- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- What does code 420 sent to exmination on amended return mean ???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does code 420 sent to exmination on amended return mean ???

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does code 420 sent to exmination on amended return mean ???

It means the amended return has been sent to a human for a review/examination. All you can do is wait ... they will either process the return OR you will get a letter to respond to.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does code 420 sent to exmination on amended return mean ???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does code 420 sent to exmination on amended return mean ???

@gagliardonnicola has status change for you yet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does code 420 sent to exmination on amended return mean ???

@Critter Mine has been in this state for 12 months. Is this possible/normal?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does code 420 sent to exmination on amended return mean ???

No that is not normal ... are you sure you successfully efiled it ? If yes then contact your state to see what is happening ...

If you efiled, does the state return status show up in this tool?

https://shop.turbotax.intuit.com/efile/efile_status_lookup.jsp

If it was accepted, then here's how to track the state refund:

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does code 420 sent to exmination on amended return mean ???

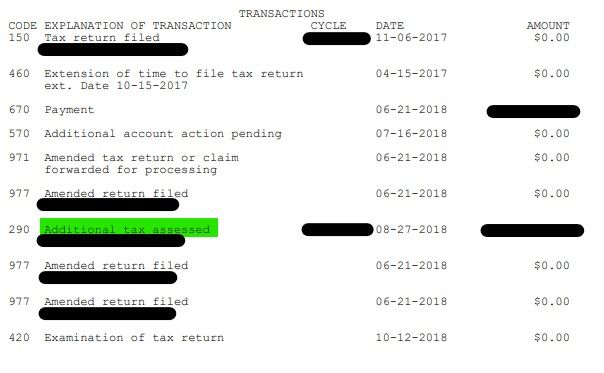

@Critter : below is an extract from my transcript. The IRS did not process my foreign tax credit and this resulted in additional tax be assessed; interest and penalties were added, too. I submitted a letter explaining the discrepancy in May this year.

To date, I have not been able to get an update and nothing has changed. Any advice as to how I can proceed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does code 420 sent to exmination on amended return mean ???

Only the IRS controls when and if a tax refund is Approved and Sent.

Call the IRS: 1-800-829-1040 hours 7 AM - 7 PM local time Monday-Friday

When calling the IRS do NOT choose the first option re: "Refund", or it will send you to an automated phone line.

So after first choosing your language, then do NOT choose Option 1 (refund info). Choose option 2 for "personal income tax" instead.

Then press 1 for "form, tax history, or payment".

Then press 3 "for all other questions."

Then press 2 "for all other questions."

- When it asks you to enter your SSN or EIN to access your account information, don’t enter anything.

- After it asks twice, you will get another menu.

Then press 2 for personal or individual tax questions.

It should then transfer you to an agent.

Or you can contact your local IRS office. See this IRS website for local IRS offices - http://www.irs.gov/uac/Contact-Your-Local-IRS-Office-1 or call 1-844-545-5640 to set up an appointment

Or you may want to contact a Taxpayer Advocate in your area. See this IRS website for Taxpayer Advocate in your area and a toll free number - http://www.irs.gov/Advocate/Local-Taxpayer-Advocate

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mattschirmer10

New Member

mcintyre210

Level 3

laura_borealis

Level 4

laura_borealis

Level 4

vw_lee

New Member