- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Where do we specify type of bank account CHECKING or SAVINGS for direct debit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do we specify type of bank account CHECKING or SAVINGS for direct debit?

@SelvamTax = you can pay directly at the IRS web site as an alternative but again, I suspect they ask for checking / Saving info as well.

https://directpay.irs.gov/directpay/payment?execution=e1s1

Be careful if you call Turbo Tax - I suspect Turbo Tax DID inform the IRS of the account type. Again, you'll find it if you go back into the software and not only look at the output report. It has to be there as it is part of the ACH record string required to ACH in the first place. It can't be missing. If it were missing, then EVERY PERSON who has a credit union account that wanted to direct debit (or direct deposit for that matter) would experience the same thing - and that would be milliosn of customers. I suspect Turbo Tax will not honor any claim as the error is basd on taxpaper input, which Turbo Tax does not cover. They only cover when their software causes the tax return to be wrong. The tax return was correct in this instance. I am not saying not to call, just be prepared for the 'up hill' battle you are going to have with TurboTax.

As for the Credit union to cross check - this is a automated process through the banking system. It's not their repsonsibility to cross-check, but rather the initiatior's responsibility to ensure the data accuracy from the get to.

and yes, the IRS penalizes for even a one day delay. By law, the money was due on April 18. If you mailed it, as long as it was posted marked by April 18 it is considered to be paid "on time". if you efiled and 'accepted' on April 18, it would still be considered 'on time' even though it would not be debited until April 19. THe problem here is when the IRS went to debit on the 19th the money was not available.

Good idea to submit form 843 - that has a better likelihood of success than contacting Turbo Tax. (talk up this is the first time this has ever happened to you)

good luck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do we specify type of bank account CHECKING or SAVINGS for direct debit?

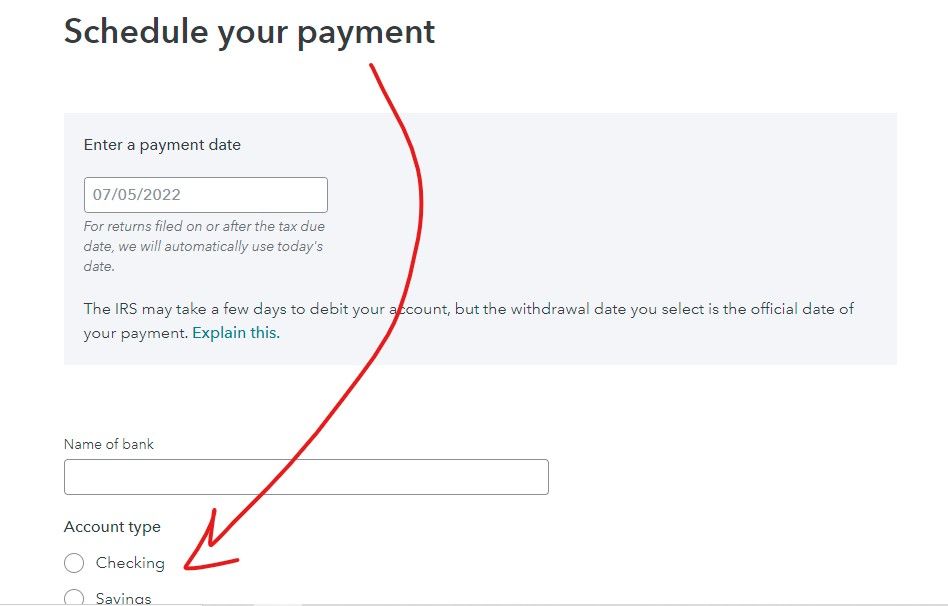

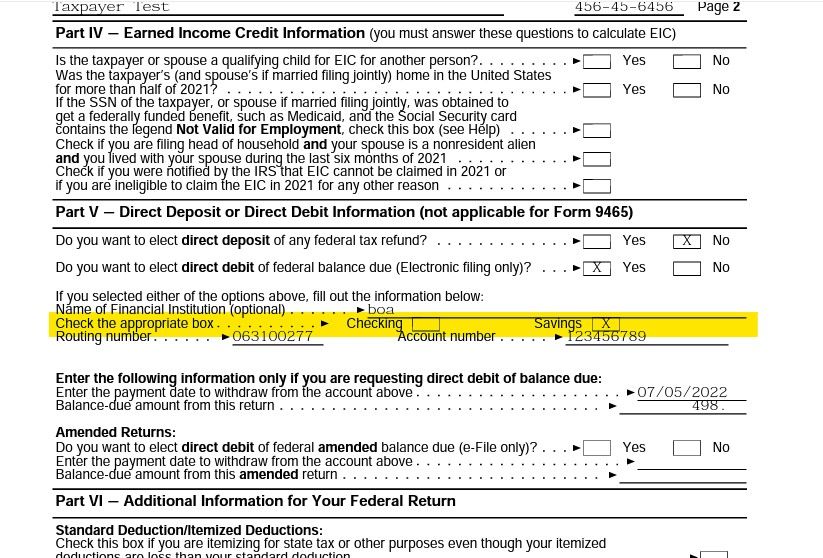

If you would like to review the entry screen you can ... log in and scroll down and click on ADD A STATE to let you back into the return then click on the FILE tab and look at the entry screen ... did you click on savings by accident ?

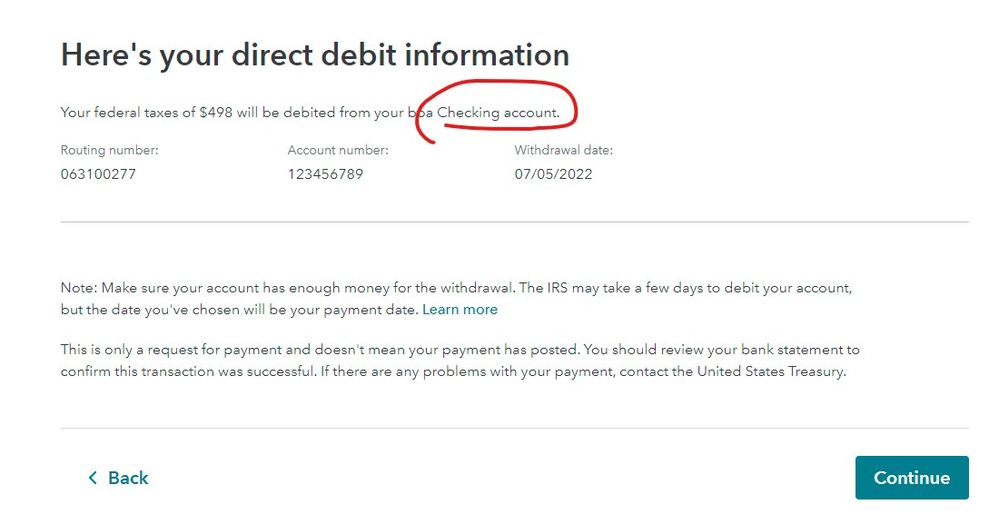

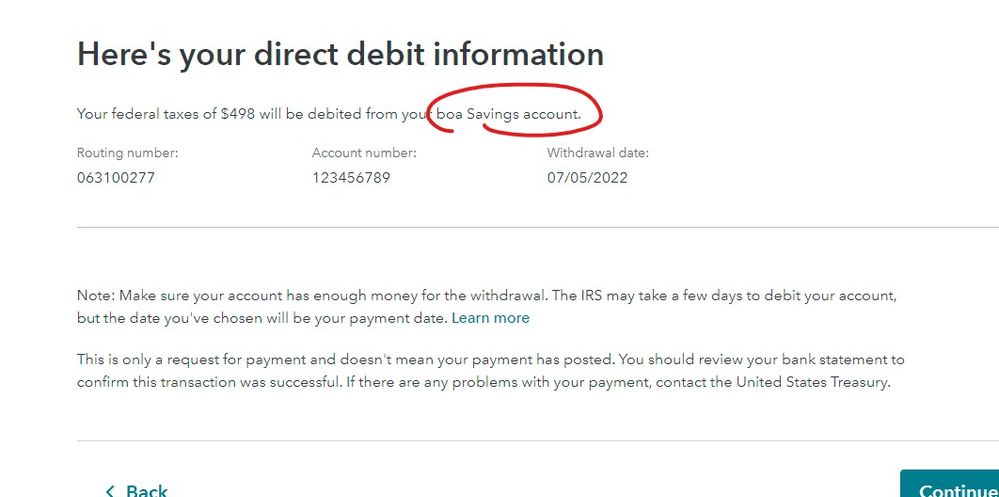

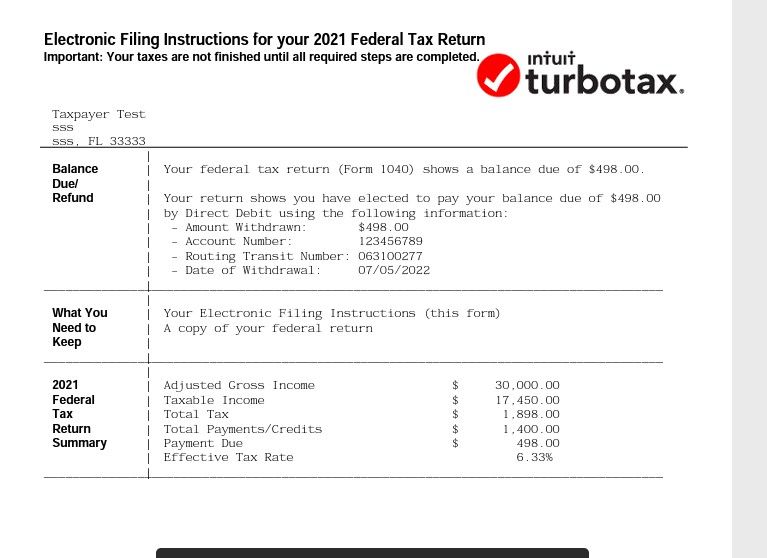

Also save a PDF of the return with all the worksheets in the print center while you are in the return to see all the screens you may have missed ... the program really does let you know everything you choose to do ... see page 2 of the information worksheet ...

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

smokentoke1904

New Member

lupecvega1957

New Member

nativi81

New Member

diaspora1010

New Member

cwc005

New Member