- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How to account for inventory converted to personal use?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to account for inventory converted to personal use?

For example, I have inventory purchased in previous years. This was categorized as inventory the year before.

This year, I withdrew a few items of inventory for personal use, and withdrew a few that was used as a prizes in giveaways, etc.

I believe I can categorize the items withdrew as Advertising/Supplies.

But do I need to credit the Inventory category?

How should items removed for Personal Use be handled?

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to account for inventory converted to personal use?

You can categorize the items used as prizes to patrons as advertising expense. Items withdrawn for personal use are not deductible.

For the prize item, just exclude them from the ending inventory.

For the personal use items, Turbotax will ask about any items withdrawn for personal use to exclude them from deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to account for inventory converted to personal use?

You can categorize the items used as prizes to patrons as advertising expense. Items withdrawn for personal use are not deductible.

For the prize item, just exclude them from the ending inventory.

For the personal use items, Turbotax will ask about any items withdrawn for personal use to exclude them from deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to account for inventory converted to personal use?

Hello,

I have a follow on question. I entered the inventory removed for personal use where TurboTax asked for it but it counted the value as part of Cost Of Goods Sold and thus subtracted the value from the business income. Is this correct?

Thanks for the help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to account for inventory converted to personal use?

No, when you withdraw inventory for personal use it you do not receive a deduction for the amount you withdrew on your tax return.

When you put an amount into the Purchases Withdrawn for Personal Use

it does not add this amount to Cost of Goods Sold.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to account for inventory converted to personal use?

I am using the TurboTax business for my PC.

We have beginning inventory of X, and we're closing the business. We have some left over inventory at the end that we are going to take for personal use.

I believe I should be doing, e.g.:

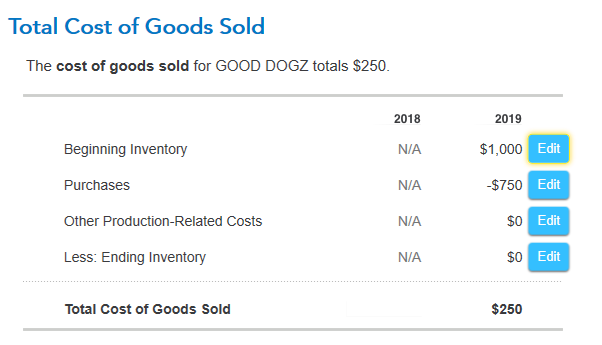

Beginning inventory: 1000

COGS:250

Inventory for Personal Use: 750

Ending Inventory: 0

This section does not appear in my inventory worksheet. When I enter it into non-deductible expense, it doesn't factor through to COGS worksheet. Where is this entered? Which form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to account for inventory converted to personal use?

In your return, you can enter the inventory for personal use as a negative number under Purchases. This will give you the COGS of $250 mentioned in your example.

You can go through the interview or enter the figure manually on form 1125-A in Forms Mode.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to account for inventory converted to personal use?

@Hal365 look at your SCH C Part III.

On line 33 I expect the "Cost" box to be selected.

Line 34 should have the NO box checked.

Line 35 is what you paid for the inventory in your physical possession on Jan 1 of the tax year.

Line 36 is what you paid for inventory purchased "during the tax year", minus what you paid for inventory purchased in "any" year that you removed for personal use.

So check line 36. If that figure isn't right, that means you entered something wrong somewhere.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Justholly

New Member

egilmore2001

New Member

RussellFam5

New Member

Linda C2

Level 2

link888888

Level 1