- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TurboTax error Step-by-Step for Mortgage Interest

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax error Step-by-Step for Mortgage Interest

Using the Step-by-Step method, on the Your 2022 Deductions and Credits summary screen, Turbo Tax Premium 2022 incorrectly shows mortgage interest when origination points are added. Turbo Tax adds all origination points to the interest, not the amortized points over the 30 year length of the mortgage. For example: The mortgage interest is $5813.60. The Origination Points is $721.77 paid in 2019 for the 30 year loan, so each year, the amortized amount should be $721.77/30 = $24. So, total interest should be $5314 + $24 = $5838 (rounded). This amount shows correctly on the Schedule A Form and the Home Mortgage Interest Worksheet. But, shows to be $6535 on the “Your 2022 Deductions and Credits” summary screen ($6535 = $5314 + $721.77). Turbo Tax needs to correct this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax error Step-by-Step for Mortgage Interest

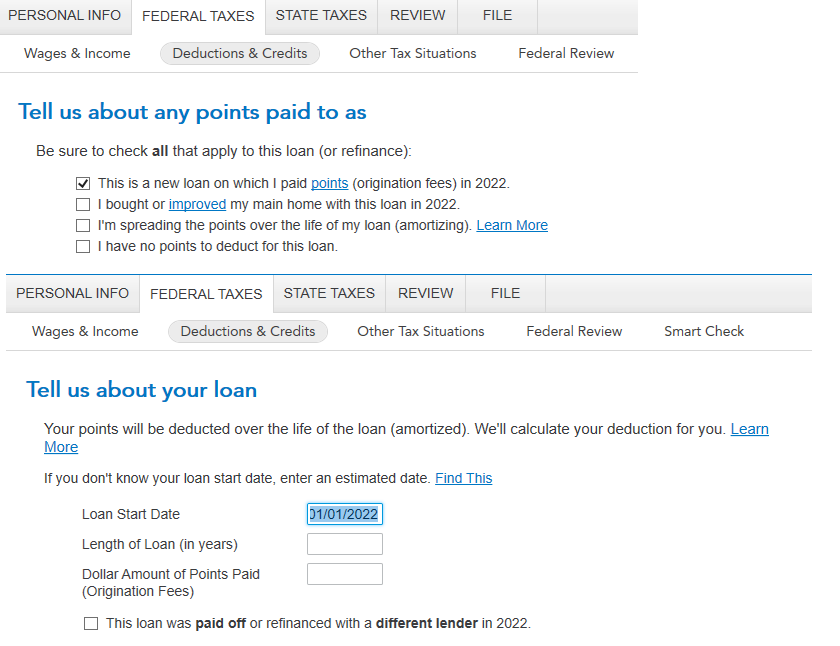

If properly posted in Step by Step the points will be amortized over the length of the loan.

Go to:

- Deductions & Credits

- I'll choose what I work on

- Select Mortgage, Interest ...

- Select Edit on the Home Loan deduction summary.

- Post

- Lender

- Primary home

- None of the above

- The entry screen will come up. [Continue]

- Is loan secured by a property of yours? Yes

- Tell us about the points paid.

- Select This is a new loan on which I paid points in 2022.

- [Continue]

- Tell us about your loan.

- Enter your point information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax error Step-by-Step for Mortgage Interest

Your instructions do not work. First off, as stated in my original post, the loan was originated in 2019, so it is not a new loan. Also, since I've been using TurboTax (CD, not online) for several years, TurboTax imports the loan information from previous years, so I can't even choose the "This is a new loan" if I wanted to. As I stated, this is a TurboTax error and is not anything I'm doing wrong. Luckily, the actual calculations using "Forms" is correct, so this will not affect my return. However, Step-by-Step should be corrected by TurboTax (not me) to fix the error whereby TurboTax incorrectly adds the full origination points to the interest, not the amortized origination points. That error shows up on the "Your 2022 Deductions and Credits" screen on the "Mortgage Interest, Refinancing, …" line, so how could the error be on my part. TurboTax shows two (2) different answers, one here and one on Forms. So, how could that error be due to anything I am doing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax error Step-by-Step for Mortgage Interest

The Deductions & Credits Summary page displays both the imported information from last year and your entries for this year. For this reason, these totals may not reflect the actual amounts entered on individual forms within your return. If you are able to confirm the forms are reporting your information as you expect, then you may ignore the values shown on the summary page.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

smlucio

Level 1

mpiseter

Level 1

Loudspeaker1999

Level 1

Loudspeaker1999

Level 1

snoblack

Level 2