- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Tax treatment of short-term rental that is managed by a property manager

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of short-term rental that is managed by a property manager

I am trying to understand the tax treatment of a short-term rental that I own through a SMLLC (that is taxed as sole proprietorship) but is managed by a property manager. Specifically:

1. Would this be considered as passive income or active income? my guess is passsive

2. Would this be reported on Schedule E or Schedule C? my guess is Schedule E

3. On this page, they consider this scenario (a short-term rental combined with non-material participation) as a best option and say that is eligible for pass-thru losses and cost-segregation options. What do they mean by pass-through losses in this context? I understand that losses from passive income cannot be used to offset income from active sources such as W2.

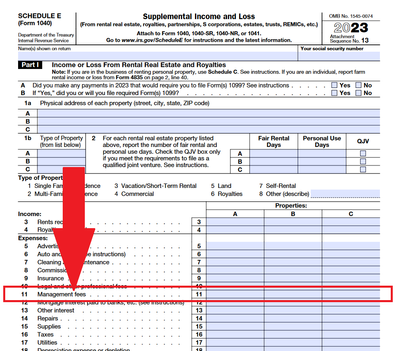

4. Does Schedule E have a line where it allows me to deduct expenses paid to the property management company for management of the property?

5. I understand that putting yourself in the active income category is good when you are operating at a loss whereas passive income is desirable when you are operating at a profit so you don't have to pay self-employment tax. correct?

References:

https://anderscpa.com/tax-considerations-for-short-term-rental-property-owners/?tag=re&c

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of short-term rental that is managed by a property manager

@siddjain1 wrote:....Does Schedule E have a line where it allows me to deduct expenses paid to the property management company for management of the property?

Yes, and the program will walk you through entering the expenses during the interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of short-term rental that is managed by a property manager

@siddjain1 wrote:....Does Schedule E have a line where it allows me to deduct expenses paid to the property management company for management of the property?

Yes, and the program will walk you through entering the expenses during the interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of short-term rental that is managed by a property manager

@siddjain1 wrote:.....I understand that putting yourself in the active income category is good when you are operating at a loss whereas passive income is desirable when you are operating at a profit so you don't have to pay self-employment tax. correct?

There are different types of income and it would be well not to conflate them.

You are basically correct but, technically, the difference in terms of self-employment tax is earned versus unearned income (and you pay self-employment tax on the former).

@siddjain1 wrote:....Would this be reported on Schedule E or Schedule C? my guess is Schedule E

You would report the income on Schedule C only if you provide significant services to your renters. Otherwise, you report on Schedule E.

@siddjain1 wrote:.....Would this be considered as passive income or active income? my guess is passsive

Yes, if you are using a management company, it's almost a certainty that your rental income would be considered to be passive (i.e., you do not materially participate).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of short-term rental that is managed by a property manager

@siddjain1 wrote:....What do they mean by pass-through losses in this context?

Pass-through losses are derived from pass-through entities, such as a partnerships/multi-member LLCs, S corporations, certain types of trusts, etc., that issue K-1s to their partners/members, shareholders, and beneficiaries, respectively.

Since your LLC is a single-member LLC, there is technically no "pass-through" income or loss since the LLC is disregarded for federal income tax purposes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of short-term rental that is managed by a property manager

Sec. 469 says passive losses can only offset passive income. Ideally, the landlord might like to recharacterize the losses as non-passive so that they can offset the landlord’s regular income. Non-passive income is not subject to limitations described under Sec. 469. One way to achieve this non-passive status is to own a short-term rental.

Short-term rentals are granted an exception to the definition of a “rental activity” under Sec. 469 if certain conditions are met.. This is a good thing for landlords who can materially participate in their rental activity but can’t meet the strenuous tests to qualify as a real estate professional.

***************************

To determine whether a short-term rental is reported on Schedule C or E, did you the landlord provide services to the tenants that trip Sec. 1402?

If the answer is yes, report the short-term rental on Schedule C. If no, Schedule E.

The services that trip Sec. 1402 are not the same as the “significant personal services” described in Treas. Reg. Sec. 1.469-1(T)(e)(3)(ii)(B) see paragraph above).

I’ve pasted below what services do trip Sec. 1402:

(2) Services rendered for occupants. Payments for the use or occupancy of rooms or other space where services are also rendered to the occupant, such as for the use or occupancy of rooms or other quarters in hotels, boarding houses, or apartment houses furnishing hotel services, or in tourist camps or tourist homes, or payments for the use or occupancy of space in parking lots, warehouses, or storage garages, do not constitute rentals from real estate; consequently, such payments are included in determining net earnings from self-employment. Generally, services are considered rendered to the occupant if they are primarily for his convenience and are other than those usually or customarily rendered in connection with the rental of rooms or other space for occupancy only. The supplying of maid service, for example, constitutes such service; whereas the furnishing of heat and light, the cleaning of public entrances, exits, stairways and lobbies, the collection of trash, and so forth, are not considered as services rendered to the occupant.

Treas. Reg. Sec. 1.1402(a)-4(c)

If you provide services “primarily for the convenience” of your tenants other than those that are customarily rendered in connection with renting rooms, then you have a Sec. 1402 activity.

And if you have a Sec. 1402 activity, the rental is reported on Schedule C and the income is subject to self-employment taxes.

What are services “primarily for the convenience” of your tenants?

Piecing together Tax Court cases shows the following:

Room service

Making beds

Furnishing linens and towels

Providing laundry service

Preparing and serving meals

Sweeping and mopping floors

Dusting and cleaning

Washing dishes

Cleaning bathroom fixtures

Emptying trashcans (in room)

Replacing scattered or misplaced articles

If these services aren't provided to your guests while they stay at your property, then you likely have a reasonable basis to report your short-term rental on Schedule E. This is true even if your short-term rental is not a “rental activity” thanks to the Sec. 469 exception.

****************************************

what I could not find clarification for is whether or not the landlord must perform these services or can a management company be used. Of course, if your management company doesn't provide any of these services then the reporting would go on Scheule E.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax treatment of short-term rental that is managed by a property manager

@Mike9241 wrote:what I could not find clarification for is whether or not the landlord must perform these services or can a management company be used.

I think I'm going to page @AmeliesUncle for some input on this issue.

I doubt there's much authority on this particular set of circumstances, but it seems to me that if the management firm is supplying the services on its own accord (without input), then the owner should probably report on Schedule E.

On the other hand, if the management firm is acting as the owner's agent (at the owner's behest) in supplying the services, then it's pretty much the same as the owner supplying the services and, as a result, the owner should report on Schedule C.

My $.02

As a footnote, the services listed are almost exactly the same for both sections of the Code.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

desert1

Level 1

Steve230

Level 1

keymaster

Level 2

JW112

Returning Member

keymaster

Level 2