- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property

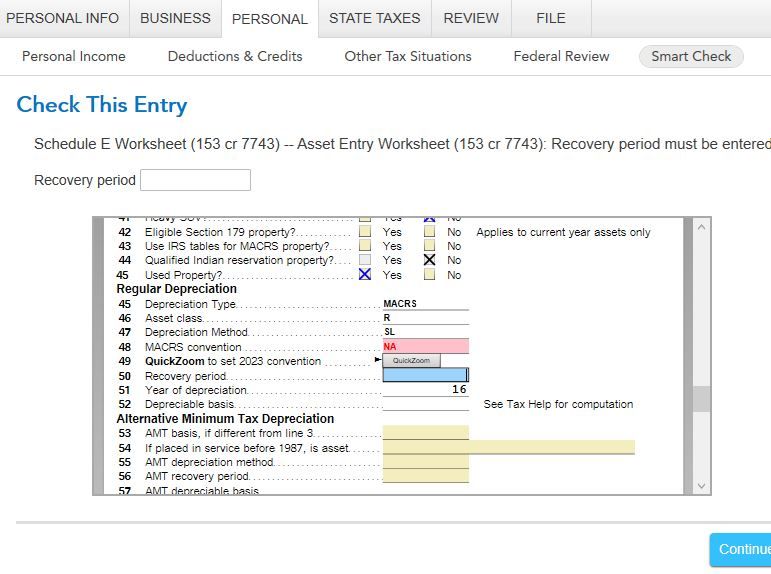

I have a rental property purchased in 2008. I stopped using as rental Dec. 31, 2022 (I did not use it at all in 2023). TT is asking for MACRS convention and recovery period. Any help is greatly appreciated!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property

Recovery period for rental real estate is 27.5 yrs and that is what you would place in this Box. Put in 27.5 in the box.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property

Was the rental reported in TurboTax for 2008 through 2022?

What did you do with the property once it was no longer a rental?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property

yes, it was used as rental 2008-2022 at which time it was converted to personal use

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property

In the Property profile section indicate that you converted the property to personal use, then move on to the asset section. Enter 0 for days rented at fair rental price and 0 for personal use days. Then move to the asset section to dispose of the property.

After you indicate that you disposed the property in 2023, entire the date you retired from use and the date you began using it for business. Depreciation that should have been taken will be computed and on the next screen, you will either accept that figure or adjust it. Carry on to complete the section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property

I've done all of that and it is still asking for the "recovery period"...I have no clue what that is

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property

Recovery period for rental real estate is 27.5 yrs and that is what you would place in this Box. Put in 27.5 in the box.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

NeUnhappy

New Member

bruced63

New Member

frank790628

Returning Member

lueylu33-

New Member

taxdoofus

New Member