- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- 2022 Transcript code 420 “Examination of tax return” and what happens next

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Transcript code 420 “Examination of tax return” and what happens next

Hi all! I’m creating this feed because I got the transcript code 420 on my 2021/2022 tax return and I don’t know what’s next. I’m not finding any clear answers, so I’m creating this post. This is what happened:

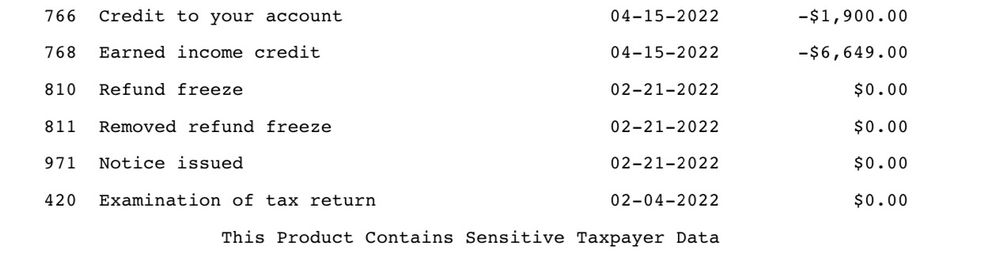

Filed 1/21/22 and accepted 1/24/22. Currently have PATH on wmr. I have not received any correspondence via mail, and I have a processing date of 2/21/2022. First, my credits were posted then tc codes 810 refund freeze, 811 removed refund freeze, 971 notice issued, and the last code is 420 examination of tax return (which was 2/4/2022) no other codes have been added since then & Im not sure what’s to come. If anyone has any answers or insight, please let me know! Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Transcript code 420 “Examination of tax return” and what happens next

Code 420 on your tax transcript means that your tax return has been pulled for an examination or audit.

You should expect a letter from the IRS asking for supporting documents or additional information related to your tax return within a few weeks.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Transcript code 420 “Examination of tax return” and what happens next

https://www.irs.gov/forms-pubs/about-publication-971

about code 971

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Transcript code 420 “Examination of tax return” and what happens next

Returns claiming Spouse Relief typically take at least 11-14 weeks to process.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Transcript code 420 “Examination of tax return” and what happens next

Update on my 2021/2022 tax return. The 420 code was an audit. I received a cp75 letter from IRS on 2/21/22. I responded to the letter on 2/27/22 with almost 200 pages of documentation ranging from mortgage payments, titles, deeds, bank statements, enrollment records for kids in school, doctors records for kids not in school. I sent in child care receipts, notarizations, old rental agreement, and utility bills for all of 2021. I also sent in court records, court orders of custody, my w2 and 1099-G. There was no stone left unturned. In early March, I spoke with a tax examiner. She told me that the issue was due to the EIC I claimed on one of my kids. On 3/9/22 I filed an amended return removing the EIC. On 3/28/22 after no movement or correspondence, I contacted the IRS taxpayer advocate service for assistance due to the financial hardship this was causing me. I was approved for their assistance on 3/28/22 and was told someone would contact me in 4 weeks. I waited until 5/24/22 with no contact still. At this point I had received correspondence from the irs stating they received my documentation and to allow 220 days for processing and to allow up to 20 weeks for processing of my amended tax return. On 5/24/22 I tried contacting the irs taxpayer advocate service to find out why no one had contacted me. I was on hold for a total of 5 hours, they transferred me to 3 representatives in that time frame where not one of them would listen to what I had to say. I was talked to and treated very disrespectfully and in the end, hung up on. Not one person would help, listen, or take the time to let me explain. Later that night, I decided to reach out to my congressman. I sent my congressman an email, explaining my story and how this has affected and contributed to my financial hardships. On 5/27/22 the congressman’s office reached back out to me, requesting more information regarding my tax documents and a signed release for their office. I sent them the information requested and was paired with the congressman’s irs taxpayer advocate representative, and I’ve been working with her since. On 6/3/22 the irs tax payer advocate that had never reached out to me from my original request for their assistance. She discussed my original tax return and my amended return with me. She also let me know that there was another issue with my tax return that contributed to the audit. According to the advocate, my unemployment income wages on my 1099-G were never reported to the IRS by the employer. I let the advocate know that I sent in bank statements & the 1099-G in my documentation sent on 2/27/22. She then explained how busy she was, that I may not hear back from her, and that she was resubmitting my audit for Re-review, and I will have an answer from the IRS in the next 10 days. She said that the irs will send correspondence with their answer via mail and if I need to get a hold of her, to contact her manager. So, I’m supposed to have my tax return audit & amended return processed with my documentation within the next 10 days! I’m hoping & praying this means I’ll be getting my refund soon! Hope this helps anyone!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mzbobbiej

New Member

ghostx66111

New Member

kevinytara

New Member

twodimplz

New Member

wong1021

Returning Member