- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

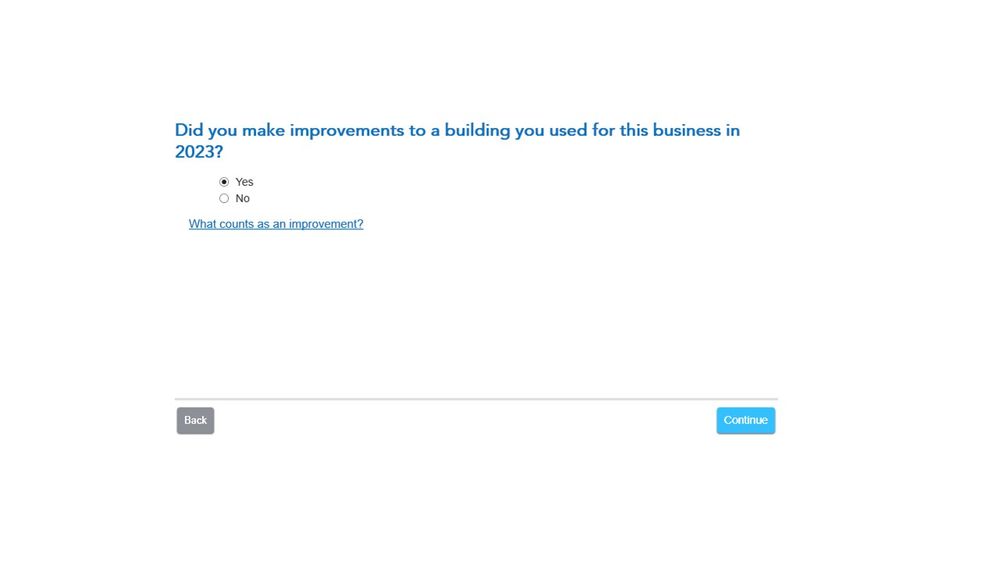

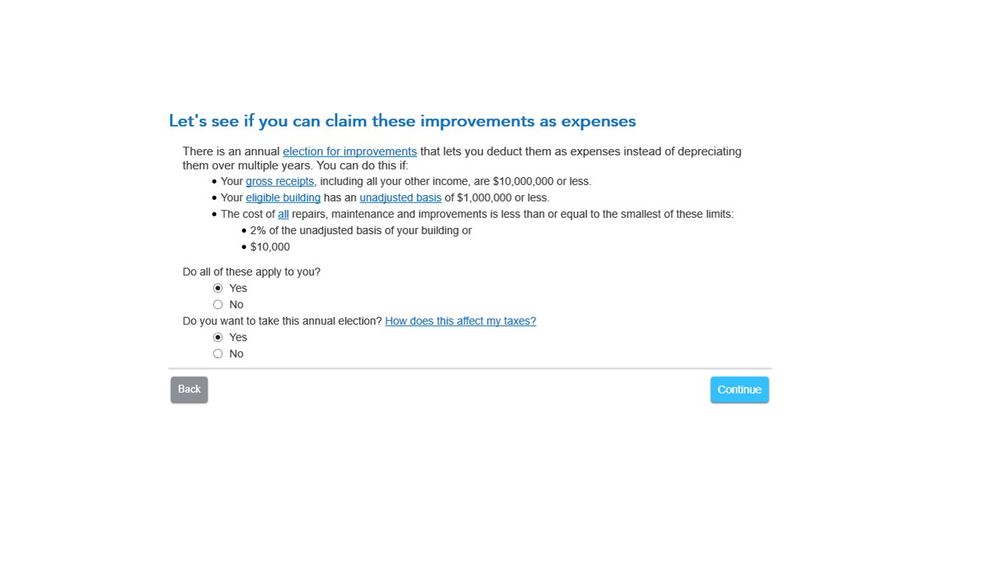

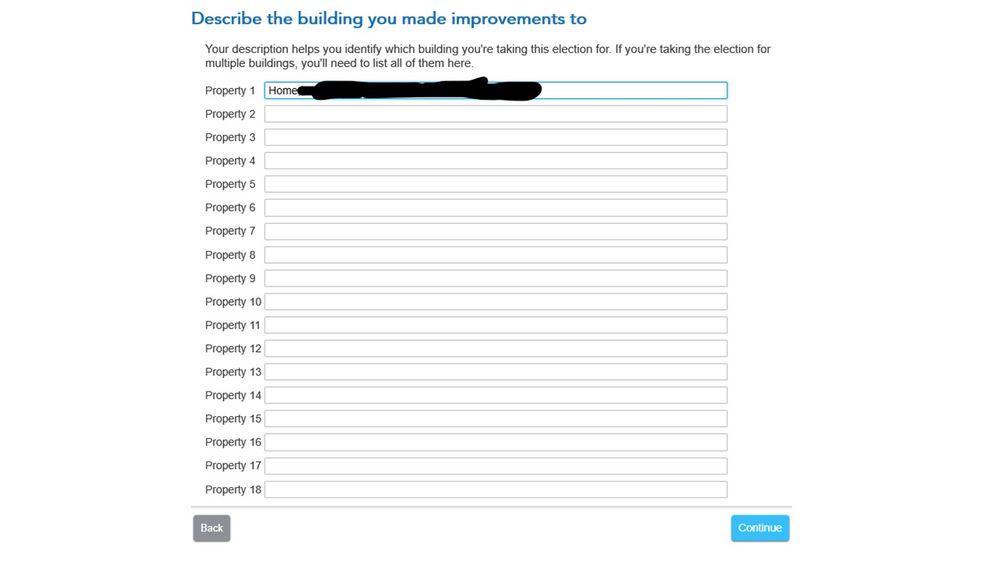

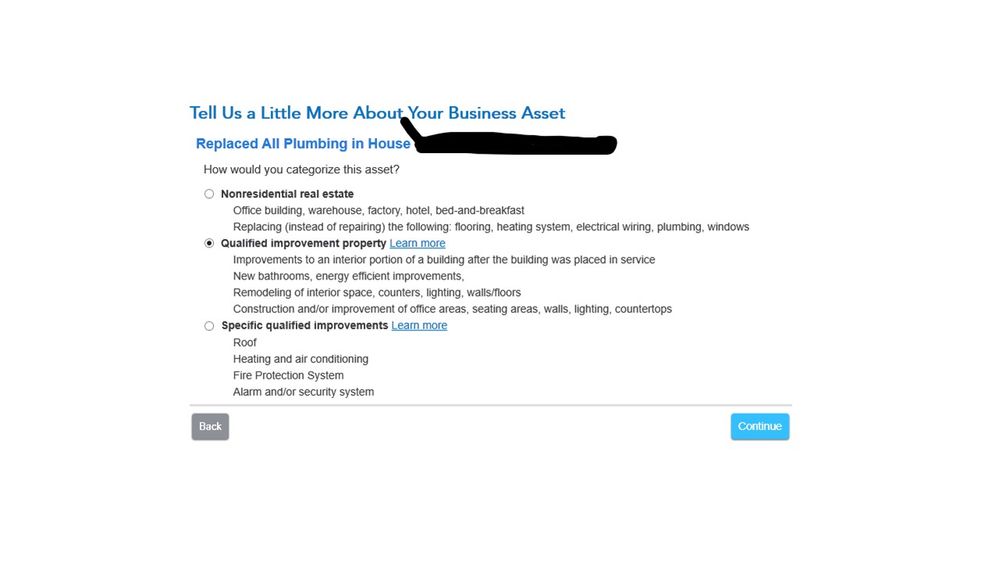

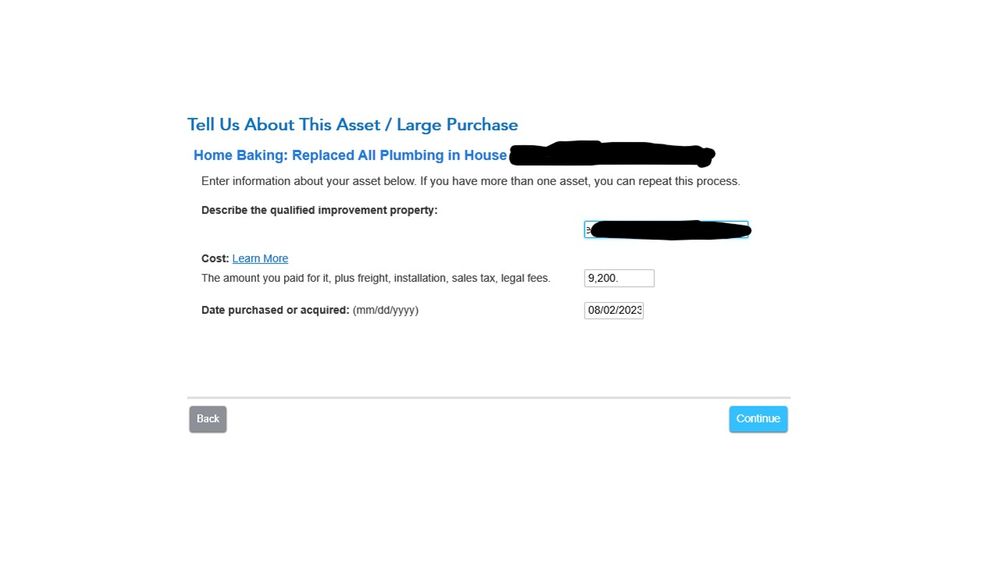

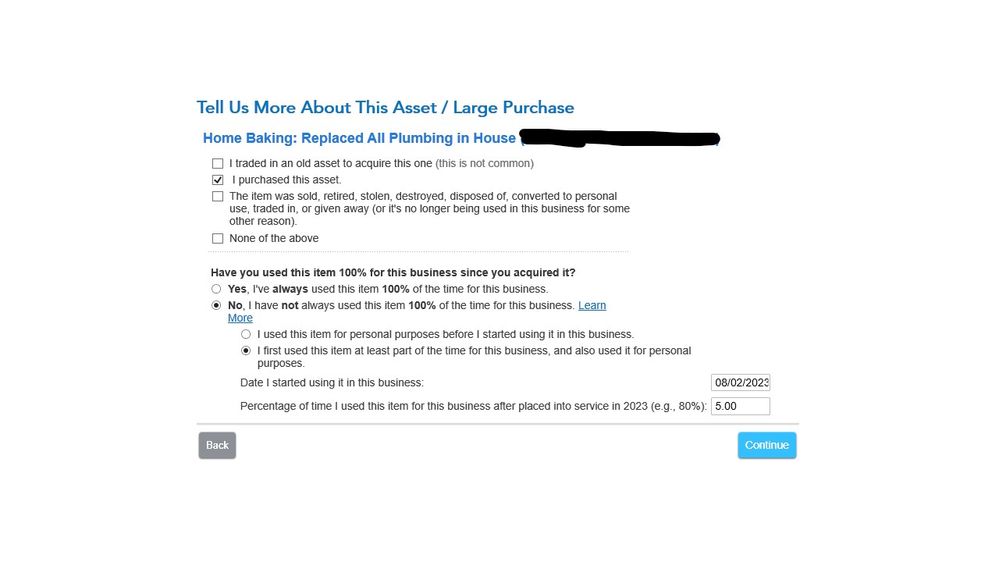

OK I think I am understanding. The pics below are the screen shots I followed along. I counted the replacement of the plumbing as a "Qualified Improvement Property", which only counts if the property is non-residential. However, the home office is considered, for these purposes, non-residential and therefore the QIP does apply.

I claim a very small area as home-office, it's just space dedicated to storing ingredients and sales equipment. It is only 0.6% of our home's square footage.

So, I can count the pipe replacement as a QIP but I can only count 0.6% of the total cost. Is that right?

February 20, 2024

3:40 PM