- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Tubotax Premier, Schedule K-1 Multiple questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tubotax Premier, Schedule K-1 Multiple questions

Hello,

Back in the fall of 2021, we invested some of our savings into an LLC partnership firm created for investing in real estate properties. Per discussion with the General Partners / Principal investors of the firm, our contribution was divided equally into two categories / “classes” of investments within the firm.

Class A – Higher distribution but lower return on capital at the time of asset sale

Class B – Lower distribution but higher return on capital at the time of asset sale.

From the funds the raised, the firm invested in two properties. The first property closed in Dec 2021 and the second property closed in Q1 2022 and we started receiving distributions through 2022.

We received two different Schedules K-1s on April 1 of this year. While filling out the Schedule K-1 information for this investment in Turbotax (Premier), it seems quite straightforward to transfer the information from the two Schedule K-1s into the tax software. But we have few questions / clarifications that we would appreciate if someone could help clarify before we file our taxes.

1. The information in both Schedule K-1s are very similar except few differences – specifically, the distribution amounts (listed under Part III, Line 19 Code A) are different. As I understand, the different amounts for Distributions are due to the two classes of investments for our funds within this firm – is my understanding correct?

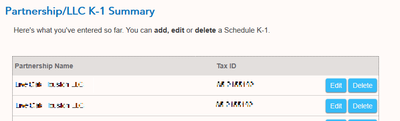

2. In Turbotax, we created two different entries (one for each class of investment with the firm) even though the Tax ID of the firm generating the Schedule K-1s is the same:

We then let Turbotax walk us through the steps for entering the information from each Schedule K-1. As mentioned above, most of the information in both K-1s is the same except for the distribution amount. In other words, except for the distribution amount, the information that is identical (e.g. Line 13/Code A, Line 13/Code K, Line 18/Code C) is copied from each K-1 into the corresponding entry/form in Turbotax.

Question2: Is this the correct way to enter the information from Schedule K-1s? If not, what would the right way be to enter the information from the two Schedule K-1s into Turbotax. Just want to confirm since so much information is identical in both K-1s.

3. In both of the K-1 forms, the Line 20 Box Z Section 199A Information is the same. Since the firm invested in two different properties (e.g. PropertyA and PropertyB), the information is reported under two columns as shown below (Note: Not actual amounts from the K-1 ).:

Column A Column B

QBI or Qualified PTP Items

Net rental real estate loss 1,000 -30,000

…..

…..

W-2 Wages 2,000 1,217

Qualified Property 36,200 64,251

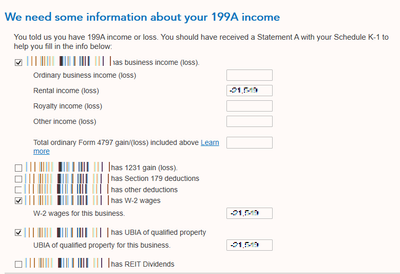

However, Turbotax only has one column for entering the amounts against “Net Rental real estate loss”, “W-2 Wages", "UBIA of Qualified Property" as can be seen in image below:

Question3: Do we need to add the amounts in the two columns from the Schedule K-1s and enter it in the respective rows in Turbotax? If not, what is the correct way to enter the Line 20 Box Z Section 199A information from the two schedule K-1s into Turbotax?

4. Both K-1s have separate statements (with identical information) for Line 20 Code AH. In this statement, under the Description section, it reads “Schedule K-3 will not be distributed unless Requested” and “Analysis of at Risk versus Not at Risk Liabilities” followed by three columns as below (Note: Not actual amounts):

At Risk Not At Risk

Non-recourse 0 765

Qualified non-recourse 20023 0

Recourse 0 0

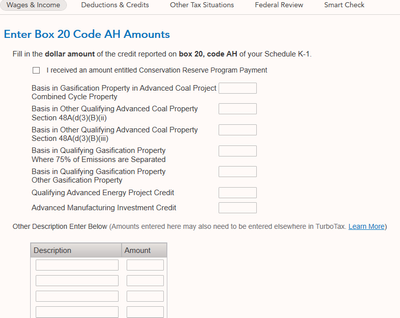

The non-zero amounts match those in Part II, Line K (Partners share of liabilities). Turbotax has this screen for Box 20 Code AH Amounts:

Question4: How do we enter the information from K-1s into above form in Turbotax? Or do we leave this form in Turbotax blank?

5. When we were notified that the K-1s are available, there was an accompanying note that "composite “Arizona” state tax return has been filed at the company level for this investment, so you do not have to file it at an individual level." We reside in the state of Minnesota while the properties themselves are located in Arizona and the LLC firm investing for this property is registered in Houston (per Part I of the K-1s) .

Question5: Is there any additional reporting / filing other than at the Federal level with these K-1s?

Thank you so much in advance for any input regarding these questions.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tubotax Premier, Schedule K-1 Multiple questions

Question 1: Why the distributions are different is a question for the partnership itself but the two investment levels would result in different distributions so it's as good an answer as any.

Question 2: That is the correct way to enter a K-1.

Question 3: Yes, combine the two columns.

Question 4: Depends on what the property that you have invested in is doing - coal or gas? Enter the amount into the corresponding box

Question 5: Nope. They took care of Arizona for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tubotax Premier, Schedule K-1 Multiple questions

Question 1: Why the distributions are different is a question for the partnership itself but the two investment levels would result in different distributions so it's as good an answer as any.

Question 2: That is the correct way to enter a K-1.

Question 3: Yes, combine the two columns.

Question 4: Depends on what the property that you have invested in is doing - coal or gas? Enter the amount into the corresponding box

Question 5: Nope. They took care of Arizona for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tubotax Premier, Schedule K-1 Multiple questions

@RobertB4444 Thank you for the response.

Qs 1: I did call and talk to the GP for the partnership yesterday and they did confirm that the reason we received two K-1s WAS due to our two different investment levels in this particular partnership.

Qs2: Thank you for confirmation

Qs 3: Thank you again

Qs 4: The two properties the partnership has invested in are multi-family residential apartment dwellings and none of the options in the Turbotax screen apply (Gas, coal etc.). So we left this screen blank in Turbotax and it did not show any errors during federal and final reviews.

Qs 5: Thank you again for this confirmation as well.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

obeteta

New Member

Raph

Community Manager

Fuzzy Red Baron

Returning Member

jim202400

New Member

joycesyi

Level 2