- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Sold a residential rental property in 2021, where do I enter my Substitute form 1099-S?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a residential rental property in 2021, where do I enter my Substitute form 1099-S?

Hello All,

As the title said, I sold my rental single family investment home in May of 2021. It was rented out from January to mid May 2021.

In Turbo Tax CD/DVD version, under the section of Rental Income & Do Any of These Situations Apply to This Property?

I selected "Sold" => "! sold or disposed of this property in 2021" The subtext tells me that i can further answer more questions in the Depreciation

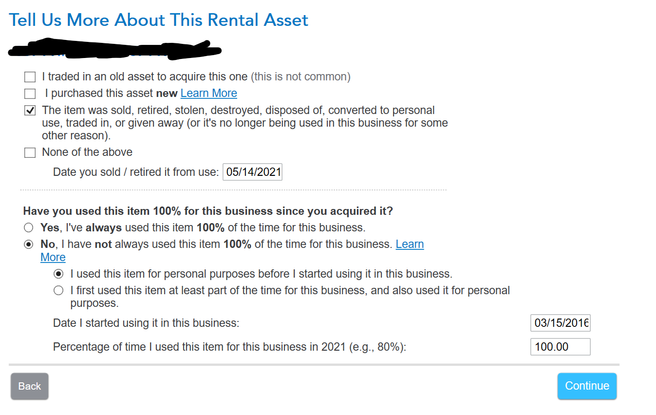

Under the "Sale of Property/ Depreciation" section and "Tell Us More About This Rental Asset", i selected "The item was sold, retired, stolen, destroyed.. " and put down the date that I sold.

My first question came from the last line where it is asking "Percentage of time I used this item for business in 2021"

Should I answer 100% since i never use it for personal purpose? or should I calculate the number of days I used it for rental and divide by 365 and get the percentage, due to the fact that I sold it in the middle of the year so I wont be able to use it for business for the entire 2021

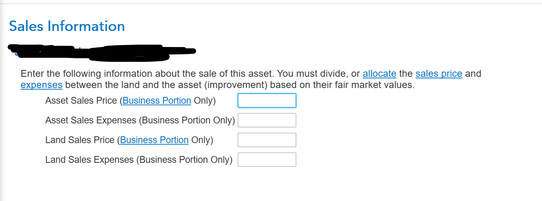

My second question is I received a 1099-S for the sales, is there a specific place in Turbo Tax where i can in put the information ? Or I only need to input in this question below:

Thank you for your help

Topics:

posted

April 8, 2022

7:46 PM

last updated

April 08, 2022

7:46 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold a residential rental property in 2021, where do I enter my Substitute form 1099-S?

IRS expects you to report the sale, when a 1099-S is supplied to you and to the IRS.

There is no special place to enter 1099-S, you report the same with or without having received a 1099-S.

April 8, 2022

8:26 PM

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

huntinad

Level 1

pottermelanie12

New Member

jeprice2842

New Member

kf_7

New Member

Johnny265

Returning Member