- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Rental Property Gifted Away - how to report disposition?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Gifted Away - how to report disposition?

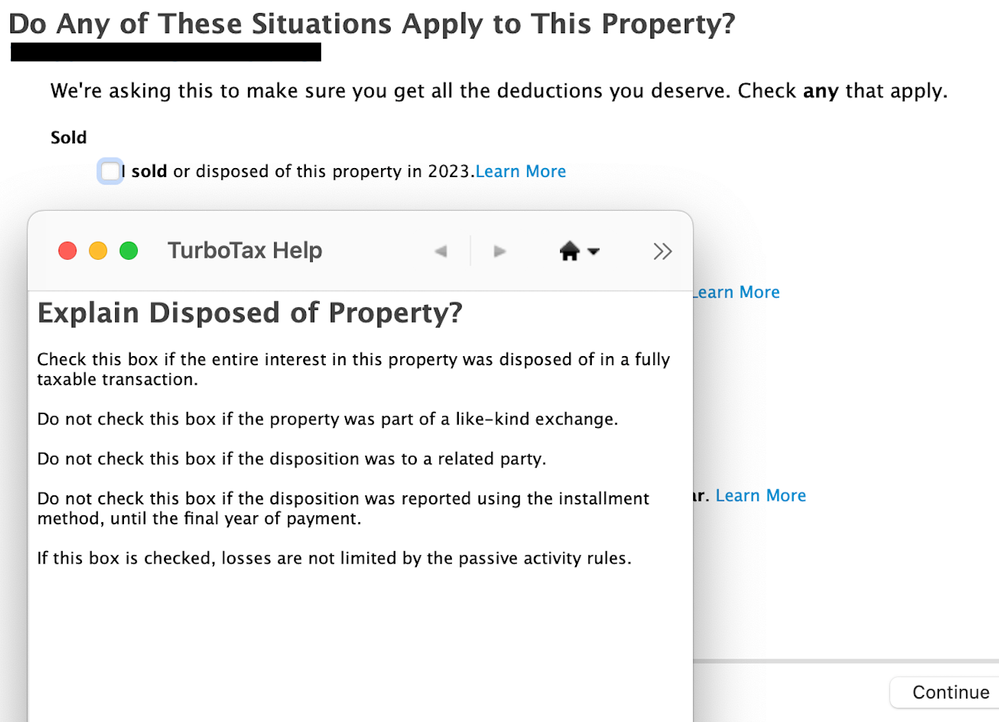

My wife has a rental property that she has 10% ownership in. Her Mom and sister have the remaining 90% ownership in the rental property. My wife gifted her 10% ownership to her mom in 2023. I know we have to file form 709 gift tax separately. For the 2023 Tax filing season we did receive some income and we're reporting that in the Schedule E, but I don't see how to dispose of this property within Turbotax. Under the "Do any of These Situations Apply to This Property", there's an option to select "I sold or disposed of this property in 2023" but we didn't sell it and when I look at the explanation it says "Do not check this box if the disposition was to a related party", so not sure if I should check this box or not since we did gifted it to her mom.

Do we still check the "I sold or disposed of this property in 2023" or is there somewhere else within Turbotax where we dispose of this property as a gift? Or because we gifted it away to her mom this does not apply and don't report rental income anymore the next year?

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Gifted Away - how to report disposition?

No, just leave this section blank since it was gifted to a related property. Next year you won't report this on your return. . Here are a couple things you and your mother need to keep in mind for tax year 2024.

- Her cost basis for depreciation is your original cost basis less any depreciation you have taken in the past plus your share of capital improvements that were made during the time you owned your share of the house.

- This will mean your Mom will need to increase this cost basis to her existing share of the ownership of the house next year.

Please, let us know if you have any further questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Gifted Away - how to report disposition?

No, just leave this section blank since it was gifted to a related property. Next year you won't report this on your return. . Here are a couple things you and your mother need to keep in mind for tax year 2024.

- Her cost basis for depreciation is your original cost basis less any depreciation you have taken in the past plus your share of capital improvements that were made during the time you owned your share of the house.

- This will mean your Mom will need to increase this cost basis to her existing share of the ownership of the house next year.

Please, let us know if you have any further questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

obeteta

New Member

zeishinkoku2020

Level 2

chunhuach

Level 1

redmoose

Returning Member

zbchristy501

Returning Member