- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TurboTax 2023 Entries on S-Corp DIssolution Actions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 Entries on S-Corp DIssolution Actions

Hello, I am having difficulty in entering, in the right places, the information needed to record, in Form 1120-S, the dissolution of my S-Corp. I am also recording the distribution of remaining equity to the sole Shareholder.

Among the pages I have worked with are:

* the TurboTax Business Schedule K-1 Worksheet,

* Schedule K-1, and

* the Weighted Average Ownership Percentage Worksheet.

It looks like I need to:

1. Record the Distribution of Assets (within Basis); I think that should be done on the Schedule K-1 Worksheet, in the section titled "Distributions from Schedule K Line 16d". Is that correct? That entry travelled correctly to Schedule K-1.

2. For the Dissolution, it appeared to be merely changing the End of year No. of shares from 100 to 0. But TurboTax Business will not let me do that, on any of the forms I have looked at. And, on the Schedule K-1 Worksheet, I also recorded 0 (zero) near the bottom of the form in the Total number of shareholders at year end. That did not do anything on the K-1.

I have not been able to find anything about this second issue in the usually-helpful right-click information for these entries.

By the way, The Asset Entry Worksheet and 4797 support info has been very useful; thanks!

Thank you for your assistance!

SG

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 Entries on S-Corp DIssolution Actions

A follow-up: I did find two posts that said that, for this situation, I should be u sing Form 1099-DIV. But in my version of TurboTax Business, that form seems not to be available.

--Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 Entries on S-Corp DIssolution Actions

A follow-up: I did find two posts that said that, for this situation, I should be u sing Form 1099-DIV. But in my version of TurboTax Business, that form seems not to be available.

--Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 Entries on S-Corp DIssolution Actions

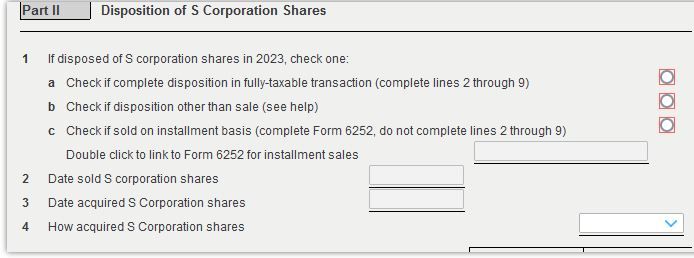

I'm trying to do something similar. I am closing an S-Corp. I selected "This S corporation ended in 2023". The next question what me to "Describe S corporation Disposal". It is assuming I am selling or transferring to another party, not ceasing operations. I select "None of the above". After I enter all my data I get a review and this pops up:

My K-1 box 17 has a "V" in it, not a "K" or "S"

It still assumes I sold or transferred my corporation and I don't know how to proceed. Any guesses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 Entries on S-Corp DIssolution Actions

You are reporting a disposition other than a sale for zero dollars. By checking the box for "S-Corp ended," you are reporting that the business is no longer in operation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

fcbdc

Returning Member

Latamo

New Member

OverTaxedInIN

New Member

easyxpress

Level 3

nocturnalmelody5

New Member