- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- EFTPS Payment from TurboTax Desktop

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFTPS Payment from TurboTax Desktop

I selected EFTPS in TurboTax Desktop to pay my underpayment due for 2023 and entered y bank infoa nd payment date. Having completed the filing and return accepted by the IRS, I can now find no record anywhere within TurboTax or my file copy of my return that such a transaction has been scheduled. Am I missing something? Did I fail to complete a step? Will the payment I thought has been set up occur on time?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFTPS Payment from TurboTax Desktop

@ LittleBluestem

I'm just a fellow user and can't explain that language on your Return Summary and Filing Instructions, but from what you saw on the Federal Information Worksheet, i.e., if there is a checkmark YES indicating you want direct debit, and then if it shows your bank, the account and routing numbers, debit amount, and debit date, then that suggests that you set up a regular direct deposit on some future date, but I would have liked to have seen it mentioned on those other pages, too. But I haven't used that direct debit method in years, so I don't remember exactly how it's supposed to appear on those summary pages. Maybe another user who has seen those summary pages after choosing direct debit will comment in this thread.

There is a way to check on it, however, and even cancel it if someone desired to do so. Inquiring about it might give you some peace of mind if they can confirm it's scheduled. You can phone the IRS E-file Payment Services 24/7 (see IRS special phone number below), but they want you to wait 7-10 days after your return was accepted before calling (perhaps to be sure it shows up in their system.) The following is from the IRS website. Bold type is mine.

https://www.irs.gov/payments/pay-taxes-by-electronic-funds-withdrawal

Cancellations, errors and questions

- In the event Treasury causes an incorrect amount of funds to be withdrawn from a bank account, Treasury will return any improperly transferred funds.

- Once your return is accepted, information pertaining to your payment, such as account information, payment date, or amount, cannot be changed. If changes are needed, the only option is to cancel the payment and choose another payment method.

- Call IRS e-file Payment Services 24/7 at 888-353-4537 to inquire about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling.

- Cancellation requests must be received no later than 11:59 p.m. ET two business days prior to the scheduled payment date.

- If a payment is returned by your financial institution (e.g., due to insufficient funds, incorrect account information, closed account, etc.) the IRS will mail a Letter 4870 to the address we have on file for you, explaining why the payment could not be processed, and providing alternate payment options.

- In the event your financial institution is unable to process your payment request, you will be responsible for making other payment arrangements, and for any penalties and interest incurred.

- Contact your financial institution immediately if there is an error in the amount withdrawn.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFTPS Payment from TurboTax Desktop

to use EFTPS.gov you have to log on to EFTPS and schedule the payment for "2023 1040".

EFTPS.gov now requires that you go through ID.me first.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFTPS Payment from TurboTax Desktop

If it is required that I do it all after logging on to EFTPS.gov, then why is it that TurboTax Desktop asked me for a payment source and payment date for EFTPS during my original return preparation? Requesting that info and then - if what you suggest is correct - doing nothing with that info makes no sense to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFTPS Payment from TurboTax Desktop

Yes you can pay by Direct Debit from Turbo Tax. I don't know how you can check the schedule. It probably should be on the cover sheet in your printout.

How to pay a federal tax due

https://ttlc.intuit.com/community/tax-payments/help/how-can-i-pay-my-federal-taxes/00/26212

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFTPS Payment from TurboTax Desktop

@ LittleBluestem wrote:If it is required that I do it all after logging on to EFTPS.gov, then why is it that TurboTax Desktop asked me for a payment source and payment date for EFTPS during my original return preparation? Requesting that info and then - if what you suggest is correct - doing nothing with that info makes no sense to me.

Are you sure you are not confusing "EFTPS" with simple "EFT?" EFTPS is a service from the US Treasury that requires an account and verification at the EFTPS website. With such an account, one can pay several types of tax payments, file an extension, and other tasks.

EFT, however, is a generic term that just means "Electronic Funds Transfer." There are several types, but one common type of EFT is through the ACH (Automated Clearing House.) Direct debits and direct deposits commonly travel through ACH from bank to bank.

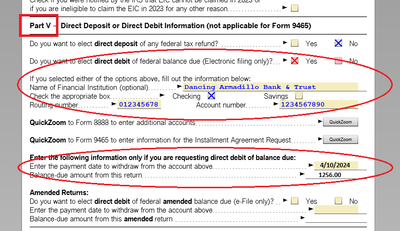

Since you are using the desktop version, there are a couple of ways to see what you chose. Go into Forms Mode, and in the left column list of forms choose "Info Wks." That brings up the Federal Information Worksheet. Scroll down to Part V, and see if your direct debit choice shows up there. Here's a sample image. Click to enlarge.

.

.

Also, while you are in Forms Mode, you can look at the Return Summary as well as the Filing Instructions. Those should also have information on how you chose to pay your balance due. Those are down near the bottom of the Federal list of forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFTPS Payment from TurboTax Desktop

Oh, one other thing. It's not clear (at least to me) if you already have an EFTPS account or not. If you do, then don't pay your tax due by both methods! i.e, if you already set up a regular bank debit through TurboTax, you don't want your bank account debited twice!

If you DO have an EFTPS account, then for future reference:

Normally when a filer has an EFTPS account and wishes to use it to pay the tax due, they should tell the TurboTax program they intend to pay by "check." That allows them to finish filing. Then the filer can go to the EFTPS website and pay there at one's convenience, as long as it's paid by the tax due date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFTPS Payment from TurboTax Desktop

mesquitebean, thank you. I understood the difference between "EFTPS" and "EFT" at the time of tax prep at least in my mind. However I now believe that I thought I was setting up an EFTPS access at that time when entering the information into Turbotax Desktop. (I do have an EFTPS account now, set up after and PIN supplied by EFTPS.) My EFTPS account does not show a scheduled payment when I checked it just now. The Federal Information Worksheet form does show my info for a direct debit scheduled for a date in the future. However the Return Summary and Filing Instructions both state, "Your federal tax return (Form 1040) shows a balance due of $." which would not be accurate since I do have a balance due. This seems like a possible software hiccup. The Filing Instructions mention sending 1040-V with that blank payment. There is no mention of a scheduled direct debit transaction on those two forms, only on the Federal Information Worksheet. Until the ACH transaction does occur (or not) on that date very close to the April 15 deadline, it appears I may not know for certain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFTPS Payment from TurboTax Desktop

@ LittleBluestem

I'm just a fellow user and can't explain that language on your Return Summary and Filing Instructions, but from what you saw on the Federal Information Worksheet, i.e., if there is a checkmark YES indicating you want direct debit, and then if it shows your bank, the account and routing numbers, debit amount, and debit date, then that suggests that you set up a regular direct deposit on some future date, but I would have liked to have seen it mentioned on those other pages, too. But I haven't used that direct debit method in years, so I don't remember exactly how it's supposed to appear on those summary pages. Maybe another user who has seen those summary pages after choosing direct debit will comment in this thread.

There is a way to check on it, however, and even cancel it if someone desired to do so. Inquiring about it might give you some peace of mind if they can confirm it's scheduled. You can phone the IRS E-file Payment Services 24/7 (see IRS special phone number below), but they want you to wait 7-10 days after your return was accepted before calling (perhaps to be sure it shows up in their system.) The following is from the IRS website. Bold type is mine.

https://www.irs.gov/payments/pay-taxes-by-electronic-funds-withdrawal

Cancellations, errors and questions

- In the event Treasury causes an incorrect amount of funds to be withdrawn from a bank account, Treasury will return any improperly transferred funds.

- Once your return is accepted, information pertaining to your payment, such as account information, payment date, or amount, cannot be changed. If changes are needed, the only option is to cancel the payment and choose another payment method.

- Call IRS e-file Payment Services 24/7 at 888-353-4537 to inquire about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling.

- Cancellation requests must be received no later than 11:59 p.m. ET two business days prior to the scheduled payment date.

- If a payment is returned by your financial institution (e.g., due to insufficient funds, incorrect account information, closed account, etc.) the IRS will mail a Letter 4870 to the address we have on file for you, explaining why the payment could not be processed, and providing alternate payment options.

- In the event your financial institution is unable to process your payment request, you will be responsible for making other payment arrangements, and for any penalties and interest incurred.

- Contact your financial institution immediately if there is an error in the amount withdrawn.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFTPS Payment from TurboTax Desktop

mesquitebean, thank you. You have pretty thoroughly corroborated my thoughts following your previous answer and I have considered that I should call the IRS payment services. The thought of calling the IRS does make me cringe some because of stories of very long wait times. Hopefully those stories don't apply to the payment line too, because I think this is a case where it is my best option. I am fine with keeping the ACH as scheduled if it is indeed scheduled. It is the uncertainty that is the problem. Thank you again as you have been most helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFTPS Payment from TurboTax Desktop

You're welcome. I've had to call that IRS Efile Payment department before, and it was actually pretty easy to reach someone, That's a separate number from their main help line. It likely depends on the time of day, and is unpredictable. It's certainly easier to reach than folks who have to call the main IRS number for help with their return. Good luck!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

candacef1994

New Member

Wjm2222

New Member

fj7

Level 1

christianalb07

New Member

WendyF

New Member