- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Short Term Rentals & Material Participation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short Term Rentals & Material Participation

Hello,

I have a STR and meet the following conditions:

Under Temp. Regs. Sec. 1.469-1T(e)(3)(ii), short-term rentals, i.e., in which the average rental period is either (1) seven days or less or (2) 30 days or less (with significant personal services provided by or on behalf of the taxpayer) are not classified as rental activities. Thus, short-term rentals (as Airbnb rentals often are) are not considered per se passive, the $25,000 rental real estate allowance for active participation does not apply, and hours spent in short-term rentals do not count toward meeting the real estate professional tests discussed below. The determination of whether a short-term rental activity is passive or nonpassive depends on whether the individual materially participated in the activity, as discussed below.

And:

Temp. Regs. Sec. 1.469-5T(a) provides seven tests by which an individual can prove material participation in a trade or business. If any one of these seven tests is met (and assuming the per se passive designation for rental activities is overcome by meeting the real estate professional exception), an individual is considered to have materially participated in a rental real estate activity, and that activity is treated as nonpassive for that tax year (and not subject to the passive loss limitations):

3. The individual participates in the activity for more than 100 hours during the tax year, and their participation in the activity for the year is not less than the participation in the activity of any other individual (including those who are not owners) for that year.

This is a slight variation of test No. 2, allowing for more outside help but first requiring at least 100 hours of the individual’s own involvement. For example, if an individual spent 120 hours on the activity during the year, they could hire a maintenance worker and a cleaner to work up to 119 hours each and still meet this test.

I am using TurboTax 2023 Premier and the step-by-step interview is not allowing the depreciation/losses to offset W-2 income. Is there a way to fix this?

Thanks for your help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short Term Rentals & Material Participation

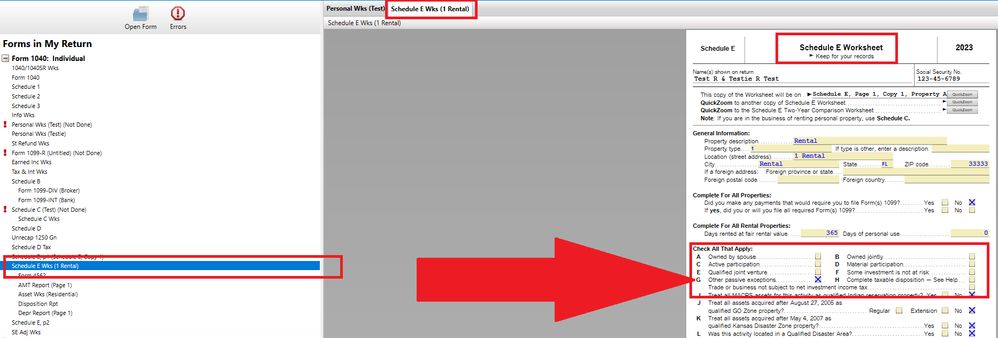

If you are using the CD/downloaded version, go to the "Forms" in the upper right hand corner.

Then on the left side, look for the "Schedule E Wks". Then check the box for "Other Passive Exceptions" (MAYBE box "G"?).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short Term Rentals & Material Participation

If you want to report this activity as a non-passive business, rather than a passive rental, you need to file Schedule C (not Schedule E) as a Self-Employed taxpayer and report the rental income.

This removes the passive loss restriction, but will subject you to Self-Employment (FICA) tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short Term Rentals & Material Participation

Thanks for the input. From a podcast discussing this topic in detail, they are saying if you are a real-estate dealer or provide substantial services related to the short term rental, then the activities are reported on schedule C and self-employment tax applies. Otherwise the activities are reported on schedule E.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short Term Rentals & Material Participation

@oreillycg wrote:

....if you are a real-estate dealer or provide substantial services related to the short term rental, then the activities are reported on schedule C and self-employment tax applies. Otherwise the activities are reported on schedule E.

That is correct. Do not report on Schedule C unless either of the two criteria apply to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short Term Rentals & Material Participation

How do I get TT to report on schedule E and show the losses as non-passive so the losses reduce W-2 earnings?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short Term Rentals & Material Participation

You need to go into Forms Mode and check a box, I believe.

I am going to page @AmeliesUncle as I think he has addressed this scenario previously.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short Term Rentals & Material Participation

That would be great! Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short Term Rentals & Material Participation

If you are using the CD/downloaded version, go to the "Forms" in the upper right hand corner.

Then on the left side, look for the "Schedule E Wks". Then check the box for "Other Passive Exceptions" (MAYBE box "G"?).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short Term Rentals & Material Participation

You are brilliant! Many thanks....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short Term Rentals & Material Participation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short Term Rentals & Material Participation

Thank you all for sharing this! I have been trying to figure it out! I missed out on this the past 2 years. :(

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

PlzStopLobbying2MakeTaxesHard

New Member

DavidArizona

Level 2

bluemoon

Level 3

kbny061

New Member

gjmport

Level 1