- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- TurboTax Desktop amend 2021 return from MFS to MFJ after spouse gets US residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop amend 2021 return from MFS to MFJ after spouse gets US residence

My Spouse was a Foreign Citizen (Non-US Citizen/Resident) when we married in 2021. I filed my taxes as a Married Filing Separately ( MFS ) for FY 2021 and 2022. Now my spouse is in the USA and got SSN & Permanent Resident Number. So, to amend my 2021 return to change filing status from MFS to MFJ, I reinstalled TurboTax Deluxe 2021 software on my computer.

I am entering below info while amending the 2021 return on TurboTax Deluxe 2021 software.

PERSONAL INFO => You & Your Family => Spouse Details =>

I entered my spouse's SSN and State of Residence.

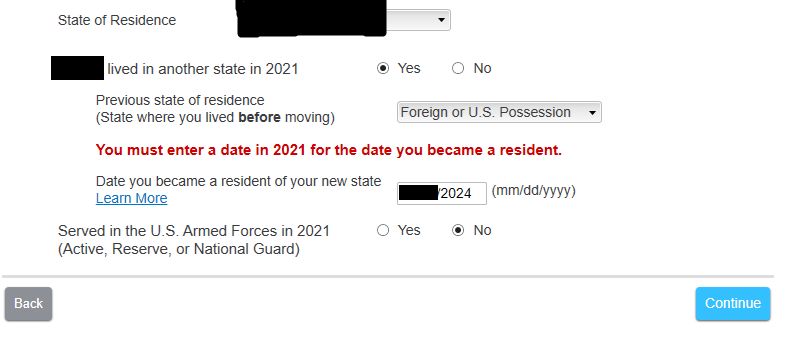

Spouse lived in another state in 2021 => YES (Because outside USA)

Previous state of residence (State where you lived before moving) => Foreign or U.S. Possession

Date you became a resident of your new state => [ mm/dd/2024 ]

When I press continue, it gives the error that “You must enter a date in 2021 for the date you became a resident.”

Refer below image for error message.

Now my spouse became a US resident in 2024, so I entered the date as 2024. But the error says to enter the date as 2021 which is incorrect for my situation.

Please guide me how to amend my 2021 return with TurboTax 2021 Desktop version.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop amend 2021 return from MFS to MFJ after spouse gets US residence

I see, so this is all for the Federal return you are amending.

For the screen you show above, do not select Texas for your spouse.

Select the last option on the drop-down "Foreign or US Possession"

Next answer No to Living in a different state and being Military

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop amend 2021 return from MFS to MFJ after spouse gets US residence

The program is asking for the date your spouse became a resident (lived in) the state, not the country.

Please complete the prior year returns as if it were the prior year. In other words, you cannot use a date for your 2021 return that is after 2021.

If your spouse was not in the USA, select that your spouse was a non-resident of the state (select Foreign or U.S. Possession)

If your spouse was in the USA, select your state and enter January 1 of that year (the tax year of the return) .

For the state return, it does not matter the date your spouse became a Permanent Resident of the US.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop amend 2021 return from MFS to MFJ after spouse gets US residence

Thanks for your reply @KrisD15

The program is asking for the date your spouse became a resident (lived in) the state, not the country.

- It will be 2024.

=> My spouse came in the USA 1st time in 2024 and started living here and became resident. That's the 1st time my spouse lived in the state.

If your spouse was not in the USA, select that your spouse was a non-resident of the state (select Foreign or U.S. Possession)

=> As my spouse has never been to the USA before 2024, I selected Foreign or U.S. Possession for 2021. But it still gives the error that “You must enter a date in 2021 for the date you became a resident.”

How can I enter 2021 year date because my spouse have never been to USA that time in 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop amend 2021 return from MFS to MFJ after spouse gets US residence

Which state are you filing?

When did YOU become a resident of that state?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop amend 2021 return from MFS to MFJ after spouse gets US residence

Filing for Texas state.

I became a permanent resident in Texas 5 years ago and now a US citizen.

My spouse became a Texas & USA resident in 2024.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop amend 2021 return from MFS to MFJ after spouse gets US residence

I see, so this is all for the Federal return you are amending.

For the screen you show above, do not select Texas for your spouse.

Select the last option on the drop-down "Foreign or US Possession"

Next answer No to Living in a different state and being Military

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop amend 2021 return from MFS to MFJ after spouse gets US residence

Thanks @KrisD15 .

So as far as I understand, my spouse was a foreign national ( not in USA ) in 2021, I don't select Texas but I have to select the last option on the drop-down "Foreign or US Possession".

Same goes for next 2 questions Living in a different state and being Military, I have to select NO for that in 2021.

Because this is an amend return for 2021 so I have to show my spouse's residency as in 2021 which was foreign national. Not the current residency of 2024 which is US Resident.

1 more question please.

After amending this 2021 return, it will go for a process. So before receiving confirmation from IRS, can I

1) amend 2022 return from TurboTax Desktop?

2) file new 2023 tax return?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop amend 2021 return from MFS to MFJ after spouse gets US residence

Correct.

Yes, go ahead and file the amended 2022 return and then file your 2023 return.

If you used TurboTax Desktop for your original return, you can use it to amend.

It may take a while for the IRS to catch-up on everything, but they will.

You don't wait for the IRS to catch-up. You just keep moving forward.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

zeishinkoku2020

Level 2

green2ski

Level 2

jcanalesr92

New Member

palmtree33

New Member