- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending Prior 8606 Forms? Correcting Total Basis for tIRA

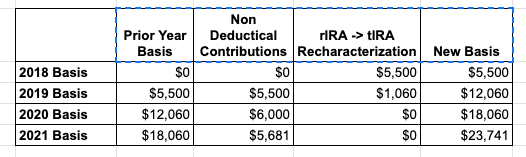

I am currently working on correcting my total basis for my Traditional IRA. I made a series of missteps that I'd like to correct to have an up to date basis for my tIRA before I convert to Roth. See below:

2018 rIRA -> tIRA recharacterization (Have 1099-R but not sure how to apply to 8606/basis)

2019 rIRA -> tIRA recharacterization (Have 1099-R but not sure how to apply to 8606/basis)

2019 after-tax contributions (have 8606 form but 2018 basis didnt carry over)

2020 after-tax contributions (have 8606 form but 2019 basis didnt cary over)

2021 after-tax contributions (have 8606 form but 2019+2020 basis didnt cary over)

Here is how my actual basis should look:

What is the best way to get my basis back up to date? I think I understand amending 8606 forms but how do I handle the Recharacterizations? A step by step guide of what to do would be very help! Thanks so much in advance