- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Calculation error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculation error

I edited my S-corp distributions in the cell provided in the shareholder information section, but the number did not change on the retained earnings reconciliations page. What's wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculation error

TurboTax will not prepare the balance sheet if the corporation's income and total assets are less than $250,000 (unless you indicate that you want to complete the balance sheet anyway).

Regardless, the balance sheet in TurboTax Business is largely a manual entry affair and you will generally always have to reconcile retained earnings in the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculation error

My problem is this:

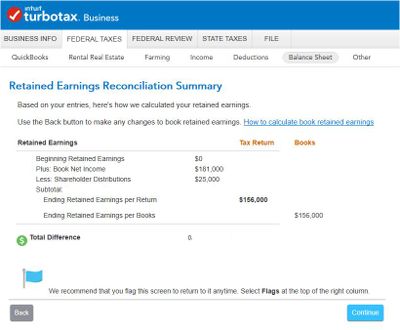

The math in the Retained Earnings Reconciliation Summery window goes like this:

beginning retained earnings

Plus book net income

less shareholder distributions

equals ending retained earnings

As far as I can tell, the number used here for shareholder distributions should pull from the only place that it is entered: the Distributions to Shareholders window under the shareholder information tab. However that is not happening. The number is not correct, and it does not change even when I experimentally modify it. Is there something malfunctioning? Any suggestions of how can I successfully enter my shareholder distributions number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculation error

@marknewman wrote:As far as I can tell, the number used here for shareholder distributions should pull from the only place that it is entered: the Distributions to Shareholders window under the shareholder information tab. However that is not happening. The number is not correct, and it does not change even when I experimentally modify it.

I just tried entering distributions in a test return and the results are depicted in the screenshot below. I was able to modify the figure and the modified figure appeared in the RE screen each time.

I have presumed that you are using the 2018 version of TurboTax Business so please advise if that is not the case.

If you are unable to resolve this issue, I would suggest contact Support (link at the bottom of this post) during regular business hours.

https://ttlc.intuit.com/community/using-turbotax/help/what-is-the-turbotax-phone-number/00/25632

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

tjhives1902

New Member

eltonrsmith

Returning Member

chuntutiu

New Member

Andre0626

Level 1

Krystal81

New Member