- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040-X AGI differs from Amended Return Summary original amount. How do I fix that?

My 1040-X AGI differs from Amended Return Summary original amount. How do I fix that?

- When attempting to amend my 2022 Federal Return, I am getting an incorrect value for Adjusted Gross Income in my 1040-X in the column labeled “A. Original amount reported or as previously adjusted”.

- The “Amount to Be Refunded” shown in the printed Filing Instructions also does not make sense.

- The “Federal Refund” box in the blue bar at the top of the TurboTax Window does not make sense, but is consistent with printed Filing Instructions.

Why amend the return in the first place?

I amended my 2022 return because I mistakenly reported a short term gain of $6,020 twice. One report was provided on a 1099-B. The other report came from my input during the TurboTax interview for a K-1 for the same investment. To correct this error, I kept the imported 1099-B and removed the responses from the K-1 interview that had resulted in the mistakenly duplicated reporting of the short term gain in the original return.

What seemed to not be working as expected?

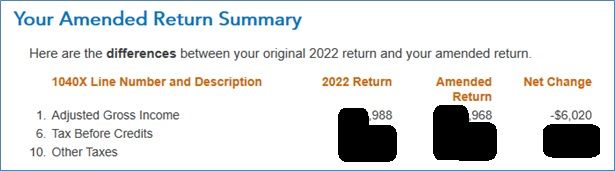

While I noticed display errors in the blue bar at the top of the TurboTax Window early on, I continued to see if I simply misunderstood what was presented for an amended return. During the TurboTax Review for my amended return, I was presented with a screen labeled as “Your Amended Return Summary”.

- That “Amended Return Summary” correctly displays the Adjusted Gross Income for my originally filed 2022 return (abbreviated as $*988).

- Note that the 1040-X has a different, erroneous value (abbreviated as $*273.)

- That “Amended Return Summary” correctly displays the Adjusted Gross Income (abbreviated as $*968) for my not yet filed Amended return.

- That “Amended Return Summary” also indicates the expected net change of -$6,020 in Adjusted Gross Income. That is how much had mistakenly been reported twice in original return.

- The “Federal Refund” box in the blue bar at the top of the TurboTax Window displayed a value of $154 that does not make sense for the Amended return.

What indicates a problem with Form 1040-X?

I saved a PDF copy of the amended return that I am still working on. I’ll call that amd.PDF.

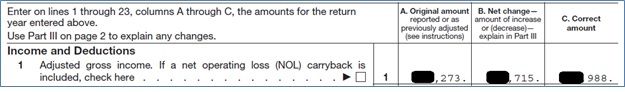

- The amd.PDF 1040-X shows an “Original amount” for my Adjusted Gross Income that differs from what is displayed in the screen labeled as “Your Amended Return Summary” during the TurboTax interview.

- The 1040-X “Original amount” for my Adjusted Gross Income also differs from the originally filed Form 1040 line 11.

- Note that the 1040-X has an erroneous value (abbreviated as $*273.)

- The amd.PDF 1040-X shows what appears to be the correct new or amended amount (abbreviated as $*988) for Adjusted Gross Income for the Amended return.

- When I look at the Form 1040 (without the “-X”) in this amd.PDF, the amount shown on line 35a looks like what I expected my refund should have been had I originally filed my taxes correctly, but sadly I made an error.

The problem is repeatable.

I created a new temporary copy of a backup of my original return to check repeatability.

- I opened TurboTax and started to amend that copy.

- The blue bar at the top of the TurboTax window showed a Federal Tax Due of $629 and an AL Refund of $79, both matching the original filing.

- I clicked continue.

- I indicated, “Yes, I’ve already filed my return”, and “I need to amend my 2022 return”, then I clicked continue.

- The numbers in the Federal Tax Due changed to Federal Tax Due of $2,301 and AL Tax Due of $129, which does not make sense.

- Furthermore, there is a link on this page for “Why did the refund monitor just change to $0?

- They did not change to $0.

- Whatever went wrong happens at this step, and can be repeated.

- I printed that to PDF that I will refer to as temp.PDF.

- This temp.PDF file contains a 1040-X that has an incorrect value for line 1, “A. Original amount reported or as previously adjusted”. It is the same incorrect value as my amended return.

- This temp.PDF file contains a 1040-X that has the actual original amount on line 1, under the heading “C. Correct amount”.