- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Got a tax refund check with Notice54

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

Hi

I filed my 2020 taxes in March-2021 and i have now received a refund check (~200) ,though I owed (and paid) money to both Fed and State (had '0' refund) in my filing.

The refund check has a Notice 54 which pretty much states there is another 'explanation letter' that IRS will mail explaining the refund and to call them if the refund is lesser or greater than expected! (I have not yet rxvd the letter yet).

Given that I used TT(Premier) to file my taxes would TT help me with handling this refund and how i should go about it, while i wait for the IRS letter?

Any inputs appreciated on this surprise situation I myself am trying to understand how it happened!

thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

Assuming it is a legit refund, did you have any unemployment? There have been major IRS changes for that. If it is for unemployment the IRS automatically adjusted your return.

If you have unemployment you can exclude up to 10,200 for each person if your income is under $150,000. Your unemployment compensation will be on Schedule 1 line 7. The exclusion will be on Schedule 1 Line 8 as a negative number. The result flows to Form 1040 Line 8.

Or did you have an amount on 1040 line 30 for the Recovery rebate credit? You might have qualified for more.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

thanks for the response.

Answering the questions

1) "Assuming it is a legit refund"

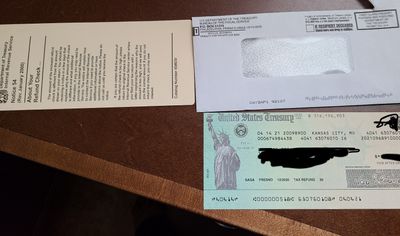

Ans: The check looks real but i have no way to find if it is legit . please see attached image of the check , any way to confirm if this is legit?

2) did you have any unemployment?

Ans: No. schedule1 line#7 is blank

3)did you have an amount on 1040 line#30 for the Recovery rebate credit

Ans: No. line 30 is blank

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

I have the same question. Got my refund check a few days ago with a notice54 card. I didn't declare unemployment and no recovery rebate credit on my tax return.

Does anyone know what's going on? Don't want to deposit it before I know what happened...

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

This notice should not prevent you from depositing the check. It is to inform you that if the regulations change regarding some Tax Cuts and Jobs Act changes, your return may be affected.

One example would be allowing taxpayers to adjust the classification of state taxes to receive credits against the state or local taxes the taxpayer was required to pay.

For more information about this notice, See Notice 2018-54 Guidance on Certain Payments Made in Exchange for State and Local Tax Credits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

I got the same check and letter today. I wonder if you find out the reason or if the check is real?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

Same thing with me... $128 refund and I owed quite a bit this year... higher than normal.. Makes me nervous getting a refund from the feds as it feels "trappy"..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

if you don't get a notice explaining the reason, contact the iRS

1. Call 1-800-829-1040 between the hours of 7:00 AM – 7:00 PM local time.

2. Press “1” for English or “2” for Spanish.

3. Press “2” for “answers about your personal income taxes.”

4. Press “1” for “questions about a form you have already submitted or a payment or to order a tax transcript.”

5. Press “3” for “all other questions about your tax history or payment.”

6. Press “2” for “all other questions about your tax history or payment.”

7. Do not input your Social Security Number when the recording tells you to.

8. Press “2” for “personal- or individual-tax related question.”

9. Press “4” for “all other inquiries.”

10. Wait to be connected to someone at the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

@barristerinky Did you have an amount on 1040 line 38? That is an estimated penalty for owing too much. It's common for the IRS to adjust it and send you a refund (or a bill).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

Ah..yes.. I do.. and the refund is about $1.50 higher... 128.50 vs the 127 listed there..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

Look near the bottom of the check. It might say 1.50 interest?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

Perfect - that explains it. Return of estimated tax penalty. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

Thanks for the info. The prompts worked however I got a "due to the high volume of callers about this topic, we are unable to answer your call." Ugh!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

Same thing. Did you ever get any other notices? I owed 6700 and had penalty of 196 and got the same amount 196 back.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Got a tax refund check with Notice54

No no other notices. This however does say a notice letter will follow to explain but that has not arrived for 2 weeks.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

tyd1005

New Member

MGloeckler

New Member

hterrence1

New Member

z28baby1997

New Member

ivymoon214

New Member