- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- IRS Direct Pay Confirmation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Direct Pay Confirmation

Yesterday, I finished my 2023 Federal Income Taxes and requested the amount due be paid through the IRS Direct Pay option. I entered the required information, and it appears correctly on my Turbotax "Electronic Filing Instructions". HOWEVER, the IRS Direct confirmation number did not appear on the Electronic Filing Instructions, and I have not received it in any other form. My IRS Direct account does not show this pending payment either. Where can I find my confirmation that my payment option was received by the IRS? I don't want to wait until April 15th to learn that the IRS did not receive the information from Intuit.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Direct Pay Confirmation

The problem I had was the IRS will accept "Direct Pay" for Estimated Tax Payments but any 1040 tax payments had to be channeled through a professional tax consultant or a software-based system (such as TurboTax). When I did my taxes with TurboTax, I selected the "Direct Pay" option and TurboTax collected the necessary information for the IRS Direct Pay system. The next day, i did not see my Federal Tax payment on the IRS Direct Pay web site and I wrote the above question searching out confirmation. Well, later in the day, I went back to the IRS Direct Pay web site and my 1040 Federal Tax Payment was there along with a confirmation number. So, the problem was that TurboTax took (more or less) 24 hours to pass the information to the IRS system. I scheduled my 2024 Tax Year estimates on the IRS Direct Pay system, but my 1040 Federal Tax payments went through TurboTax. Intuit/TurboTax claims that they did not receive a confirmation from the IRS when they forwarded the information. Theredfore,they could nnot pass it along to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Direct Pay Confirmation

TurboTax does not have an option for you to use the IRS payment option for Direct Pay - https://www.irs.gov/payments/direct-pay

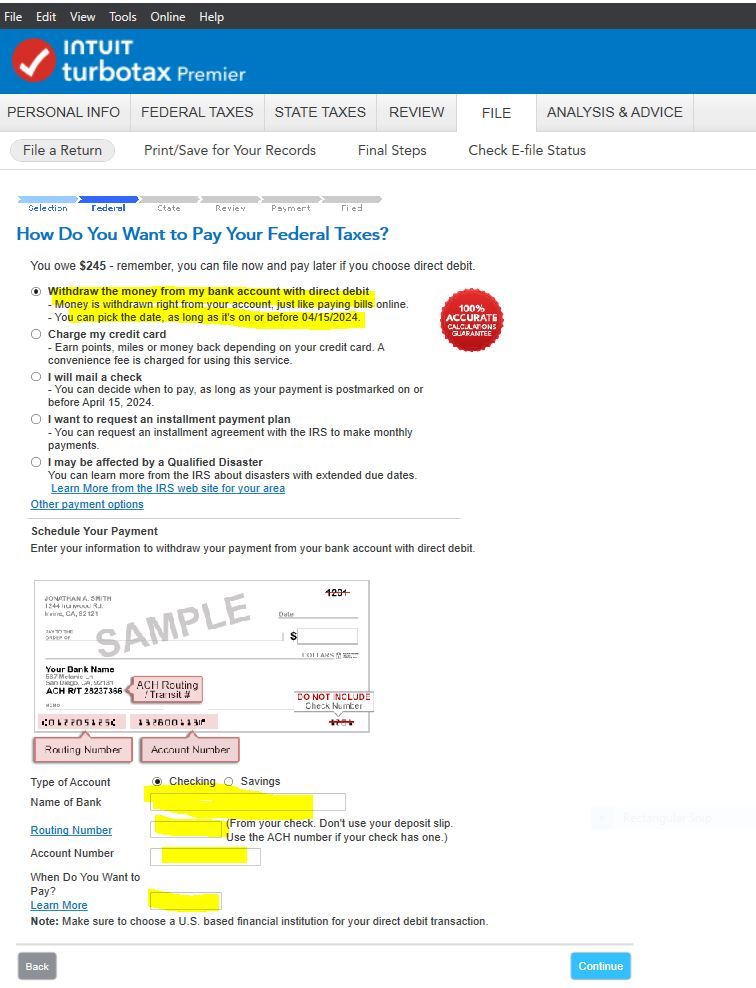

What is available is a direct debit from your bank. You have to enter the type of account, Checking or Savings. The Bank name, The bank routing number and the bank account number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Direct Pay Confirmation

First of all here is a quote from your own web pages,

"The IRS will withdraw the entire owed amount from your bank account. Direct debit for partial payments isn't available."

I asked you why I could not find a confirmation for my selected option. I know how to enter the information. In fact, as I said, the information I entered appeared on my filing instructions.

The reply I expected to my question would be how to find my confirmation or, "We do not send a confirmation, but we have all the information to pay the IRS, just trust us". Perhaps there is another acceptable response but instructions on how to enter the information is not what I was asking for.

Please answer my original question. I will wait.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Direct Pay Confirmation

You noted in your original posting IRS Direct Pay Confirmation

Since the IRS has an option for Direct Pay on their payment website I assumed, incorrectly, that is what you were referring to.

TurboTax uses Direct Debit from a bank account for the taxes owed. TurboTax does not receive any confirmation from the IRS that the payment has been received or debited from a bank account. The IRS does not send confirmation of a direct debit from a bank account to the taxpayer.

Your proof of payment is when the IRS debit your account.

You can also see the payment in your IRS Tax Account - https://www.irs.gov/payments/your-online-account

You can call IRS e-file Payment Services 24/7 at 888-353-4537 to inquire about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Direct Pay Confirmation

if you used IRS direct pay through its website (vs direct debit using that option in the tax return) upon successfully completing the request a confirmation page should have appeared with a confirmation number. you receive nothing if you use direct debit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Direct Pay Confirmation

The problem I had was the IRS will accept "Direct Pay" for Estimated Tax Payments but any 1040 tax payments had to be channeled through a professional tax consultant or a software-based system (such as TurboTax). When I did my taxes with TurboTax, I selected the "Direct Pay" option and TurboTax collected the necessary information for the IRS Direct Pay system. The next day, i did not see my Federal Tax payment on the IRS Direct Pay web site and I wrote the above question searching out confirmation. Well, later in the day, I went back to the IRS Direct Pay web site and my 1040 Federal Tax Payment was there along with a confirmation number. So, the problem was that TurboTax took (more or less) 24 hours to pass the information to the IRS system. I scheduled my 2024 Tax Year estimates on the IRS Direct Pay system, but my 1040 Federal Tax payments went through TurboTax. Intuit/TurboTax claims that they did not receive a confirmation from the IRS when they forwarded the information. Theredfore,they could nnot pass it along to me.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

funeslaw

New Member

efrimming

New Member

mootzie

Level 2

mjlmommy2006

Returning Member

andrew0072

New Member