- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- When the stimulus checks came in I did not get mine. They sent it to an inactive bank account. How can I receive that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When the stimulus checks came in I did not get mine. They sent it to an inactive bank account. How can I receive that?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When the stimulus checks came in I did not get mine. They sent it to an inactive bank account. How can I receive that?

Could you please clarify which stimulus checks you did not receive?( 1St, 2nd 3rd )

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When the stimulus checks came in I did not get mine. They sent it to an inactive bank account. How can I receive that?

The 2nd ($600) and the 3rd one in March (1,400). In my last year tax return I put in that I did not receive it and they took $600.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When the stimulus checks came in I did not get mine. They sent it to an inactive bank account. How can I receive that?

The process for the 3rd stimulus payment has changed. You can report that you did not receive the payment and get the Recovery Rebate Credit, which is the same as the stimulus payment. This credit is a refundable credit so even if you don't owe taxes you can receive this amount. To claim the Recovery Rebate Credit please follow these steps:

- Open your tax return in TurboTax Online.

- Search for Recovery Rebate Credit using the magnifying glass near the top of the screen on the right.

- Click the Jump to recovery rebate credit link.

- Answer the question regarding the payment you did not receive. (Enter $0)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When the stimulus checks came in I did not get mine. They sent it to an inactive bank account. How can I receive that?

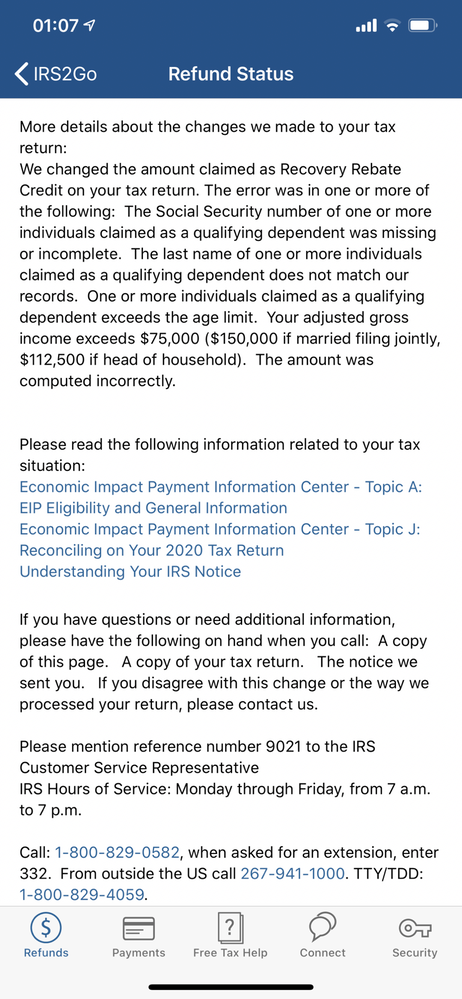

I also received this notion when it came to last year's tax return. Is it possible to get the money that wasn’t fully repaid? I’m not sure if I did something and if I did I do NOT know where

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When the stimulus checks came in I did not get mine. They sent it to an inactive bank account. How can I receive that?

The only way you may be able to recover any amounts from the stimulus payments made in 2020 would be to amend your 2020 return making the dependent corrections listed in this notice.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When the stimulus checks came in I did not get mine. They sent it to an inactive bank account. How can I receive that?

I don’t have any dependents that’s the thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When the stimulus checks came in I did not get mine. They sent it to an inactive bank account. How can I receive that?

You need to have IRS put a trace on $600 check sent to inactive bank account. In their records you’ve already received it so that’s why the denied it. The $1400 stimulus should be filed on 2021 return .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When the stimulus checks came in I did not get mine. They sent it to an inactive bank account. How can I receive that?

When a deposit is made to the wrong account, it is returned to the IRS and a check should be reissued to you by regular mail. If you did not receive that check then you should contact the Taxpayer Advocate Service (TAS) for assistance.

- You can click here to begin: TAS Qualifier Tool. or

- Submit a request for assistance - Form 911 Request for TAS Assistance (instructions are included)

- Locate the local TAS Office for your area

This will get the process started for you. It's not going to be a fast process because they are handling a large volume at this time.

If you do not hear from TAS within one week of submitting Form 911, contact the Taxpayer Advocate office where you originally submitted your request. Incomplete information or requests submitted to a Taxpayer Advocate office outside of your geographical location may result in delays.

Per IRS FAQ: The IRS will issue a paper check for the amount of that deposit once it is received. You incorrectly enter an account or routing number that belongs to someone else and your designated financial institution accepts the deposit. You must work directly with the respective financial institution to recover your funds.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mrsbreeden16

New Member

ilenearg

Level 2

janaly304

New Member

hornbergermichael555

New Member

Garyb3262

New Member