- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- what does " options" mean here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

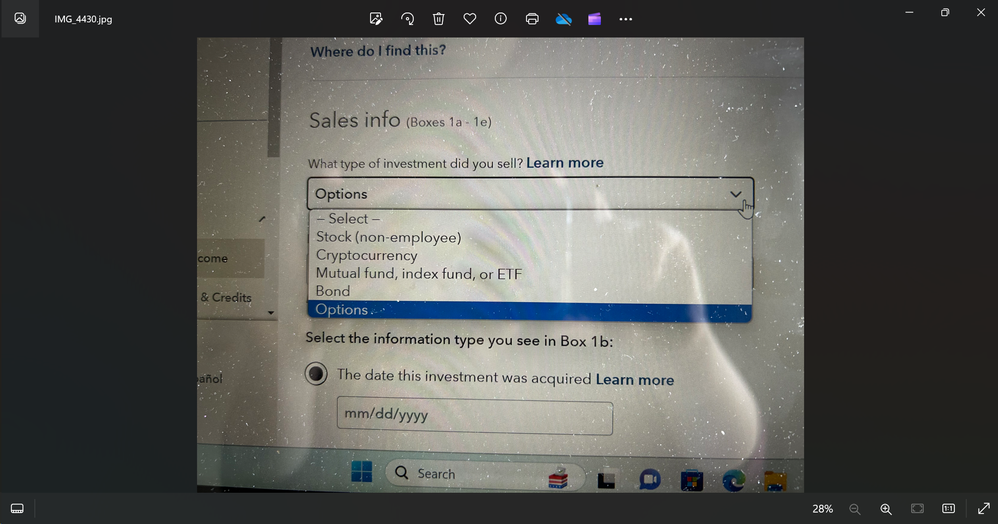

what does " options" mean here?

Hello,

I am working on the investment section of my tax return.

I have STOCK sold on my 1099-b.

Can anybody tell me what does "options" here mean?

People told me since the payer is Merrill who issued this 1099-b, it is a bank. I should choose stock( non-employee)

Is that correct?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what does " options" mean here?

Yes, you should choose Stock (non-employee) if that is what was sold on your 1099-B; that is the most common. Options are a type of stock that is granted to you by your employer. Employee stock has special handling requirements, so we need you to specify whether your stock is employer-granted or not.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what does " options" mean here?

Correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what does " options" mean here?

Yes, you should choose Stock (non-employee) if that is what was sold on your 1099-B; that is the most common. Options are a type of stock that is granted to you by your employer. Employee stock has special handling requirements, so we need you to specify whether your stock is employer-granted or not.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what does " options" mean here?

I am not sure whether the stock is employer granted or not.

I called turbo tax and asked this question, they told me : look at the 1099-b, who issued it? I said , it is Merrill, it is a bank. Then they told me, I should choose " stock- non employee".

Is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what does " options" mean here?

Correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what does " options" mean here?

Thank you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

yibanksproperties

New Member

jh777

Level 3

jcrouser

New Member

charles232

Level 1

dinesh_grad

New Member