- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- 1040-X AGI differs from Amended Return Summary original amount. How do I fix that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-X AGI differs from Amended Return Summary original amount. How do I fix that?

My 1040-X AGI differs from Amended Return Summary original amount. How do I fix that?

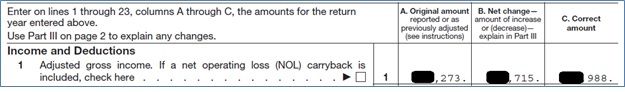

- When attempting to amend my 2022 Federal Return, I am getting an incorrect value for Adjusted Gross Income in my 1040-X in the column labeled “A. Original amount reported or as previously adjusted”.

- The “Amount to Be Refunded” shown in the printed Filing Instructions also does not make sense.

- The “Federal Refund” box in the blue bar at the top of the TurboTax Window does not make sense, but is consistent with printed Filing Instructions.

Why amend the return in the first place?

I amended my 2022 return because I mistakenly reported a short term gain of $6,020 twice. One report was provided on a 1099-B. The other report came from my input during the TurboTax interview for a K-1 for the same investment. To correct this error, I kept the imported 1099-B and removed the responses from the K-1 interview that had resulted in the mistakenly duplicated reporting of the short term gain in the original return.

What seemed to not be working as expected?

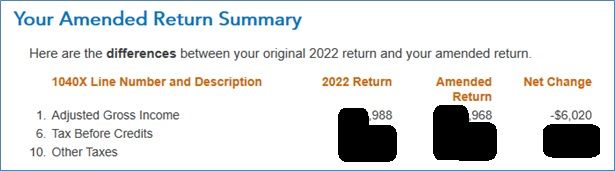

While I noticed display errors in the blue bar at the top of the TurboTax Window early on, I continued to see if I simply misunderstood what was presented for an amended return. During the TurboTax Review for my amended return, I was presented with a screen labeled as “Your Amended Return Summary”.

- That “Amended Return Summary” correctly displays the Adjusted Gross Income for my originally filed 2022 return (abbreviated as $*988).

- Note that the 1040-X has a different, erroneous value (abbreviated as $*273.)

- That “Amended Return Summary” correctly displays the Adjusted Gross Income (abbreviated as $*968) for my not yet filed Amended return.

- That “Amended Return Summary” also indicates the expected net change of -$6,020 in Adjusted Gross Income. That is how much had mistakenly been reported twice in original return.

- The “Federal Refund” box in the blue bar at the top of the TurboTax Window displayed a value of $154 that does not make sense for the Amended return.

What indicates a problem with Form 1040-X?

I saved a PDF copy of the amended return that I am still working on. I’ll call that amd.PDF.

- The amd.PDF 1040-X shows an “Original amount” for my Adjusted Gross Income that differs from what is displayed in the screen labeled as “Your Amended Return Summary” during the TurboTax interview.

- The 1040-X “Original amount” for my Adjusted Gross Income also differs from the originally filed Form 1040 line 11.

- Note that the 1040-X has an erroneous value (abbreviated as $*273.)

- The amd.PDF 1040-X shows what appears to be the correct new or amended amount (abbreviated as $*988) for Adjusted Gross Income for the Amended return.

- When I look at the Form 1040 (without the “-X”) in this amd.PDF, the amount shown on line 35a looks like what I expected my refund should have been had I originally filed my taxes correctly, but sadly I made an error.

The problem is repeatable.

I created a new temporary copy of a backup of my original return to check repeatability.

- I opened TurboTax and started to amend that copy.

- The blue bar at the top of the TurboTax window showed a Federal Tax Due of $629 and an AL Refund of $79, both matching the original filing.

- I clicked continue.

- I indicated, “Yes, I’ve already filed my return”, and “I need to amend my 2022 return”, then I clicked continue.

- The numbers in the Federal Tax Due changed to Federal Tax Due of $2,301 and AL Tax Due of $129, which does not make sense.

- Furthermore, there is a link on this page for “Why did the refund monitor just change to $0?

- They did not change to $0.

- Whatever went wrong happens at this step, and can be repeated.

- I printed that to PDF that I will refer to as temp.PDF.

- This temp.PDF file contains a 1040-X that has an incorrect value for line 1, “A. Original amount reported or as previously adjusted”. It is the same incorrect value as my amended return.

- This temp.PDF file contains a 1040-X that has the actual original amount on line 1, under the heading “C. Correct amount”.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-X AGI differs from Amended Return Summary original amount. How do I fix that?

First the bad news:

I never resolved whatever was causing the repeatable issue using Step-by-Step as described in the bottom part of my original post. Whether it is what I am doing or the software I cannot tell. The repeatability is described above under “I created a new temporary copy of a backup of my original return to check repeatability” near the bottom third of my original post.

Now the good news:

I repeated the Step-by-Step approach that seems to involve an issue with transfer of data to Form 1040-X from my original return. I then decided to work forward from there and use the TurboTax Forms to try to fix my Form 1040-X. That did work.

Details:

- The instructions available from the IRS (https://www.irs.gov/pub/irs-pdf/i1040x.pdf) were helpful.

- At the bottom of page 5 of the PDF there is a paragraph that begins with, “You are changing amounts on your original return or as previously adjusted by the IRS.”

- That is the basic issue I have.

- At the top of page 6 of the PDF the following appears, “Column A. Enter the amounts from your original return. However, if you previously amended that return or it was changed by the IRS, enter the adjusted amounts.”

- At the bottom of page 5 of the PDF there is a paragraph that begins with, “You are changing amounts on your original return or as previously adjusted by the IRS.”

- Using the IRS instructions and TurboTax Forms I was able to fix Form 1040-X.

The work in Step-by-Step did seem to have generated Form 1040-X column C correctly, and column B appears to be calculated as the value of column A minus the value of column C for each row.

I had to make changes (peculiar to my return in some parts) to Form 1040-X column A rows 1 through 15.

- For 1040-X column A row 1 (A1) I copied the value from my original 1040 line 11.

- For 1040-X column A row 6 (A6) I copied the value from my original 1040 line 18.

- For 1040-X column A row 10 (A10) I copied the value from my original 1040 line 23.

- For 1040-X column A row 11 (A11) I copied the value from my original 1040 line 24.

- In the “Original 2022 Return Payments Smart Worksheet” for item ‘B’ I entered the value from my original 1040 line 37.

- This reflects the fact that I made an additional payment that was due with my original return.

- Form 1040-X Row 21 and row 22 now had the correct value, and the TurboTax “Federal Tax Summary” (hover cursor over numbers near top of TurboTax Window) was also correct.

- I also entered an Explanation of Changes in Form 1040-X part III.

- I ran the Federal Review, updated the AL return and then the overall review, which shows the differences between the 2020 Return and the Amended Return, which had been correct before I modified form 1040-X and remained correct after I modified form 1040-X. I do not understand how TurboTax had this part correct but the 1040-X values included errors, but it would seem that the data is obtained from different sources.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-X AGI differs from Amended Return Summary original amount. How do I fix that?

When amending your return in TurboTax, follow the on-screen prompts exactly so that it doesn't change the starting point of the return. If the as-filed AGI is incorrect on the 1040X, then you may have changed the starting point.

See this help article for steps to undo an amended return in TurboTax.

See this help article for steps to amend your return in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-X AGI differs from Amended Return Summary original amount. How do I fix that?

Thank you for your reply!

I neglected to mention that I am using TurboTax CD/Download software on Windows.

The link @MonikaK1 provided appears to be for the online version, but that link also provides a link to the instructions that I believe are intended.

Question: Is there any reason I cannot instead simply use the file that I backed up after my returns had been accepted?

As indicated in the image below, I have a copy that was saved 3/20/2023 when the return was accepted, and long before I started attempting to amend.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-X AGI differs from Amended Return Summary original amount. How do I fix that?

First the bad news:

I never resolved whatever was causing the repeatable issue using Step-by-Step as described in the bottom part of my original post. Whether it is what I am doing or the software I cannot tell. The repeatability is described above under “I created a new temporary copy of a backup of my original return to check repeatability” near the bottom third of my original post.

Now the good news:

I repeated the Step-by-Step approach that seems to involve an issue with transfer of data to Form 1040-X from my original return. I then decided to work forward from there and use the TurboTax Forms to try to fix my Form 1040-X. That did work.

Details:

- The instructions available from the IRS (https://www.irs.gov/pub/irs-pdf/i1040x.pdf) were helpful.

- At the bottom of page 5 of the PDF there is a paragraph that begins with, “You are changing amounts on your original return or as previously adjusted by the IRS.”

- That is the basic issue I have.

- At the top of page 6 of the PDF the following appears, “Column A. Enter the amounts from your original return. However, if you previously amended that return or it was changed by the IRS, enter the adjusted amounts.”

- At the bottom of page 5 of the PDF there is a paragraph that begins with, “You are changing amounts on your original return or as previously adjusted by the IRS.”

- Using the IRS instructions and TurboTax Forms I was able to fix Form 1040-X.

The work in Step-by-Step did seem to have generated Form 1040-X column C correctly, and column B appears to be calculated as the value of column A minus the value of column C for each row.

I had to make changes (peculiar to my return in some parts) to Form 1040-X column A rows 1 through 15.

- For 1040-X column A row 1 (A1) I copied the value from my original 1040 line 11.

- For 1040-X column A row 6 (A6) I copied the value from my original 1040 line 18.

- For 1040-X column A row 10 (A10) I copied the value from my original 1040 line 23.

- For 1040-X column A row 11 (A11) I copied the value from my original 1040 line 24.

- In the “Original 2022 Return Payments Smart Worksheet” for item ‘B’ I entered the value from my original 1040 line 37.

- This reflects the fact that I made an additional payment that was due with my original return.

- Form 1040-X Row 21 and row 22 now had the correct value, and the TurboTax “Federal Tax Summary” (hover cursor over numbers near top of TurboTax Window) was also correct.

- I also entered an Explanation of Changes in Form 1040-X part III.

- I ran the Federal Review, updated the AL return and then the overall review, which shows the differences between the 2020 Return and the Amended Return, which had been correct before I modified form 1040-X and remained correct after I modified form 1040-X. I do not understand how TurboTax had this part correct but the 1040-X values included errors, but it would seem that the data is obtained from different sources.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-X AGI differs from Amended Return Summary original amount. How do I fix that?

I have the same exact problem @Gordon3 , however, I filed the return with the IRS before I realized that the AGI on the 1040-X was incorrect. Good news: the Feds accepted my amended return (perhaps because the mistake is in the 1040-X and not the amended 1040 itself). But now, the state will not accept my amended return because they say that the expected refund on my 1040-X does not match. How do I fix this? Can I just handprint out the 1040-X and send it to the state?

PS - This error is very reproducible. All I have to do is click on amend my original return and it pops up with a refund due before I even start making changes

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Tinell

New Member

Kathyyy

Returning Member

Bob in Plano

Level 3

Brian Galuardi

New Member

svielledent77

New Member