- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Section 1256 Description or "account description"? (Form 6781)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Description or "account description"? (Form 6781)

Hello,

I am finishing up tax return and the last hurdle is how to put "Description" for Form 6781. I am hearing that it could be brokerage account name or it could be security description. My Section 1256 part in 1099-B includes 3-4 tickers involved (SPX/UVXY/XSP), so I dont know how to put this all together for description.

Can someone help me to write the descriptions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Description or "account description"? (Form 6781)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Description or "account description"? (Form 6781)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Description or "account description"? (Form 6781)

Great. That sounds more reasonable than putting individual tickers.

It's kind of along the line of what I have confusion, but from Brokerage 1099-B, I thought the loss is calculated, (and therefore, value is reported in amounts from 1099-B), but looking at Form 6781, there is also Part I A From Schedule K-1. So there are two reported values from K-1 Schedule and Section 1256, but I feel like the loss is duplicated report in Form 6781 because the same traded ticker is included.

Specifically, it's UVXY from K-1 schedule that has the amount loss reported in Section 1256. Shouldn't section 1256 from 1099-B include the amount loss that's reported in K-1 schedule as well?

I traded both UVXY shares and loss. K-1 Schedule clearly says -390$ as "Other income" and while I can't really calculate how -392 comes out, I think

I see section 1256 part of 1099-B does NOT include transaction history for UVXY, but simply option trading only (transaction for shares are included in 1099-B, "Proceeds from Broker and Barter Exchange Transactions"), so the loss from K-1 schedule shouldnt be included here in Form 1256.

Can you tell me how it should be reported?

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Description or "account description"? (Form 6781)

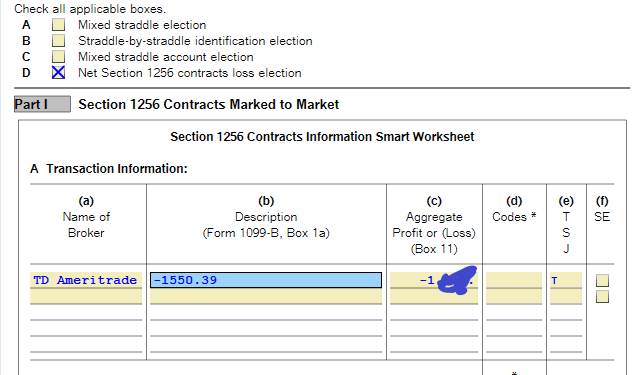

sometimes the simplest thing is to go to the IRS website (or state for state forms) and read the instructions for that line.

from IRS instructions

Specific Instructions

Part I

Line 1

Include on line 1 all capital gains and

losses from section 1256 contracts open

at the end of your tax year or closed out

during the year. If you received a Form

1099-B, Proceeds From Broker and

Barter Exchange Transactions, or

substitute statement, include on line 1

the amount from box 11 of each form. In

column (a), write “Form 1099-B” and the

broker’s name. List separately each

transaction for which you didn’t receive

a Form 1099-B or substitute statement,

or received a Form 1099-B that isn’t for

your tax year.

********************************

Turbotax has it backwards so the broker in the first column and 1099-B in the second.

***********************************

are you really making a 1256 loss election which involves calculating the allowable amount that can be carried back and then amending the 3rd prior year and possibly the 2nd and then the first prior year return for the allowed carryback.

the calculation is also described in the instructions. Here it is:

Box D. Net Section 1256 Contracts Loss Election

If you have a net section 1256 contracts loss for 2022, you can elect to carry it back 3 years. Your net section 1256 contracts loss is the smaller of:

• The excess of your losses from section 1256 contracts over the total of {(a) your gains from section 1256 contracts plus (b) $3,000 ($1,500 if married filing separately),} - (b) is inconsistent with code section 1212 dealing with 1256 loss carryback and PUB 550

************************

PUB 550

Net section 1256 contracts loss. This loss is the lesser of:

• The net capital loss for your tax year deter-mined by taking into account only the gains and losses from section 1256 contracts, or

• The capital loss carryover to the next tax year determined without this election

******************************

or

+ The total you would figure as your short-term and long-term capital loss carryovers to 2023 if line 6 of Form 6781 were zero. Use a separate Schedule D (Form 1040) and Capital Loss Carryover Worksheet (in Pub. 550) to figure this amount.

The amount you can carry back to any prior year is limited to the smaller of:

• The gain, if any, that you would report on line 16 of Schedule D (Form 1040) for that carryback year if only gains and losses from section 1256 contracts were taken into account; or

• The gain, if any, reported on line 16 of Schedule D (Form 1040) for that carryback year.

The amounts just described are figured prior to any carryback from the loss year. Also, the carryback is allowed only to the extent it doesn’t increase or produce a net operating loss for the carryback year. The loss is carried to the earliest year first.

Make the election by checking box D and entering the amount to be carried back on line 6. To carry your loss back, file Form 1045, Application for Tentative Refund, or an amended return. Attach an amended Form 6781 and an amended Schedule D (Form 1040) for the applicable years.

On the amended Forms 6781 for the years to which the loss is carried back, report the carryback on line 1 of that year’s amended Form 6781. Enter “Net section 1256 contracts loss carried back from” and the tax year in column (a), and enter the amount of the loss carried back in column (b).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Description or "account description"? (Form 6781)

Fpr "identification of account" on the Form, show

TD Ameritrade

or

TD Ameritrade 1099-B

If you have two tax documents reporting the same loss , you would not want to enter that twice.

If you have a different loss on a K-1, then you need to understand which account that is associated with.

--

You don't check Box D unless you are doing NOL carryback (this is not common).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Description or "account description"? (Form 6781)

K-1 gains/losses go on Schedule D lines 5, 12

6781 gains/losses go on Schedule D lines 4, 11

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 1256 Description or "account description"? (Form 6781)

Again Thank you so much. I read instructions about Box D, and glad to uncheck on the box as I dont plan to carry back.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ataguchi

Level 1

rockwellkgirl

New Member

dbrodt244

New Member

Valveran1

New Member

PaulKoss

New Member