- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I need my state return to be deposited to my bank account but turbotax didn't give me the option to put my bank information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need my state return to be deposited to my bank account but turbotax didn't give me the option to put my bank information

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need my state return to be deposited to my bank account but turbotax didn't give me the option to put my bank information

In Forms mode, open the Info Wks (Info Worksheet) and scroll down to Direct Deposit which was Part V. on the 2021 worksheet. Fill in the bank info. Then go to the state module and do the same. TT regularly fails to carry this info over from the previous year, so you have to fill it in manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need my state return to be deposited to my bank account but turbotax didn't give me the option to put my bank information

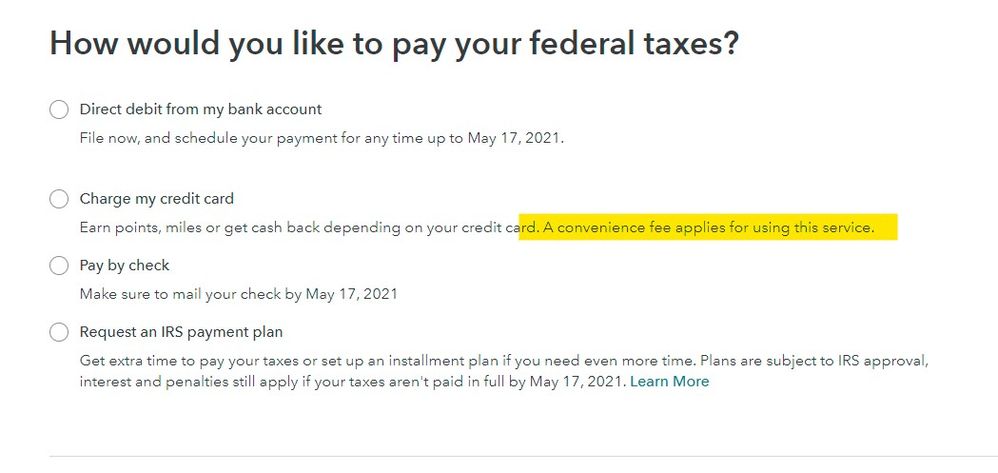

With the ONLINE version the original poster was posting from there is no FORMS mode so in the FILE tab STEP 2 all the options for refunds and balance dues are presented ... first for the feds and then the state. If you have already efiled it is too late to make any changes.

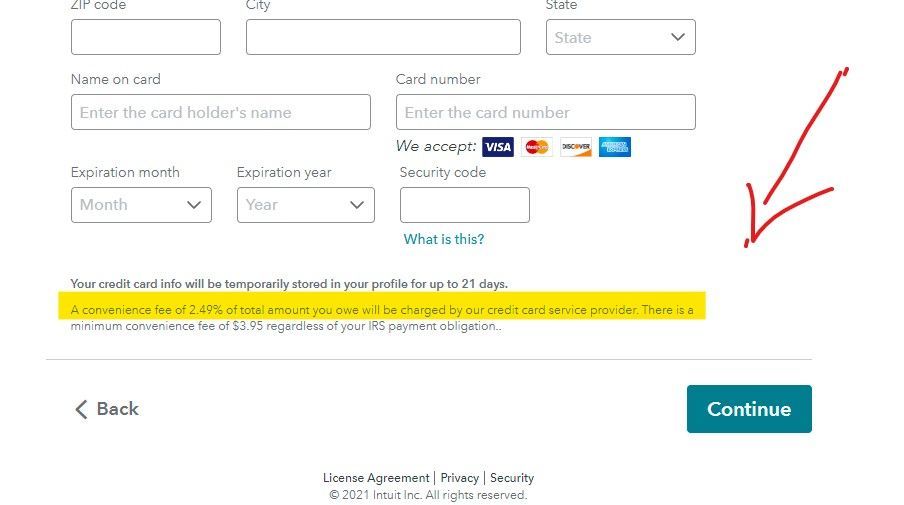

And if you choose to pay the balance due with a debit card (which processes like a Credit card) there is a fee which is clearly posted ... direct debiting from your checking account is free but if you entered the debit card on that account it is NOT free.

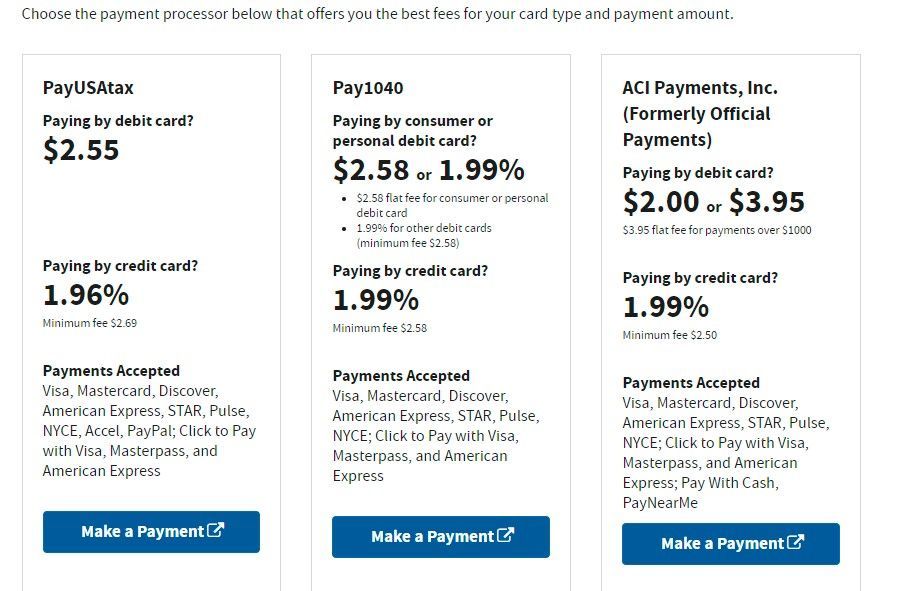

SAME THING IS ON THE IRS WEB SITE where the fees are actually a bit cheaper :

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Veronicapena25

New Member

nishanae100

New Member

Jarronharden6

New Member

queenmendo67

New Member

victoriasamba19

New Member