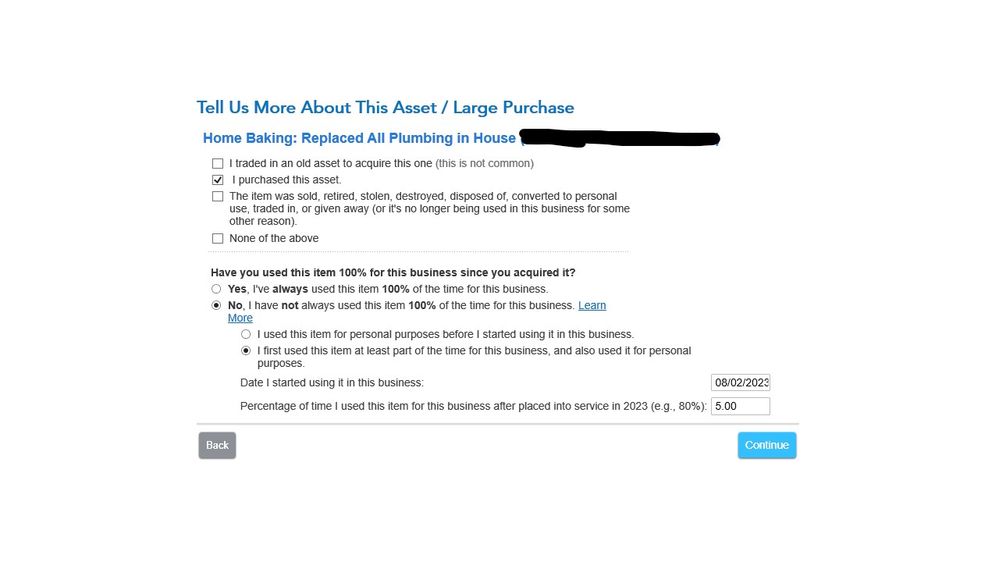

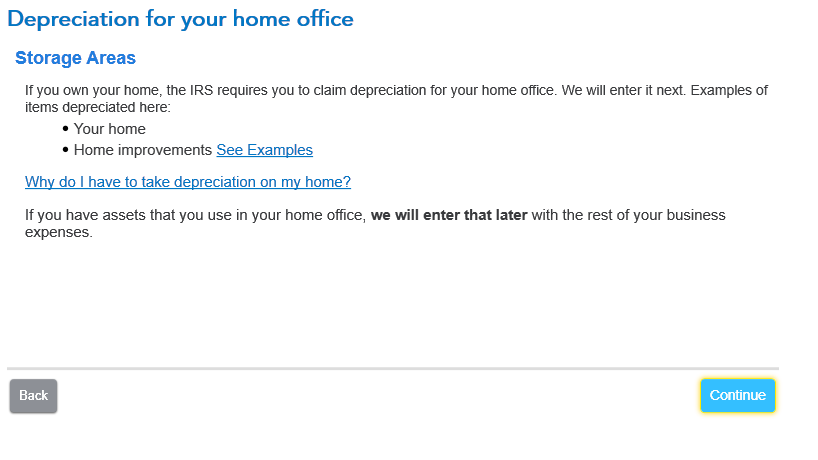

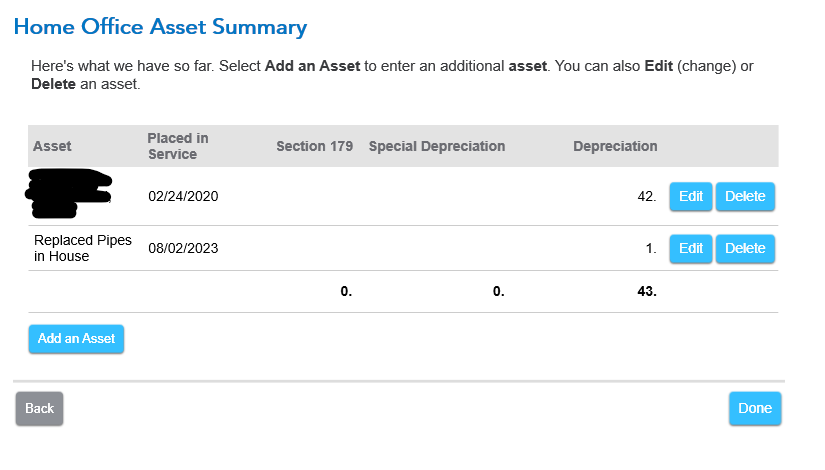

Did I enter it correctly here?

And what do I enter (Turbotax didn't prompt me) here for Special Depreciation?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Baking Business - Replaced All Plumbing in House, where and how to enter as depreciating asset?

Did you allocate the plumbing cost to the entire home? You should report only the portion that services your business. The majority of this cost would either be a repair expense or increase your basis in the home.

Bonus depreciation is "a special depreciation allowance to recover part of the cost of qualified property placed in service during the tax year. The allowance applies only for the first year you place the property in service. The allowance is an additional deduction you can take after any section 179 deduction and before you figure regular depreciation under MACRS for the year you place the property in service."

TurboTax will offer this bonus depreciation during the asset interview sequence if your property qualifies for this special allowance. Because this type of depreciation can be "recaptured" as ordinary income when you sell the asset, taking this additional deduction is optional.

See IRS Pub 946: Claiming the Special Depreciation Allowance

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Baking Business - Replaced All Plumbing in House, where and how to enter as depreciating asset?

Thanks for the reply! Yes, I specified only 5% of the cost of replacing the plumbing in the house is allocated to the baking business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Baking Business - Replaced All Plumbing in House, where and how to enter as depreciating asset?

I think you chose the wrong category for the plumbing. You need to indicate it is an improvement to the home itself. It will not qualify for the Special Depreciation Allowance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Baking Business - Replaced All Plumbing in House, where and how to enter as depreciating asset?

Any idea how I am supposed to categorize the home plumbing improvement to the house in which we operate the home baking business?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Baking Business - Replaced All Plumbing in House, where and how to enter as depreciating asset?

Yes, I can give you an idea about how to handle this expense/asset. It's difficult for me to determine in your screen image exactly how you listed the asset, however you would add the plumbing as a nonresidential asset like the home office if you are using that deduction. You can use the same square feet percentage used for your 'storage areas used exclusively for the business' ingredients and sales'. As far as the kitchen where the baking is done, because it's a personal use space as well, it does not meet the exclusive use test. So total home office square feet divided by the total home square feet provides the business use percentage.

The plumbing is considered the same as the office being depreciated over 39 years for nonresidential property. It can be confusing but the office portion of your home is a business and not used for residential purposes. So the rules are quite clear, that it must be part of your home office that can be listed as a new asset in 2023 as a capital improvement using the same percentage you used originally for a home office expense.

You do have an option to determine the home office percentage of the cost, then enter it as an asset at that cost without adding it to your home office expense if you haven't used that before.

Please update here if you have more questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Baking Business - Replaced All Plumbing in House, where and how to enter as depreciating asset?

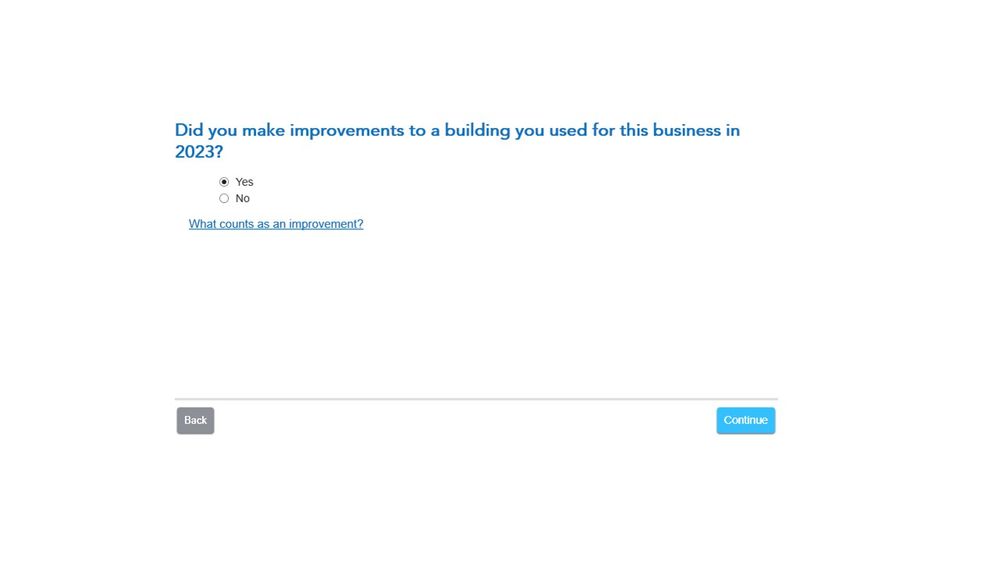

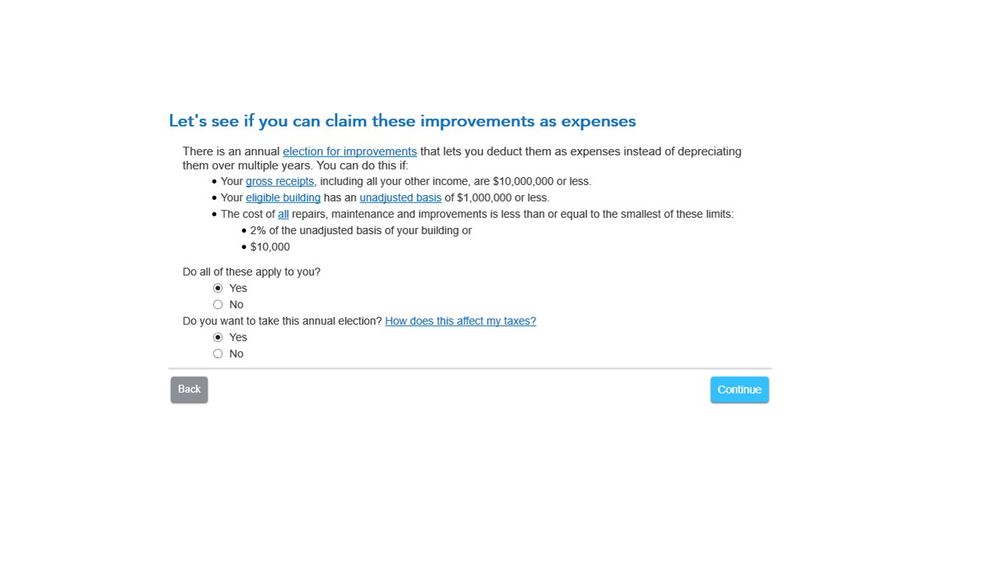

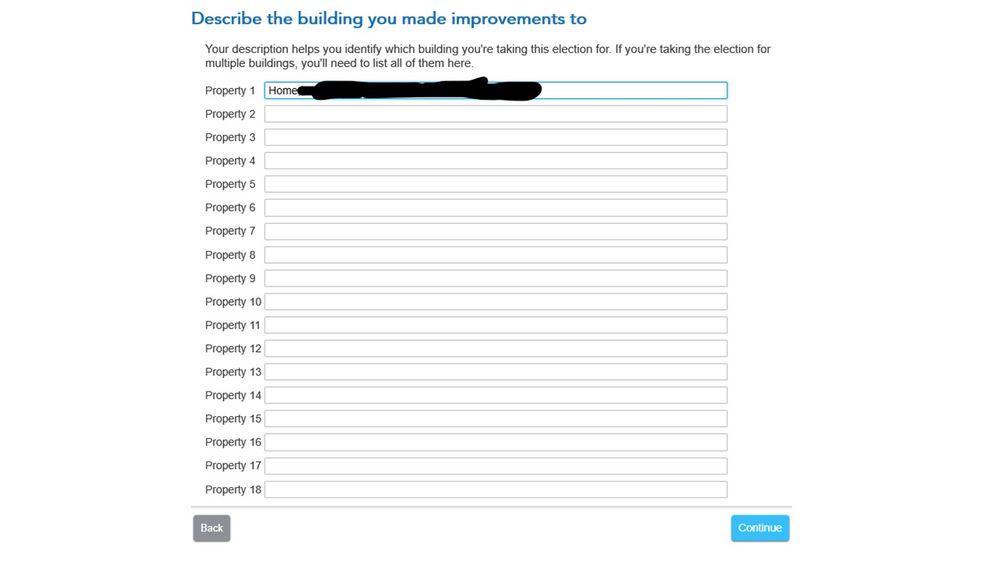

OK I think I am understanding. The pics below are the screen shots I followed along. I counted the replacement of the plumbing as a "Qualified Improvement Property", which only counts if the property is non-residential. However, the home office is considered, for these purposes, non-residential and therefore the QIP does apply.

I claim a very small area as home-office, it's just space dedicated to storing ingredients and sales equipment. It is only 0.6% of our home's square footage.

So, I can count the pipe replacement as a QIP but I can only count 0.6% of the total cost. Is that right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Baking Business - Replaced All Plumbing in House, where and how to enter as depreciating asset?

Yes, you are correct that the plumbing can only count 0.6% of the total cost. You understand the concept and how it should flow on the business portion if your tax return, You have selected that it qualifies for the DeMinimis Safe Harbor. When this occurs, you list the expense in miscellaneous or other expenses on your self employment schedule and it is a full business portion of the expense deducted in the year placed in service (no depreciation required).

TurboTax gives the details for improvement property in your screen image number 2 (placed below), once you answered 'Yes' to these questions you can go directly to the miscellaneous or other expenses and do not complete the rest of the asset information because you do not have to depreciate it when you meet the DeMinimis Safe Harbor requirements.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Baking Business - Replaced All Plumbing in House, where and how to enter as depreciating asset?

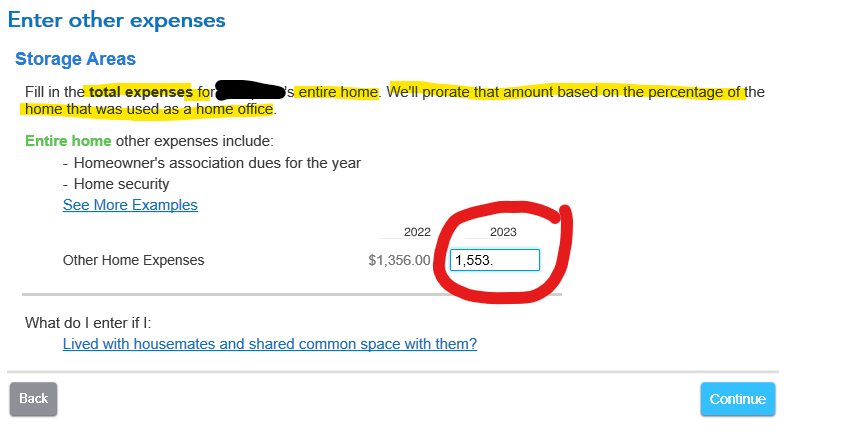

Ah I think I see. So here on this screen is where I would include the cost of the pipe replacement?

For tax year 2023, I already have $1,553 of expenses for the entire home. Can I add the $9,200 pipe replacement here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Baking Business - Replaced All Plumbing in House, where and how to enter as depreciating asset?

Wait a minute, my post above was incorrect. This is where I enter the pipe replacement and claim depreciation on it.

I know theses are ultra small numbers I'm dealing with, but I want to learn how to do this now so in the future if the company grows I'll understand what a paid accountant is doing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Baking Business - Replaced All Plumbing in House, where and how to enter as depreciating asset?

Yes, this is the home office section and the appropriate place to enter the main home cost as an asset for the year you began using it for the bake company and then the plumbing as an asset in 2023.

If you have not used the home office depreciation in the past then you can add the plumbing to the original cost of the home as one asset. When you enter the square feet percentage then TurboTax will do the math on the depreciation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Tomc63

Level 1

wendyle1993

Level 3

sherryskin

New Member

coloradokat

Level 1

PaulB1

Level 2