- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- TurboTax 2023 calculated the wrong underpayment penalty for California

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 calculated the wrong underpayment penalty for California

I just entered all the entries for my 2023 on turbo tax desktop app home and business.

I noticed that the underpayment penalty was wrong when calculated by turbotax. Please fix it and update the software.

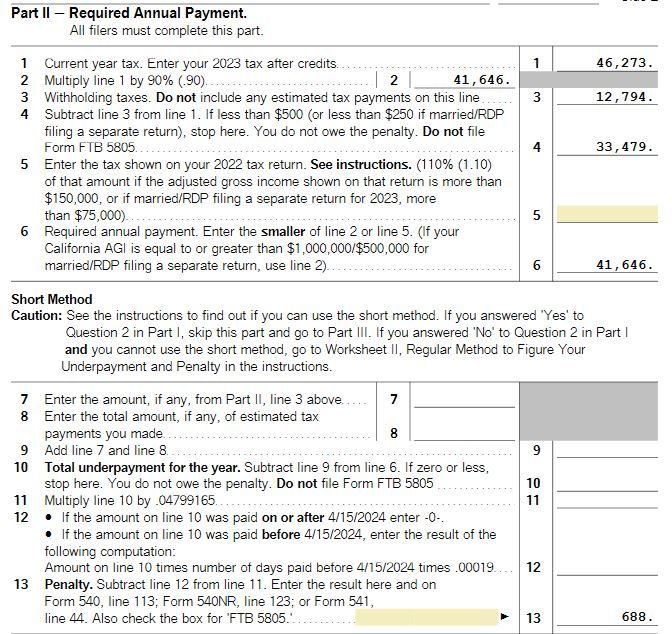

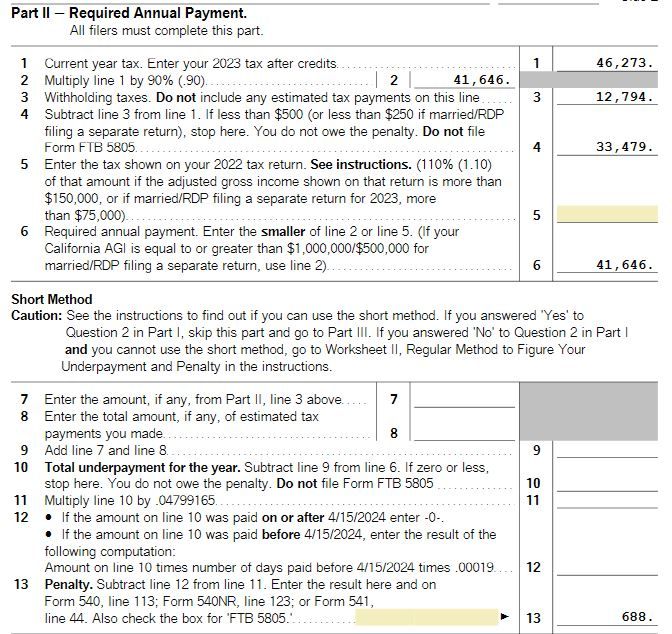

Turbotax calculated the california underpayment penalty to be $688. Whereas, when I did the calculations manually following the form 5805 instructions, it was $55.

Please fix and update the software.

Another user brought this up, but the support posted some explanation about why underpayment penalty is imposed. We don't need explanation, we know why we need to pay underpayment penalty. We just need the software to get fix and updated. It was working in turbotax 2022 but not 2023.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 calculated the wrong underpayment penalty for California

If the calculation is incorrect because it isn't following the disaster relief rules for payment dates for 2023 returns:

Visit or revisit the Other Tax Situations section and review the Underpayment Penalty information to confirm it is correct. Go through the interview and follow the prompts; when you get to the Penalty Waivers screen, answer "yes" if you qualify for a disaster exception, then "yes" at the next screen to request a waiver of the penalty, in all or part. Enter the reason in the field provided.

If you live in a federally declared disaster area and met the special filing and payment deadlines for that disaster, you qualify for an automatic underpayment penalty waiver. Even if the penalty is calculated on the return, the IRS should not charge the penalty.

See here for the IRS requirements for the California disasters for 2023.

If you get a notice from the IRS proposing to assess the penalty, see this IRS webpage for guidelines and next steps.

Because the Federal and state extended filing deadlines are available only for individuals living in areas impacted by official disaster declarations during specified dates, the deadlines themselves aren't updated in the software. The tax agencies made an administrative decision not to impose the penalties, but since the law itself didn't change, tax software including TurboTax still calculates the penalties.

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. Therefore, taxpayers do not need to contact the agency to get this relief. However, if an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment, or deposit due date falling within the postponement period, the taxpayer should call the number on the notice to have the penalty abated.

See here for related information from the California Franchise Tax Board.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 calculated the wrong underpayment penalty for California

This wrong calculation has nothing to do with the disaster relief waiver by IRS.

It is for California 540 form return which uses the 5805 worksheet to calculate. It is the california franchise tax board. Nothing to do with IRS underpayment penalty. It is the california underpayment penalty.

Please fix/update the 2023 turbotax home and business software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 calculated the wrong underpayment penalty for California

Please advise if you observed where in TurboTax's California Form 5805 you found the discrepancy with your own calculation.

In order for us to troubleshoot this issue, you can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions for TurboTax Desktop users:

- From the black bar at the top of your screen, select Online

- Click Send Tax File to Agent

- Click Send on the message that pops up

- TurboTax will create a "sanitized" copy of your return information with no personal info

- Post the 7-digit token number here in this thread

We will then be able to review your file to see what you are seeing, and we can determine what is going on in your return and provide you with a suggested resolution here in this thread.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 calculated the wrong underpayment penalty for California

Hi,

The 7 digit token is 1226473. Turbotax automatically puts $688 in California form 5805 Line 13. When I calculate it manually, it is $55.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 calculated the wrong underpayment penalty for California

Hi

The token is 1226473.

Turbotax 2023 calculated $688 for line 13 of California form 5805. When I calculate it manually, it is $55.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 calculated the wrong underpayment penalty for California

Thank you; I have reviewed the file.

I found no entries made in the California Underpayment Penalty interview. I recommend that you return to the California section and complete the Underpayment Penalty interview under Other Situations. Your answers to the questions affect the calculation of the penalty.

Did you also review the Underpayment Statement in the California forms list? It provides a chronological listing by quarter of events or transactions that impact the penalty calculation, including rate changes during the year. If the dollar amounts and dates on the form are correct, the calculations on the statement appear correct.

The Running Balance, Percent, and the Number of Days between events are determined and with this information, the penalty is computed. The benefit of this presentation is the simplicity of display and the highest level of accuracy. Each event is considered individually. Multiple payments per quarter and penalty accrued are both handled with this method.

The Event and Date Columns chronologically present each event that may have an impact on the calculation. They include Amount Due, Applied Amounts, Withholding, Voucher Payments, Rate Changes (if applicable), Compounding (if applicable) and Date Return Filed.

The Underpayment Statement allows up to four amount due and withholding dates which default to the applicable state due dates. If your state has an underpayment calculation for farmers, only one amount due date and withholding date are presented. The statement can also accommodate up to eight voucher payments and dates. These too will default to the state due dates previously mentioned. The last event is the return Date Filed.

The events are listed below with the state forms or statements from which the information may flow:

Amount Due: Calculated within the applicable state form used for computing underpayment of estimated taxes by individuals.

- Applied: From your state main form if it has a separate line for Overpayment Applied or from the Tax Payments Worksheet, line 6, Overpayment from Previous Year Applied to Current Year.

- Withholding: From the total state withholding line of your state main form split quarterly. To override the splitting of withholding into quarterly amounts (if applicable in your state) enter the correct withholding per quarter on the applicable state form/statement.

- Payment: From the Tax Payments Worksheet, lines 1 through 5(e), date and amount columns.

- Date Filed: From the Tax Payments Worksheet, date return will be filed and balance paid. The Date Filed will default to your state due date if left blank.

Note: No data entry is required for this statement. If changes are necessary go to the appropriate form or statement as shown above, make the required changes and the new calculations will be reflected in the updated statement.

Any event listed in the Event column will have a positive or negative impact. The Amount Due Column will list positive impact amounts such as Amount Due or Compounding (if applicable). The Amount Paid Column will list negative impact amounts such as Applied, Withholding and/or Voucher Payment Amounts.

Combining any event with the previous Running Balance amount results in the current outstanding balance until the next event or transaction is realized and a new Running Balance is computed.

The Running Balance, Percent and Number of Days Column amounts are all used in computing the penalty figure which appears in the Penalty Column. If your state has a Rate change during the year this will be reflected in the Event and Date Column as well as the Percent Column. Combining all the figures in the Penalty Column result in the total penalty to be carried to your state underpayment form.

The Underpayment Penalty Statement will be calculated and printed under the following conditions:

- - If more than one payment is made for any quarter, or;

- - If any payment is not made timely, or;

- - If an overpayment is applied backwards to a previous quarter, or;

- - If there is an amount on the line for remaining underpayment from the previous period (if applicable).

If the above conditions are not met the statement will not be produced. All amounts and penalty calculations will appear on the applicable state form used in computing underpayment of estimated tax by individuals. In this case, the state form is adequate for clearly presenting the penalty computations.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 calculated the wrong underpayment penalty for California

I sent another copy of my return. Token number 1226610.

I went thru the interview. It is the same, Turbotax still came up with $688.

If you do the simple math based on the entries I have:

Line 7 12,794 (from Line 3, already input into turbotax 2023)

Line 8 30,000 (also entered in estimated tax paid)

Line 9 42,794 (add line 7 & Line 😎

Line 10 42,794 - 41,646 = 1148 (line 9 - line 6, which is already entered)

Line 11 = 1148 x 0.04799165 = 55 (this is the number I got). Don't know why turbotax keeps coming up with 688.

It is not a data entry issue, it is the software not running the calculations with the data already entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 calculated the wrong underpayment penalty for California

Thank you for providing the code. I have reviewed your data file.

Your manual calculations were made using the short method. According to the California instructions for Form 5805:

You may use the short method only if you are a calendar-year taxpayer and either one of the following apply:

- You made no estimated tax payments or your only payments were California income tax withheld.

- You paid estimated tax on the required due dates.

You may not use the short method if either of the following apply:

- You made any estimated tax payment late.

- You answered "Yes" to Part I, Question 3.

You didn't enter any state quarterly estimated payments in the area provided in the Federal section. You entered two additional payments, both made in November.

Based on your entries. TurboTax is correctly using Worksheet II, Regular Method, and the accompanying Underpayment Statement to figure your underpayment and penalty. The calculations are correct following that method.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

richardm75

New Member

freddytax

Level 1

rpmm

Returning Member

sparksj337

Returning Member

Larry793

New Member