- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Schedule-H / 1040-ES Confusion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule-H / 1040-ES Confusion

I've seen a few threads regarding this, but I'm still a tad confused.

I use a payroll service, and they sent quarterly tax payments (1040-ES) on my behalf in 2020.

They also generate and send other forms on my behalf (W2's, W3, 940, etc.).

So my question is, if I enter in the quarterly payments from the 1040-ES in Turbo Tax as estimated payments, do I need to counter this by also filling out Schedule H? Or do I only fill in the Schedule H data in Turbo Tax if I did NOT make any estimated tax payments (1040-ES) during the year?

I've seen conflicting information on this, but my understanding is I input the Schedule H which creates the tax liability for taxes owed for my household employee, but then filling out the 1040-ES data essentially cancels that out.

I can't imagine only filling out the estimated tax payments is the way to do it, because I'm essentially getting credited for taxes that I ultimately owed and paid... I don't know.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule-H / 1040-ES Confusion

Also, to add on - part of the reason I don't think I need to also submit Schedule H is because my payroll service submits form 941 on my behalf with the 1040-ES payments:

"A common mistake that household employers make is reporting their payroll twice. This happens when both Schedule H and Form 941 are filed in the same year. Many business owners file Form 941 quarterly and report wages there. Then, when tax season rolls around they apply these same figures to Schedule H and, therefore, pay the employment tax twice.

Be careful not to make this mistake and avoid paying too much or becoming subject to an IRS investigation to resolve the issue."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule-H / 1040-ES Confusion

If your household help's pay is included in the payroll services you already have prepared regularly by your payroll services and the household help aleady receives a W2 and both employer and employee's portions of social security and medicare taxes are already withheld and paid/deposited, then you do not also need to prepare Sch H in your individual return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule-H / 1040-ES Confusion

Hi @gloriah5200 - How do I avoid doing Schedule H in TurboTax Online Premier for tax year 2023? It asks me the questions and then forces me down the path of Schedule H without giving me a chance to indicate that I already paid the taxes quarterly to both New York State and the federal govt. Please help! Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule-H / 1040-ES Confusion

You paid quarterly taxes for unemployment, of course. If you filed the 941 for all taxes, delete the sch H and answer the questions to avoid it. Did you pay anyone more than...no

If you are using:

- Online: see How do I view and delete forms in TTO?

- Desktop: If you are working in the cd/download TurboTax program:

- On the top right, there is a FORMS button.

- Click on FORMS.

- Locate the form you want to delete.

- Click on the form name.

- Below the form, bottom left, select DELETE FORM button.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule-H / 1040-ES Confusion

How do I know if the payroll service (Poppins Payroll) filed the 941?

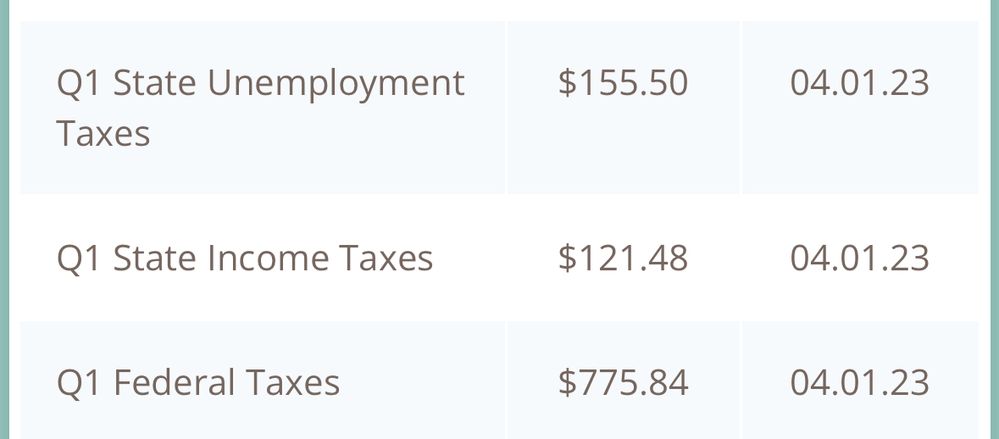

This is what I paid for Q1 in 2023 and the only quarter I had an employee that year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule-H / 1040-ES Confusion

The payroll service should have prepared a copy of the form for your records.

Was IRS form 941 filed under an Employer Identification Number (EIN)? You are able to view your account here to see whether the form was filed and payment remitted.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.