- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Schedule NR

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule NR

Hello,

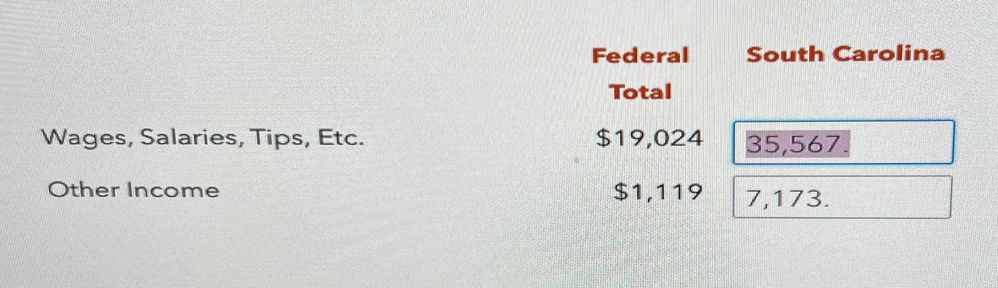

when trying to file my taxes, since I was a part time resident I have to file a Schedule NR with SC. My only problem is that it want me to put in my number, but when I do it say it’s too large. And the information that it populated on column A is too small and I can not edit it. Is there something else I should be doing.

The federal total is wrong but I cannot edit it anywhere. I am not sure where this number is coming from but it is no where on my W-2s.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule NR

If your Federal Wages are incorrect, revisit the income section on your federal return to make sure you have entered the correct amount from your W-2.

- Log in to your account./

- Go to Federal Taxes

- Go to Wages and Income/ might need to select Income and Expenses first.

- Click Edit next to Job (W-2) and review your W-2.

For the state return, if you were a resident of two different states during the tax year ( if you moved from one state to another), you'll normally file part-year returns in both states, assuming each state collects income tax and you had income in each state.

You need to make sure you've set up your personal information correctly. We'll ask about where you lived in 2023 when you set up your personal information.

How do I file a part-year state return?

You will allocate your income between the two states. The income allocation for SC is the amount of income that was earned in that state (also referred to as "state source income").

Select the type of income you received from the link below for instructions on to to allocate your income.

For wages select Earned income (comes from employment, such as wages, salaries, tips, payment for services, and commissions)

How do I allocate (split) income for a part-year state return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17725498558

New Member

jduong715

New Member

joannewit59

New Member

larslanian

Level 3

user17725187148

New Member