- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Schedule K-1 Limited Partner

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Limited Partner

I am a limited partner for a publically traded partnership. When I enter the inforamation from the K-1 form and do a federal review, there are several errors noted that has to do with information the general partners may need to enter and not a limited partner. How to enter all the inforamtion from the K-1 form, especially the many inputs on line 20 - Other information. I have 6 additional entries labled ZZ1 thru ZZ9 (ZZ4 and ZZ7 are not listed). Please advise soonest.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Limited Partner

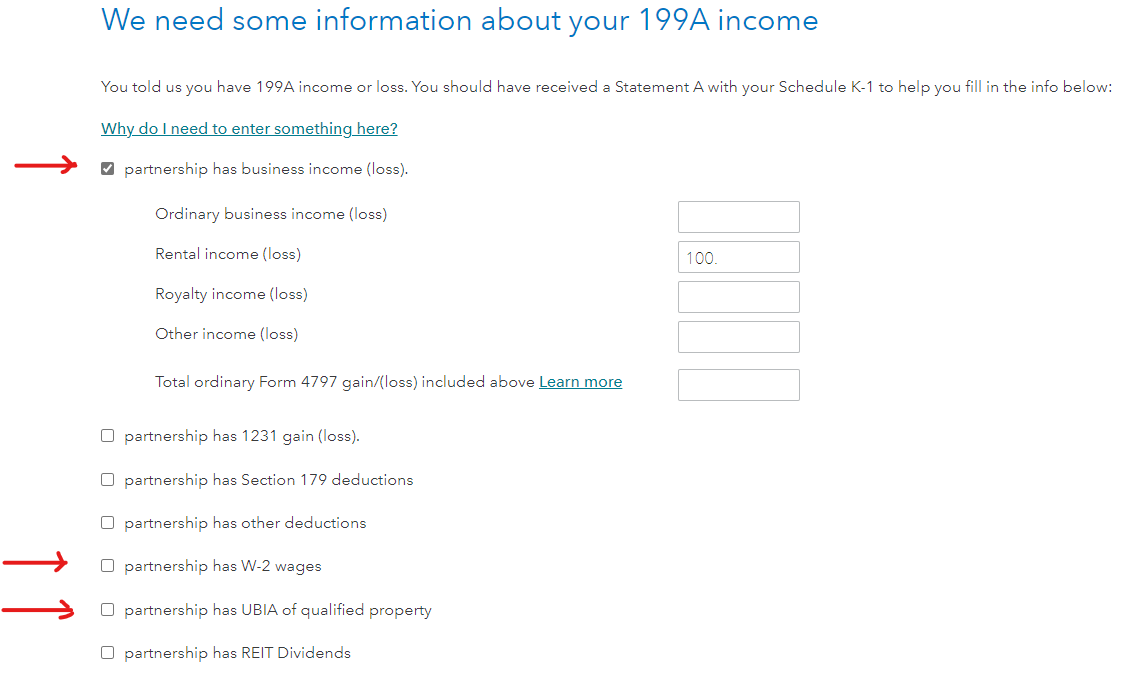

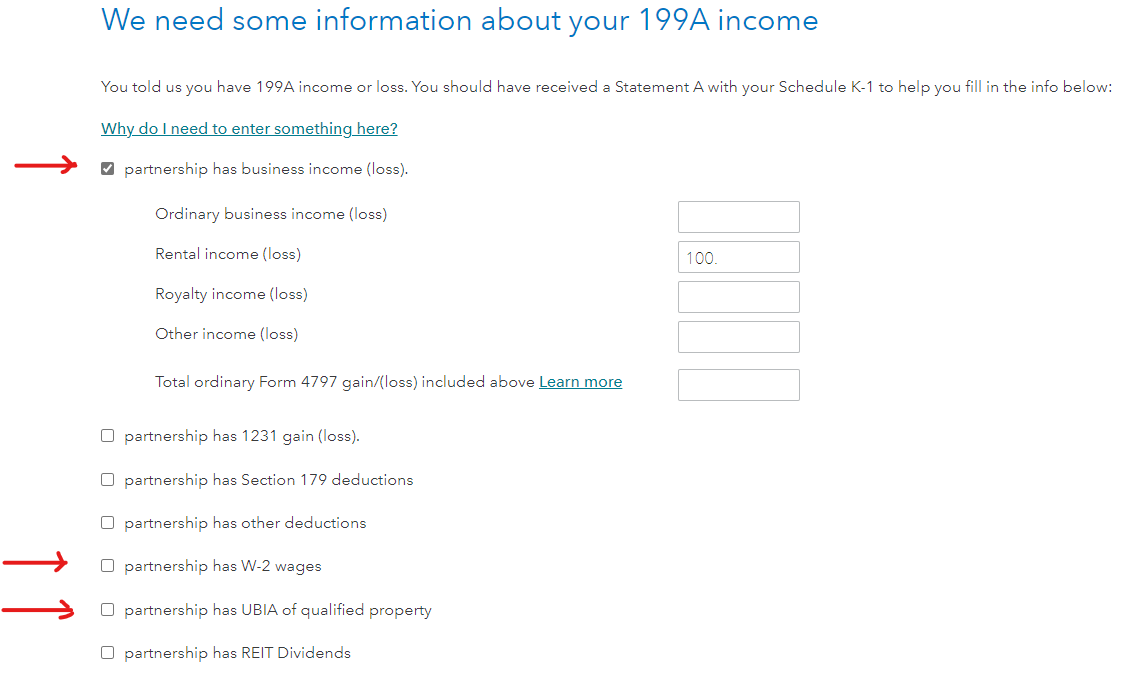

Follow these directions to report section 199A information from your partnership K-1.

- At the screen Enter Box 20 info, select code Z Section 199A information.

- Click Continue.

- At the screen We need some information about your 199A income, you may need to enter the following information:

- Ordinary business income (loss) from this business,

- W-2 wages for this business, and

- UBI of qualified property for this business.

Enter these values for the qualified business income deduction to be calculated.

IRS Partners Instructions for form K-1 (1065), page 31 states:

Code ZZ

Other

Any other information you may need to file your return not shown elsewhere on Schedule K-1.

There may be additional information that was attached to your K-1 that would explain the code ZZ entries.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Limited Partner

I ended up doing just that to get the error removed. It would have been much easier if this information had been provided or included in the program by TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Limited Partner

there is no standard for anything coded ZZ so we need an explanation of what each says but not the amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Limited Partner

That didn't work. TurboTax still had errors associated with the entries. It also wanted more information about subjects that are not covered in the K-1 form. Any additional advise about correcting the issue with TurboTax? Please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Limited Partner

Follow these directions to report section 199A information from your partnership K-1.

- At the screen Enter Box 20 info, select code Z Section 199A information.

- Click Continue.

- At the screen We need some information about your 199A income, you may need to enter the following information:

- Ordinary business income (loss) from this business,

- W-2 wages for this business, and

- UBI of qualified property for this business.

Enter these values for the qualified business income deduction to be calculated.

IRS Partners Instructions for form K-1 (1065), page 31 states:

Code ZZ

Other

Any other information you may need to file your return not shown elsewhere on Schedule K-1.

There may be additional information that was attached to your K-1 that would explain the code ZZ entries.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Limited Partner

I ended up doing just that to get the error removed. It would have been much easier if this information had been provided or included in the program by TurboTax.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

markkatzmann

New Member

ssel

Level 3

KMJK

Level 3

jkzimmer

Returning Member

TugBoatBaby

Level 1