Hi Everyone,

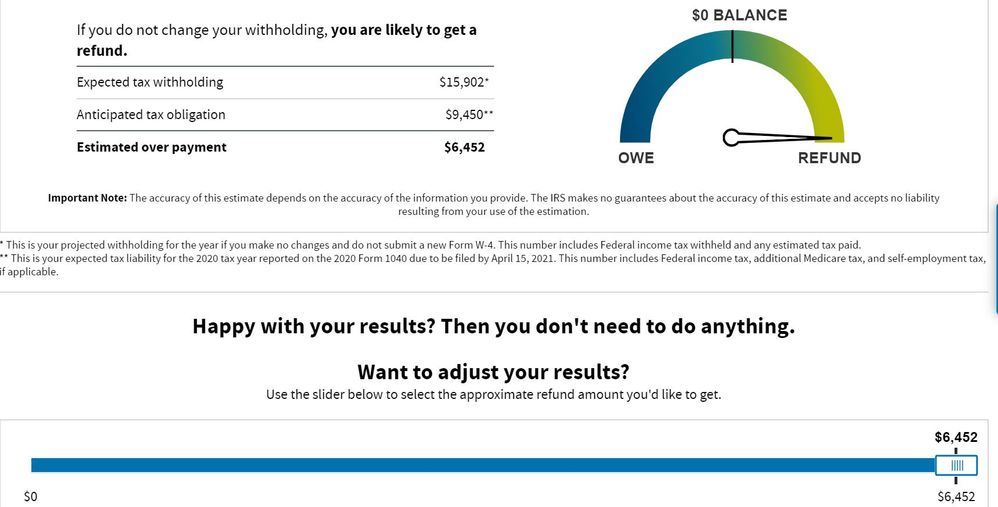

I just did my W4 simulation . This is the result. According to the calculator I should be able to reduce the amount of taxes I am paying.

When I adjust the my refund to 0$ (I want my money now and not overpay taxes) the system states I should be paying $712 taxes instead what I am paying now (much higher).

When I then generate the W4 in point 4c it states I must withhold additional $83 dollars ????

Im lost. How am I going to retrive the 6452 overpayment by increasing the amount of taxes I am already paying. How do I tell my employer to reduce my tax to 712 instead of increasing it even more? Where am I making mistake in understanding the W4 form?

Logic: I can do nothing and get 6452 refund or if I do something the 4c point says I must pay more??? Please help

Rob.