- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form K1 and Leaving Employer

Hello,

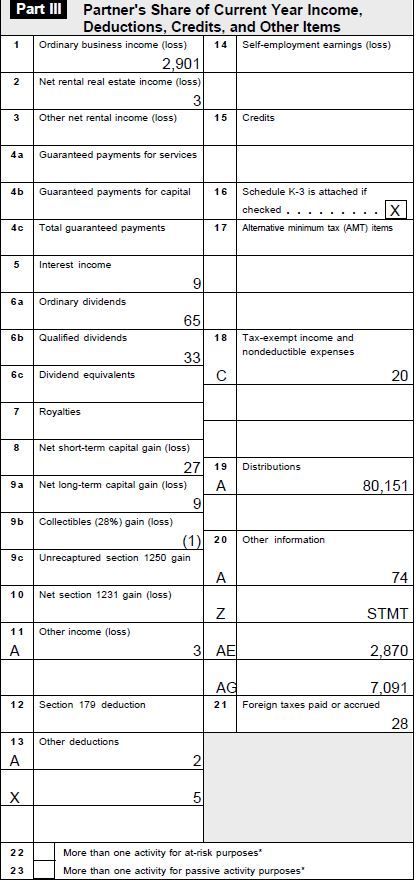

I was employed at a private partnership firm where I had received restricted units. I have been receiving K-1 and entering it in TT every year. I left the firm last year and received the final K-1(including distribution in Field 19) which I am trying to input into TT this year. I was wondering if someone could provide some clarity on the following:

Line L:

Beginning Capital Account: 68,911

Capital contributed during the year: 13,402

Current year net income (loss): 2,962

Other increase (decrease): (5,124)- Refers to Adjustment to Tax Capital for Leaving Partners

Withdrawals and distributions: 80,151

Box 19: Distribution

A: 80,151

Questions:

- Where do I enter the Box L info?

- Isn't that needed for computing the gain/loss on the distribution?

- How is this used "Other increase (decrease): (5,124)"

- I have entered all the other fields of the K-1(screenshot below)

Thanks!