- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Form K1 and Leaving Employer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form K1 and Leaving Employer

Hello,

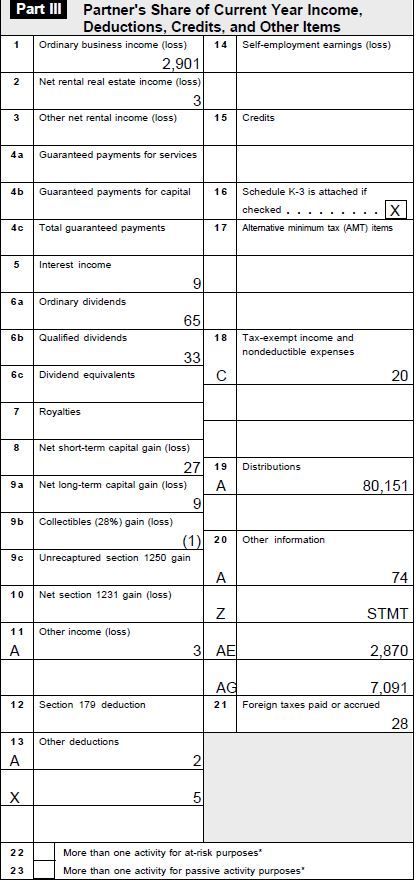

I was employed at a private partnership firm where I had received restricted units. I have been receiving K-1 and entering it in TT every year. I left the firm last year and received the final K-1(including distribution in Field 19) which I am trying to input into TT this year. I was wondering if someone could provide some clarity on the following:

Line L:

Beginning Capital Account: 68,911

Capital contributed during the year: 13,402

Current year net income (loss): 2,962

Other increase (decrease): (5,124)- Refers to Adjustment to Tax Capital for Leaving Partners

Withdrawals and distributions: 80,151

Box 19: Distribution

A: 80,151

Questions:

- Where do I enter the Box L info?

- Isn't that needed for computing the gain/loss on the distribution?

- How is this used "Other increase (decrease): (5,124)"

- I have entered all the other fields of the K-1(screenshot below)

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form K1 and Leaving Employer

Yes, let's answer these questions individually.

- All box L is entered in a screen titled Enter Capital Account Information. I have included a screenshot on how to record the information you have just given to me.

- The gain of the distribution adds to your basis of your capital account but does not affect your tax return.

- The decrease reduces your basis by (5124).

- Lastly, your distributions should be reported as a negative number.

Now you capital account should be zero since you no longer a partner in the firm, which is what it should be. The only time this information is taxable is if your distributions were in excess of your basis in your capital account. If this was the case, then the excess would have been taxable to you. in your case, this isn't an issue. Here is how to report the information in your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form K1 and Leaving Employer

Thanks for the response.

For Point(1), you mention "All box L is entered in a screen titled Enter Capital Account Information.". Could you please provide the navigation to get to this screen- I cannot find this in my TT Premier edition.

I also looked at Forms but could not find anything named Enter Capital Account Information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form K1 and Leaving Employer

Schedule K-1 Part II Section L appears under your personal information on the left column of the form with the title "Partner's Capital Account Analysis."

To enter this in TurboTax Premier/Premium using step-by-step:

- Use the search box at the top right corner of the TurboTax header, type in "k-1" and hit Enter. Click on the "jump to k-1" link to go directly to that topic.

- Click Yes, then Start beside Partnerships/LLCs.

- Click Edit beside the K-1 you need to work on.

- On the page "Review your information," click No.

- Continue through the screens (update information as needed) to the page "Enter Capital Account Information" (shown in previous post).

- Enter the amounts shown on Schedule K-1 Part II Section L.

Your other option is to use Forms Mode, available only in TurboTax for Desktop.

- Open your return and click the Forms icon in the TurboTax header.

- In the list of Forms in My Return on the left, find "K-1 Partner" for the partnership you need to work on.

- Click on the form name to open it in the large window.

- The top section of this form is very similar to the actual K-1. You can manually enter information in any box highlighted in yellow.

- Click Step-by-Step in the header to return to the main screens.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

Marky17

New Member

glerbnik84

Level 3

moovas

New Member

coronelenergy

New Member