- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Amended return doesnt show extra amount to be refunded

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return doesnt show extra amount to be refunded

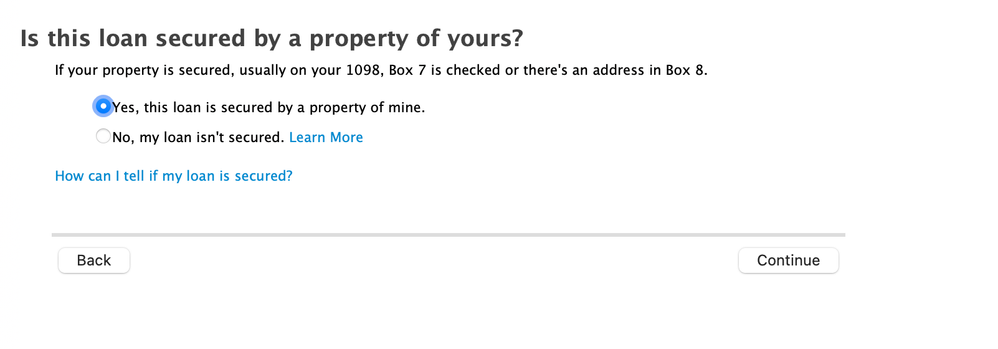

I mistakenly did not select that my loan is secured by a property of mine. I amended the form and chose yes this time. I am suppose to receive an extra $1500 back from state taxes from choosing "YES" but the amended 1040x form does not show this amount anywhere. Anyone have any advice on what to do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amended return doesnt show extra amount to be refunded

If you completed Form 1040X following the steps provided in TurboTax, it will create an amended Federal return.

If the changes you made in the mortgage interest questionnaire increased your deductible interest but only affected your state return, for example, because your itemized deductions are below the standard deduction for the Federal return, you would only see a bottom-line difference on the state amended return.

TurboTax will prompt you for any additional info needed for the state return. Each state has its own procedures for amending the state return. See this help article for more information on amending a California state return.

Form 1040-X for the Federal return contains three columns:

- Column A. This column shows the numbers previously reported on your tax return. Use the copy of your tax return you gathered in Step 1 to complete this column.

- Column B. This column shows how the amounts from your original return need to increase or decrease. For example, if you're amending your gross income to include $50 of interest income missing from your previously filed tax return, you would enter $50 on line 1, column B.

- Column C. This column shows the correct amount. Just add the amounts from column A and column B and enter the result here.

The lower part of the form, starting with Line 16, reconciles the changes made and any additional payments made. If you owe an additional amount based on the changes, it will appear on Line 20 of Form 1040X. If you have overpaid your tax, based on the changes, the overpayment will appear on Line 21 of Form 1040X.

In Part III of Form 1040-X, you'll need to provide a clear explanation for your reasons for filing an amended return.

See this tax tips article for more information.

See this article and this one for more information on filing an amended return with TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ashton71

New Member

faith4302

New Member

Tinell

New Member

Bob in Plano

Level 3

psh84

New Member