- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Amending Prior 8606 Forms? Correcting Total Basis for tIRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending Prior 8606 Forms? Correcting Total Basis for tIRA

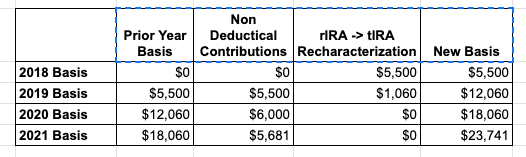

I am currently working on correcting my total basis for my Traditional IRA. I made a series of missteps that I'd like to correct to have an up to date basis for my tIRA before I convert to Roth. See below:

2018 rIRA -> tIRA recharacterization (Have 1099-R but not sure how to apply to 8606/basis)

2019 rIRA -> tIRA recharacterization (Have 1099-R but not sure how to apply to 8606/basis)

2019 after-tax contributions (have 8606 form but 2018 basis didnt carry over)

2020 after-tax contributions (have 8606 form but 2019 basis didnt cary over)

2021 after-tax contributions (have 8606 form but 2019+2020 basis didnt cary over)

Here is how my actual basis should look:

What is the best way to get my basis back up to date? I think I understand amending 8606 forms but how do I handle the Recharacterizations? A step by step guide of what to do would be very help! Thanks so much in advance

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending Prior 8606 Forms? Correcting Total Basis for tIRA

A recharacterization from a Roth IRA to a traditional IRA is treated as if the contribution was originally made to the traditional IRA on the date of the original contribution. Whatever portion of the resulting traditional IRA contribution is nondeductible adds to your basis for that year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending Prior 8606 Forms? Correcting Total Basis for tIRA

Thanks and this just goes onto form 8606 or somewhere else? If I did $5500 non deductible contribution AND and $1000 rIRA -> tIRA rollover in the same year - how do I code this on my return / amendment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending Prior 8606 Forms? Correcting Total Basis for tIRA

Nondeductible traditional IRA contributions are required to be reported on line 1 of the Form 8606 for the year for which the contribution was made. With a $5,500 contribution originally made to the traditional IRA and a $1,000 contribution made to the Roth IRA for that same year and subsequently recharacterized, you contributed $6,500 to your traditional IRA for that year. Your Form 8606 for that year should have had $6,500 on line 1 (assuming that you were covered by a workplace retirement plan and that your MAGI was above the limit where your traditional IRA contribution is nondeductible).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending Prior 8606 Forms? Correcting Total Basis for tIRA

Great - thanks for the clarification. So does my above table look correct? In terms of amending my 8606 should I send an amended 8606 for every year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending Prior 8606 Forms? Correcting Total Basis for tIRA

The proper way to file Form 8606 is attached to Form 1040-X.

Form 8606 can be mailed by itself only when you are otherwise not required to file a tax return.

Do you have the correct taxable amount on Line 4b and did not take a deduction?

After you e-File,

get Form 1040-X from IRS website and mail it in with your 8606, which you can also get in fillable PDF.

Note: since you are not changing any dollar amounts on your amended tax return, you can leave all the lines 1-23 EMPTY.

Part III -- Explain what you did.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending Prior 8606 Forms? Correcting Total Basis for tIRA

" If I did $5500 non deductible contribution AND and $1000 rIRA -> tIRA rollover in the same year..."

I'm still confused by this because you have provided incomplete and possibly conflicting information. Movement of funds from a Roth IRA to a traditional IRA can only be a recharacterization, not a rollover. Did you originally contribute $5,500 to a traditional IRA and $1,000 to a Roth IRA for 2019 or did you contribute $4,500 to a traditional IRA and $1,000 to a Roth IRA for that year? Your table appears to reflect the former. It seems odd that you would have contributed only $6,000 in 2020 if you were age 50 in 2019 and eligible to contribute $6,500 for 2019, making me think that you made an excess contribution for 2019 that is still present in your traditional IRA.

Regarding 2019, it seems that you recharacterized $1,000 of contribution, not $1,060, and the extra $60 transferred consisted of gains, not contributions, that were required to accompany the transfer. That $60 is not part of your basis since it was not part of your contributions.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sherb

New Member

user17698790479

New Member

johnson-kavon

New Member

separate899

Level 3

vsls0224

New Member