- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Turbotax is saying I am ineligible for Child Tax Credit "because your total income of $149,046 exceeded the $200,000 limit for married filing separately status". Why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

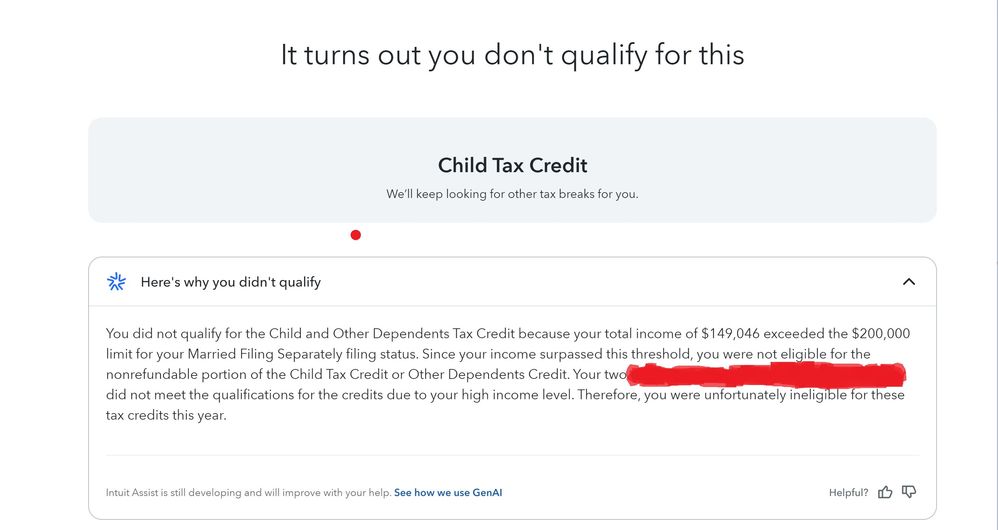

Turbotax is saying I am ineligible for Child Tax Credit "because your total income of $149,046 exceeded the $200,000 limit for married filing separately status". Why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is saying I am ineligible for Child Tax Credit "because your total income of $149,046 exceeded the $200,000 limit for married filing separately status". Why?

Can you please provide a screenshot (without any identifying information) of your screen indicating that you are ineligible for the Child Tax Credit due to your total income of 149,046? Please tag me in your reply. Thank you!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is saying I am ineligible for Child Tax Credit "because your total income of $149,046 exceeded the $200,000 limit for married filing separately status". Why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is saying I am ineligible for Child Tax Credit "because your total income of $149,046 exceeded the $200,000 limit for married filing separately status". Why?

Thank you for the screenshot. To further research this, it would be helpful to have a TurboTax ".tax2023" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions: Go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

Thank you for your patience.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is saying I am ineligible for Child Tax Credit "because your total income of $149,046 exceeded the $200,000 limit for married filing separately status". Why?

Here is the Token Number: 1195428 @LenaH

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is saying I am ineligible for Child Tax Credit "because your total income of $149,046 exceeded the $200,000 limit for married filing separately status". Why?

You seem to have a defective copy of TurboTax. Where did you buy it from?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is saying I am ineligible for Child Tax Credit "because your total income of $149,046 exceeded the $200,000 limit for married filing separately status". Why?

I am using their online version. It is their live production version @taxlady28

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is saying I am ineligible for Child Tax Credit "because your total income of $149,046 exceeded the $200,000 limit for married filing separately status". Why?

Thank you for providing your token number. After taking a closer look at your return, there were some boxes checked on a worksheet that somehow could not be unchecked by going back through the dependents section of your return. I was able to resolve this by deleting your dependent who was listed first on your return (born in 2017) and re-entering the information for that dependent. This corrected the issue and allowed the child tax credit for that dependent to be included as part of your return. (Dates of birth and state of residence are the only personal information kept in the diagnostic files since both of these pieces of data are crucial to determine certain credits and taxes.)

As for the message that you were seeing on screen stating that you did not qualify for the child tax credit because your AGI was higher than $200,000.00, that was a snag in the Intuit Assist explanation. It has been reported as being inaccurate so it can be corrected.

For reference, take a look at the following TurboTax article for details about removing/re-adding your dependent:

How do I add or remove a dependent?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

millbemis

New Member

villalobosman

New Member

debjit21

New Member

dayn57803

New Member

andileb

New Member