- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Desktop amend 2021 return from MFS to MFJ after spouse gets US residence

My Spouse was a Foreign Citizen (Non-US Citizen/Resident) when we married in 2021. I filed my taxes as a Married Filing Separately ( MFS ) for FY 2021 and 2022. Now my spouse is in the USA and got SSN & Permanent Resident Number. So, to amend my 2021 return to change filing status from MFS to MFJ, I reinstalled TurboTax Deluxe 2021 software on my computer.

I am entering below info while amending the 2021 return on TurboTax Deluxe 2021 software.

PERSONAL INFO => You & Your Family => Spouse Details =>

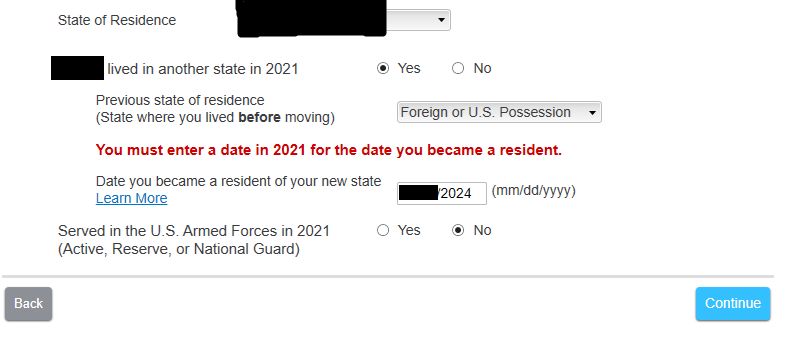

I entered my spouse's SSN and State of Residence.

Spouse lived in another state in 2021 => YES (Because outside USA)

Previous state of residence (State where you lived before moving) => Foreign or U.S. Possession

Date you became a resident of your new state => [ mm/dd/2024 ]

When I press continue, it gives the error that “You must enter a date in 2021 for the date you became a resident.”

Refer below image for error message.

Now my spouse became a US resident in 2024, so I entered the date as 2024. But the error says to enter the date as 2021 which is incorrect for my situation.

Please guide me how to amend my 2021 return with TurboTax 2021 Desktop version.