Hi Community,

My question is regarding how to interact TurboTax software. I haven't made any contributions in 2023 but I got my 401k solo account opened in 2023. I plan to make contribution before April 15th, 2024. I don't know how to answer TurboTax questions. Below are steps:

https://ttlc.intuit.com/turbotax-support/en-us/help-article/self-employed/enter-solo-401-k-turbotax/...

- Sign in to your TurboTax account, and open or continue your return.

- Search for self-employed retirement plans (be sure to include the hyphen) and select the Jump to link.

- Answer Yes to the question, Did you make a 2023 self-employed retirement plan contribution?

- Answer Yes to Did you contribute to an Individual or Roth 401(k) plan?

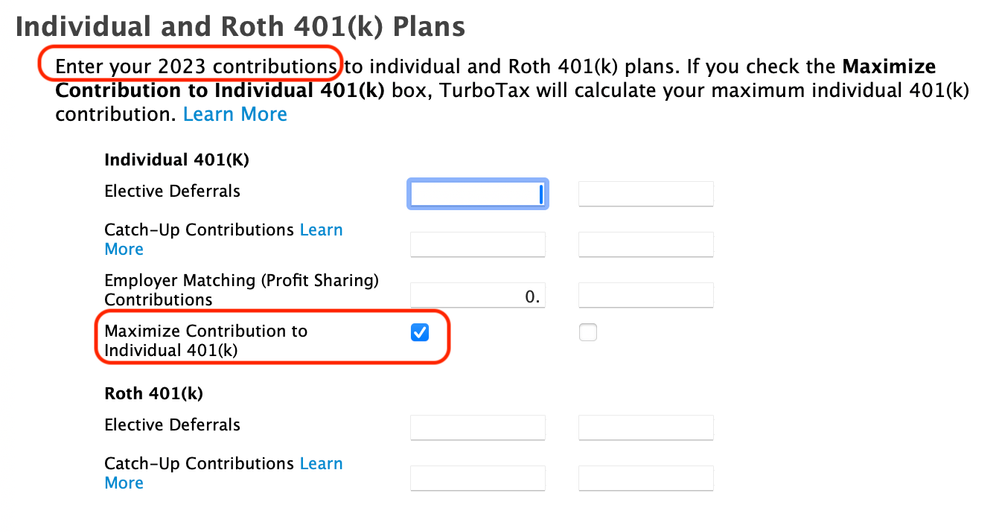

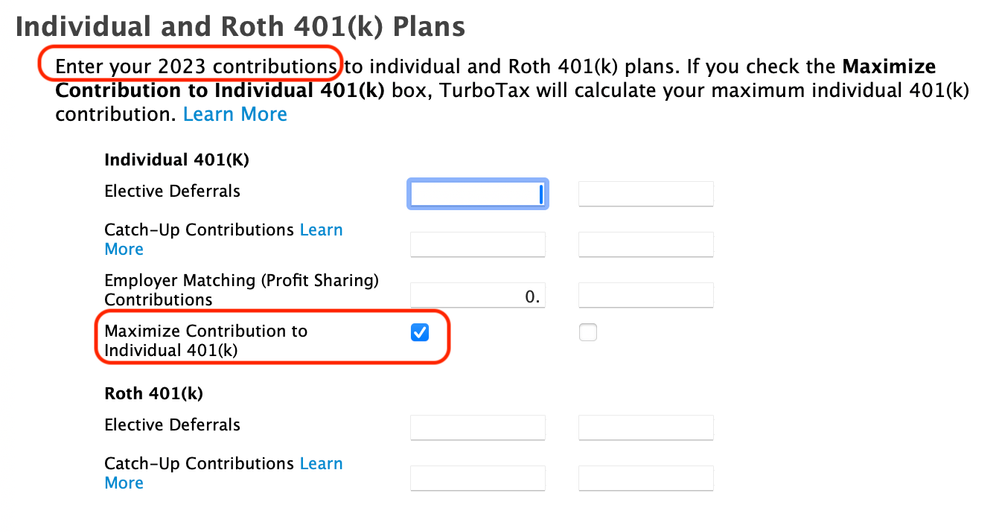

- On the next screen, enter your Elective Deferrals and any Catch-Up Contributions you made in 2023.

- Enter your Employer Matching (Profit Sharing) Contributions for 2023.

- Note: There's no Employer Matching box for Roth 401(k)s because any matching employee contributions are pretax.

- If you haven’t made all your contributions for the tax year and would like TurboTax to calculate your maximum contributions for the year, check the box next to Maximize Contribution to Individual 401(k) and Continue.

In this page,  because I haven't made any contribution in 2023, I will type all 0 or left empty.

because I haven't made any contribution in 2023, I will type all 0 or left empty.

because I plan to contribute for 2023, I check the "Maximize Contribution to Individual 401(k)" box.

Is my understanding correct?

Looks not.

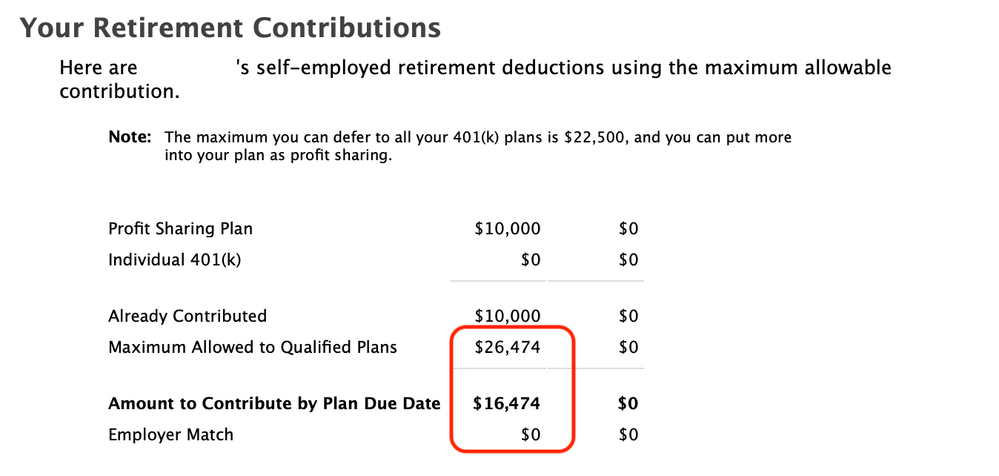

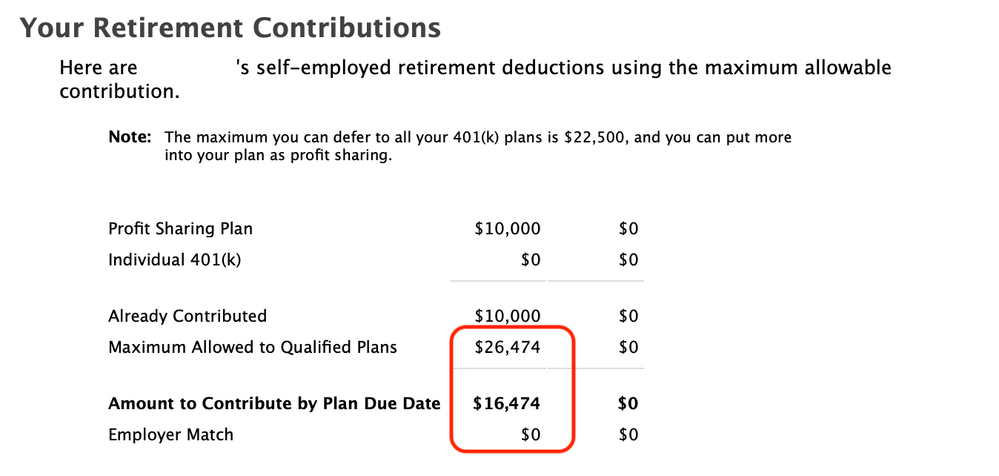

The "Maximize contribution" checkbox will lead to "maximum allowed to qualified plans" 26474.

But I only want/plan to contribute 10000.

But I also cannot uncheck the checkbox because I didn't make any contribution in 2023.

A deadlock here....